FAA Registry,

FAA Registry,  business aircraft,

business aircraft,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  piston,

piston,  pre-owned aircraft,

pre-owned aircraft,  single,

single,  turboprop,

turboprop,  used aircraft,

used aircraft,  values in

values in  Charts

Charts  Monday, June 6, 2011 at 8:44AM

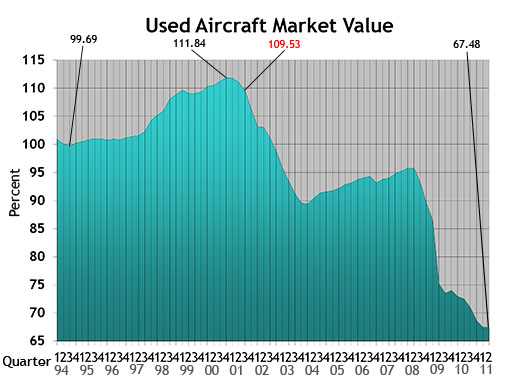

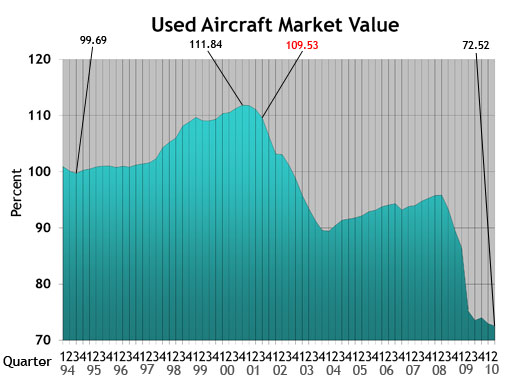

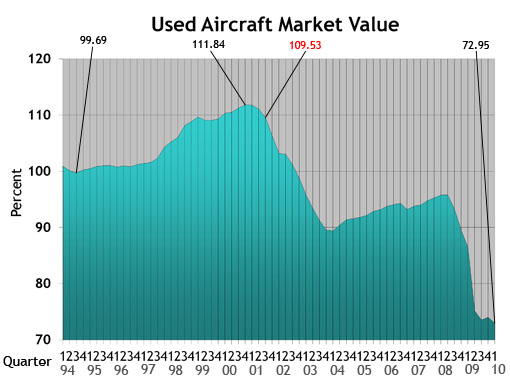

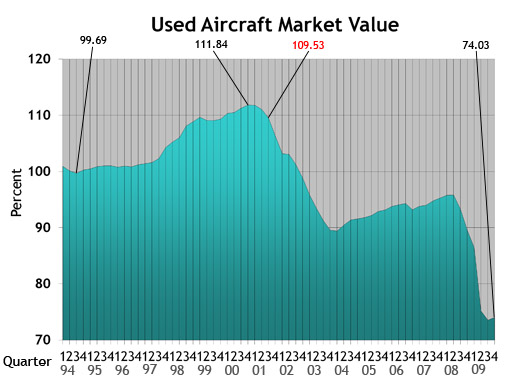

Monday, June 6, 2011 at 8:44AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

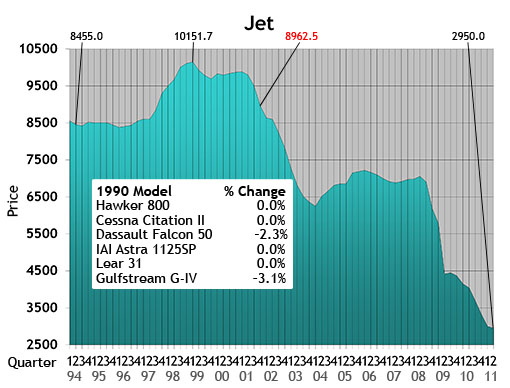

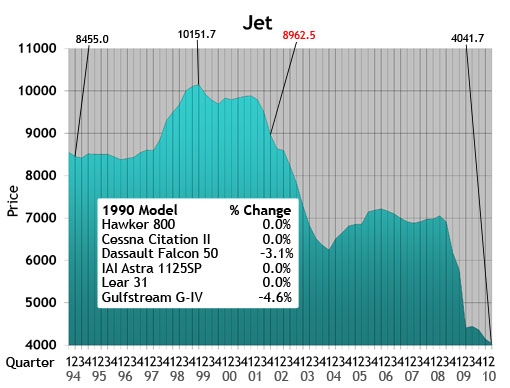

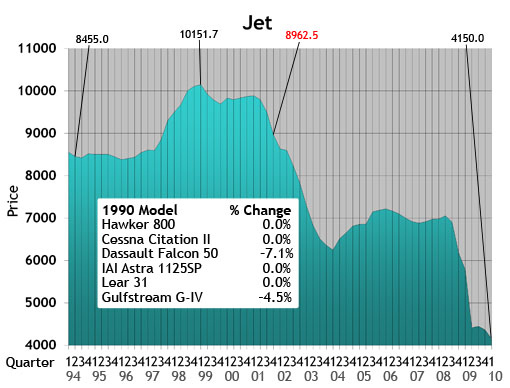

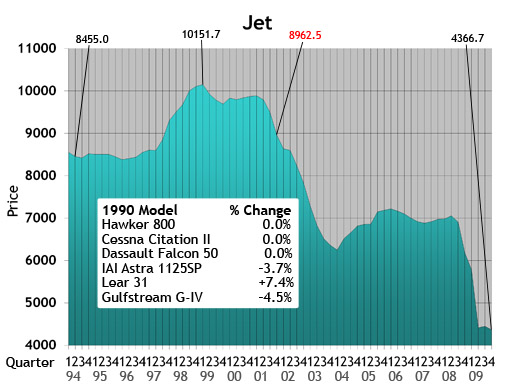

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

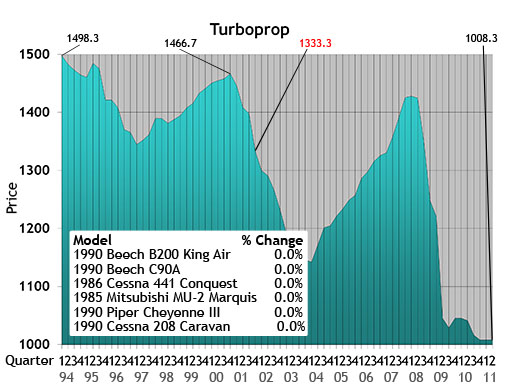

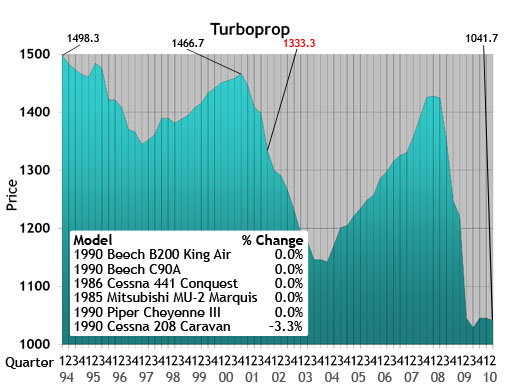

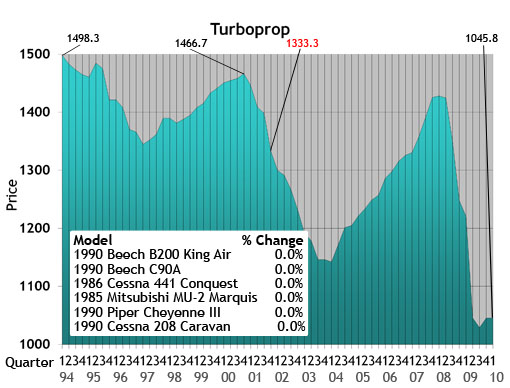

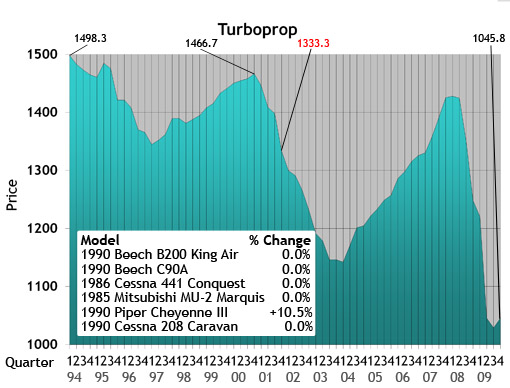

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

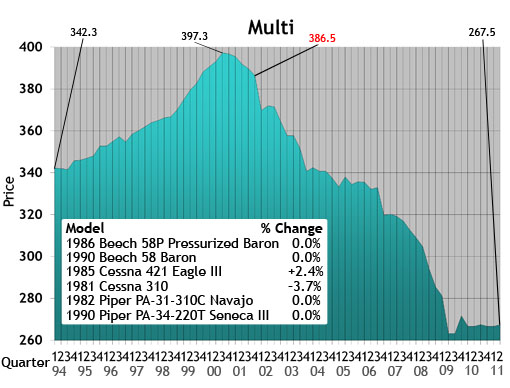

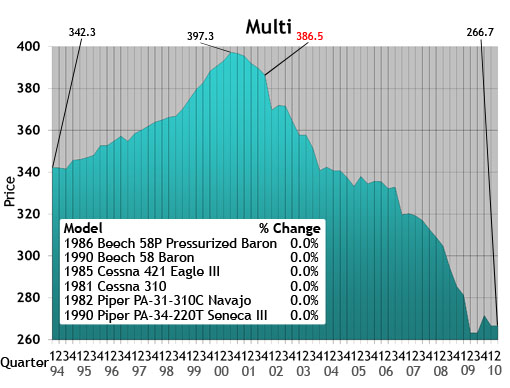

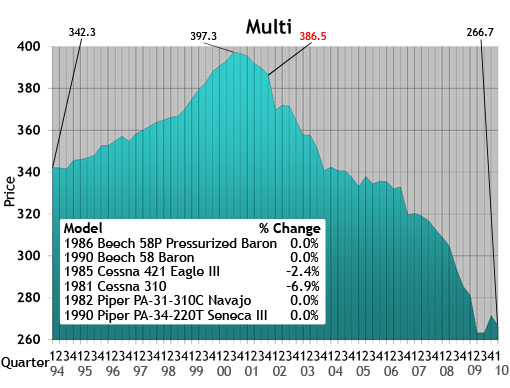

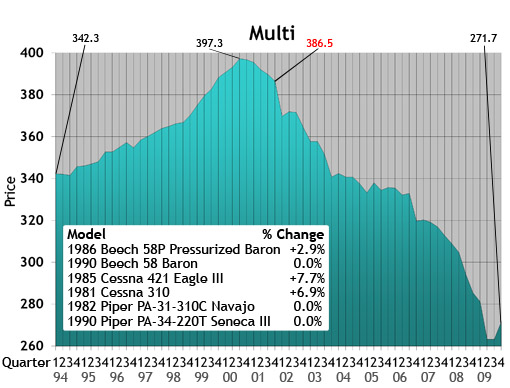

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

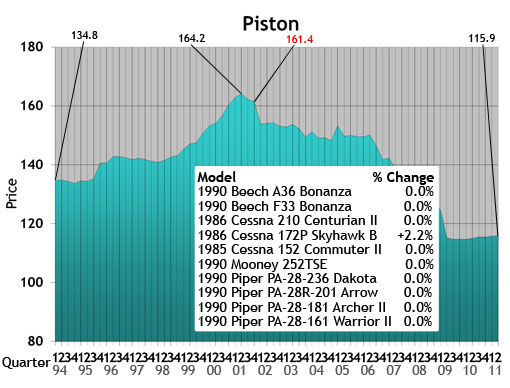

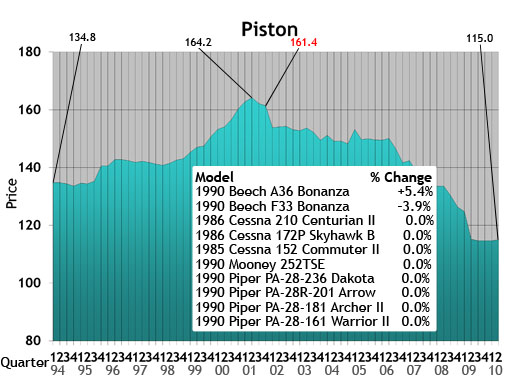

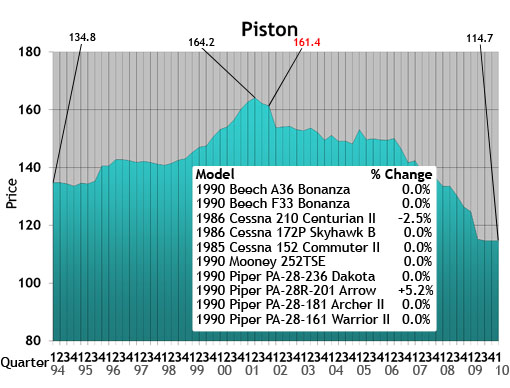

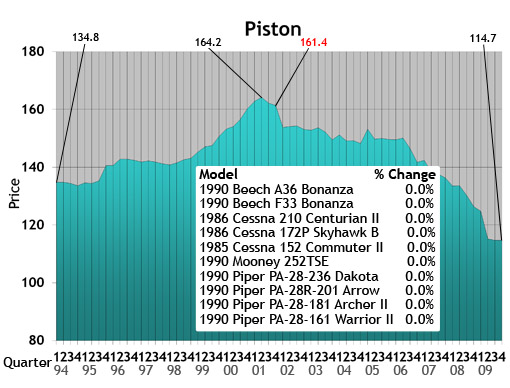

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

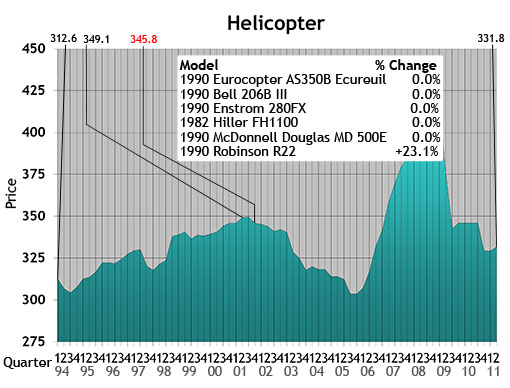

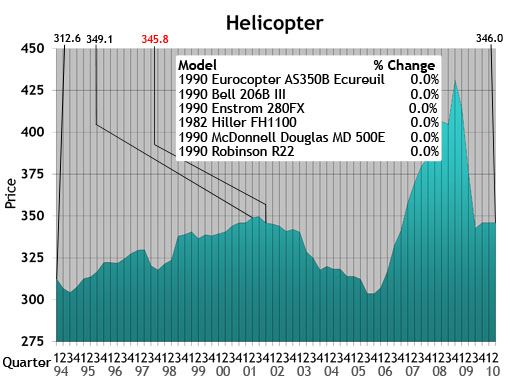

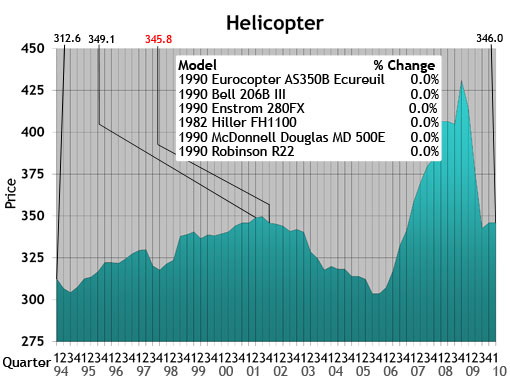

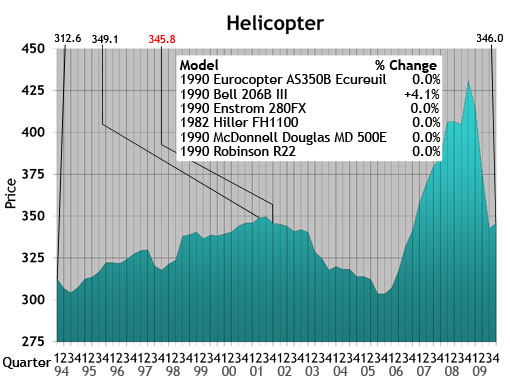

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

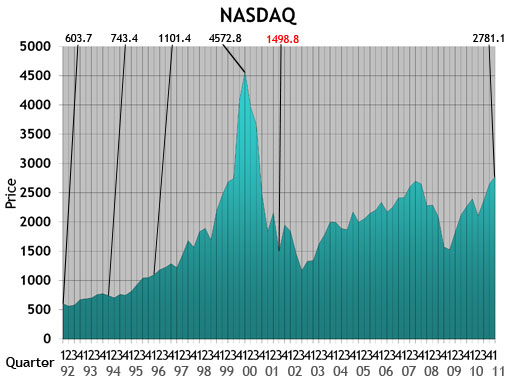

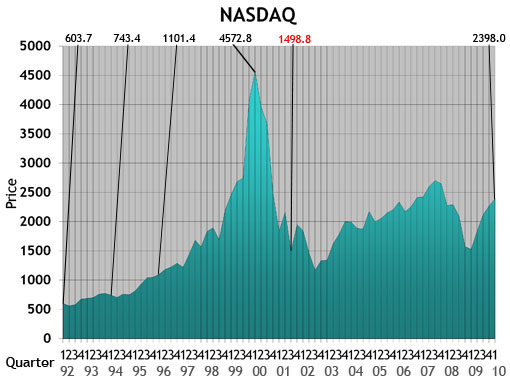

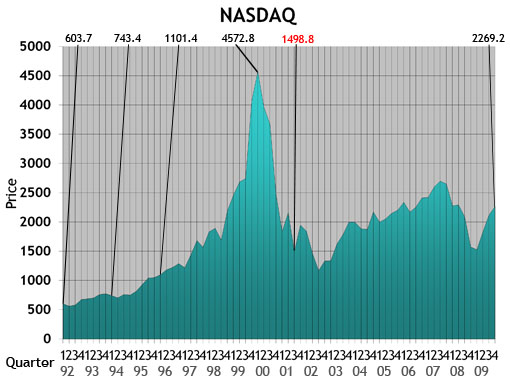

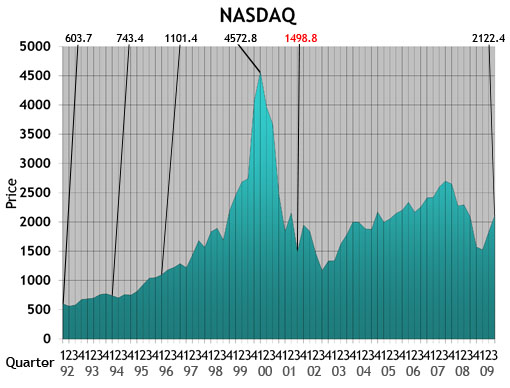

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

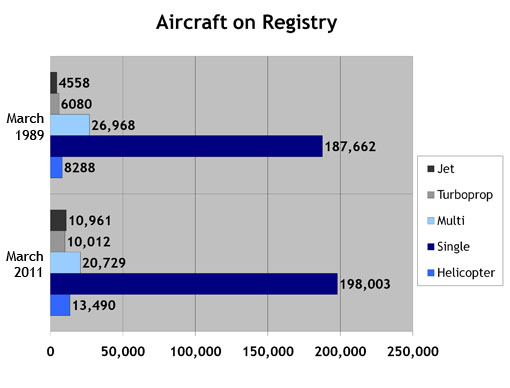

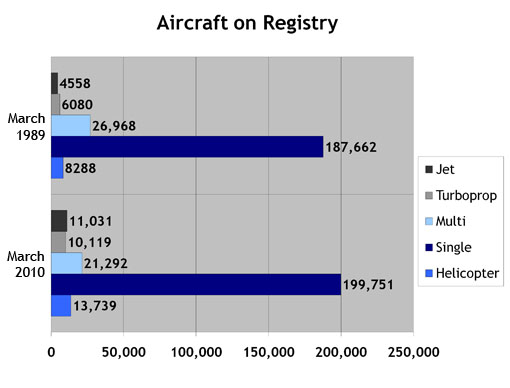

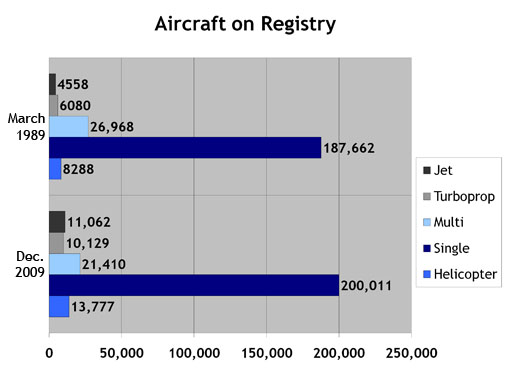

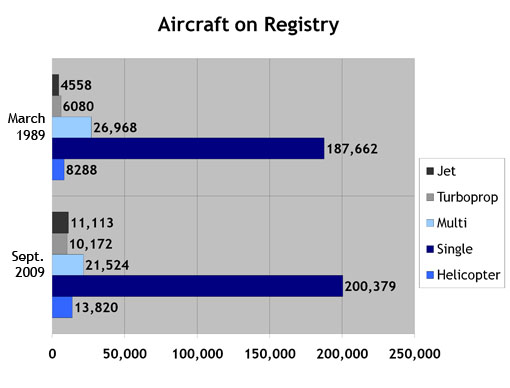

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

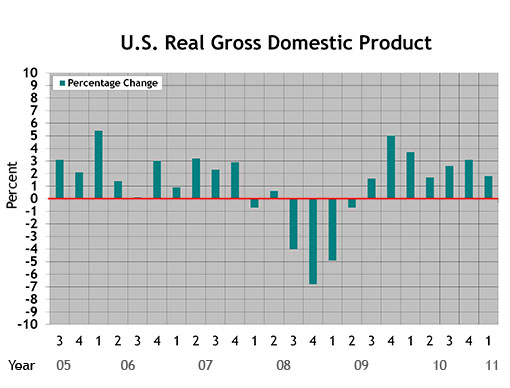

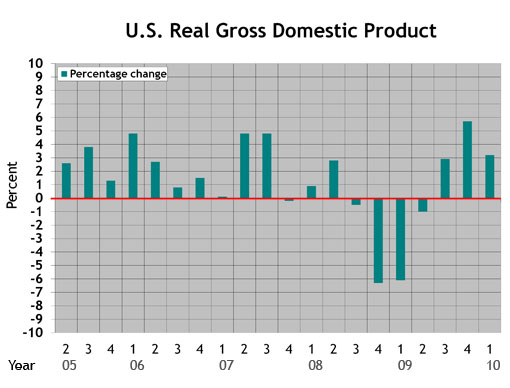

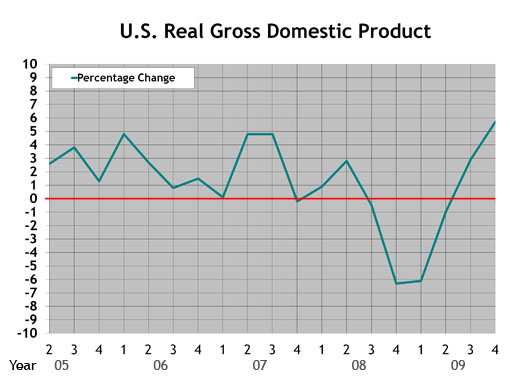

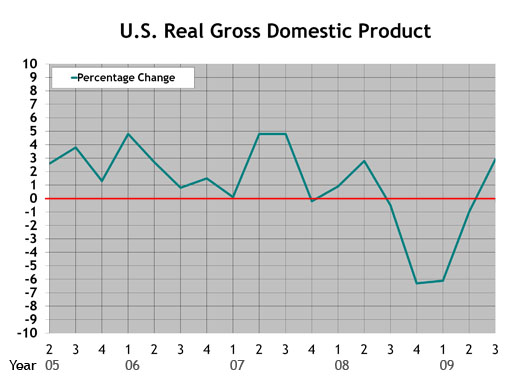

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

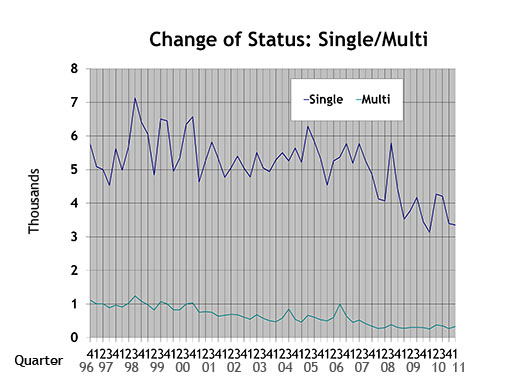

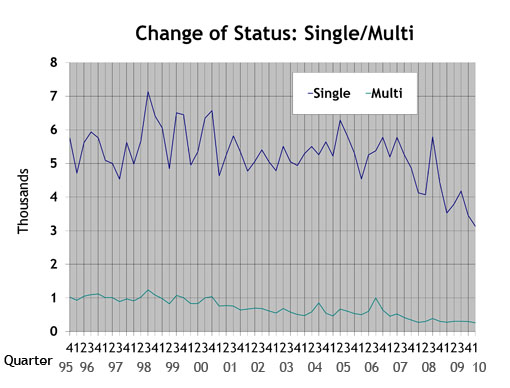

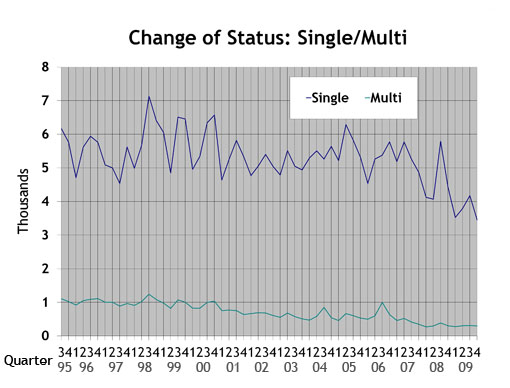

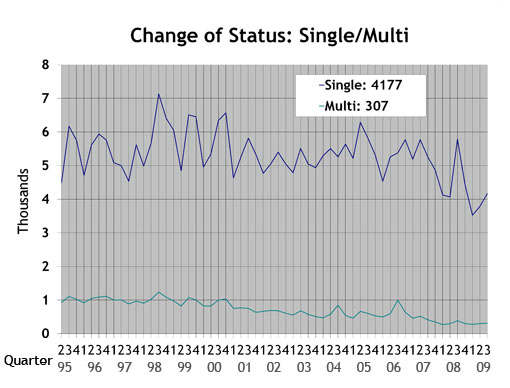

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

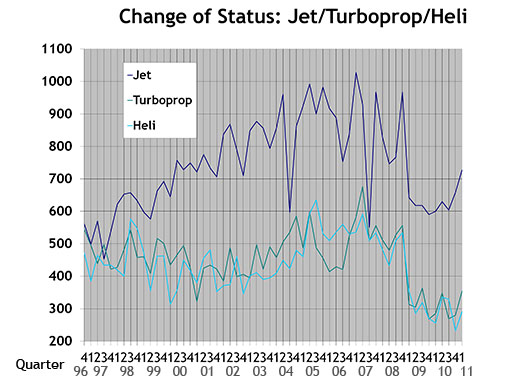

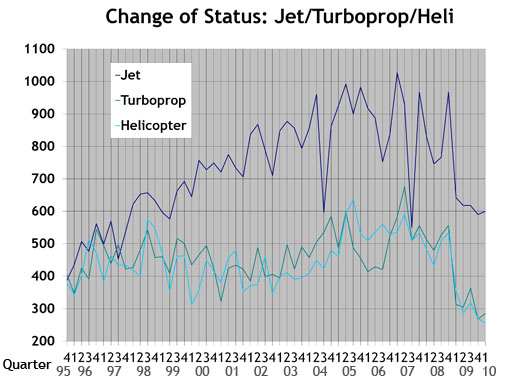

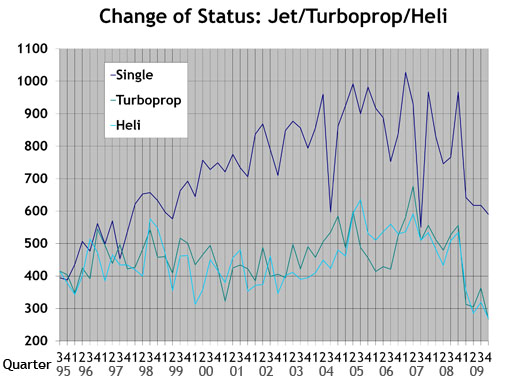

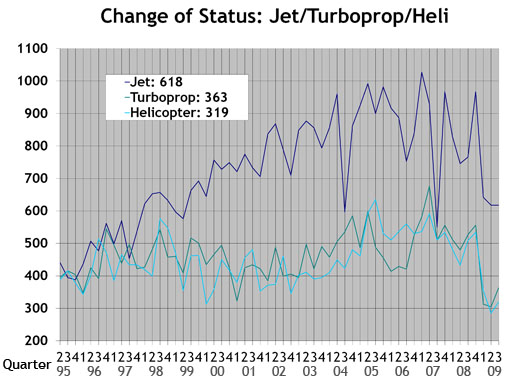

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

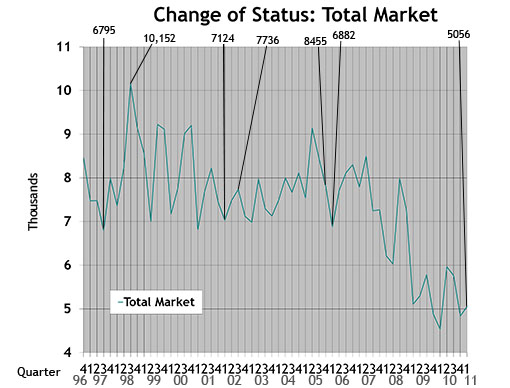

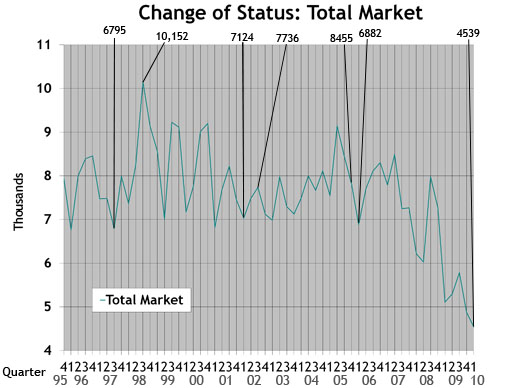

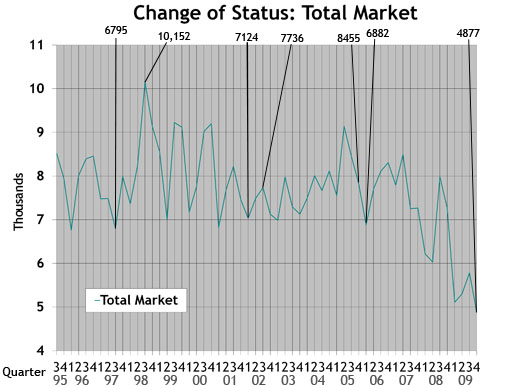

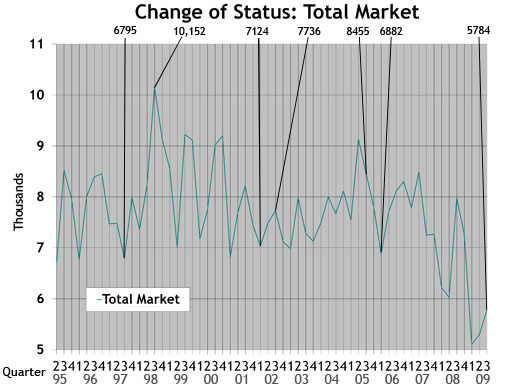

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Wednesday, May 26, 2010 at 9:13AM

Wednesday, May 26, 2010 at 9:13AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Wednesday, February 17, 2010 at 12:09PM

Wednesday, February 17, 2010 at 12:09PM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11. Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box. Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box. Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft. Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft. Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft. NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971. Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory. U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005. Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis. Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters. Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Beech,

Beech,  Cessna,

Cessna,  Gulfstream,

Gulfstream,  Piper,

Piper,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  piston,

piston,  single,

single,  turboprop,

turboprop,  used aircraft,

used aircraft,  values in

values in  Charts

Charts  Monday, November 30, 2009 at 3:30PM

Monday, November 30, 2009 at 3:30PM by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Entering its home stretch, 2009 certainly has been a forgettable year for general aviation. The losses in value for most owners of corporate aircraft have been significant and, at times, have even been heartbreaking.

However, something is happening out there. While economists predict an economic recovery will be achingly slow, some aircraft values are moving up. The change is barely perceptible and does not apply to every market segment. But inventories are finally contracting instead of expanding, and dealers are again becoming cautiously optimistic.

At the Dubai Airshow, Aircraft Bluebook–Price Digest has witnessed upbeat attitudes.

Aircraft Bluebook was represented in Dubai with its sister publications AC-U-KWIK and The Air Charter Guide. These publications are intricately involved in all aspects of corporate aviation, including aircraft values, FBOs, ground transportation, lodging or a multitude of other support services. At the Dubai Airshow, business was robust. The publications experienced record advertising and book sales.

This trade show in Dubai reflects the health of the international corporate aviation segment. We can hope that the skies over North America will soon host greater numbers of corporate jets giving lift to the companies that use corporate aviation to propel themselves out of these dark times.

While the economy thumbs for a lift, corporate aviation is showing signs of lifting the economy. Remember the National Business Aviation Association and General Aviation Manufacturers Association’s campaign slogan: “No Plane, No Gain.”

Bluebook-at-a-glance

Increased — 46

Decreased — 160

Stable — 652

For large-cabin/long-range aircraft, inventories have firmed with sale prices holding at what should be considered bottom market pricing. The bottom market seekers still waiting for a better opportunity may be surprised when the uptick in values reemerges.

The Lear 31 and Cessna 525 had values in the plus column. The Gulfstream G-IV and Bombardier Challenger 601 experienced minor decreases.

Bluebook-at-a-glance

Increased — 126

Decreased — 11

Stable — 453

Turboprop ag planes continue to demonstrate improved values for yet another quarter. The Piaggio P180 and the family of Piper Cheyennes experienced modest gains. Also in the plus column were the 300 series Beechcraft King Air. Values for select 90 series Beechcraft King Airs were down slightly from the previous quarter. Most aircraft in this category remained stable.

Bluebook-at-a-glance

Increased — 32

Decreased — 37

Stable — 586

Aerostars experienced minor increases in value. The Cessna 421 also demonstrated modest increases when compared to the previous quarter. The Beech Duke and Cessna 414 values were down slightly. Most values reflected no change.

Bluebook-at-a-glance

Increased — 132

Decreased — 108

Stable — 2209

Ag planes kept a positive note for another quarter. The Cirrus SR20 also improved modestly in select model years. For the most part, the majority of single-engine piston aircraft held steady. Decreases in value were minimal. Select Mooneys were down a few thousand dollars.

Bluebook-at-a-glance

Increased — 62

Decreased — 170

Stable — 770

The helicopter markets reported in Bluebook appear to be leveling off as well. Most models were stable for the reporting quarter. Eurocopter Twin Stars as well as the Bell 206 series were up slightly. Some values declining for this quarter include the Eurocopter AS350 and the Bell 430.

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us at 877-531-1450 or 913-967-1913.

Beech,

Beech,  Bell,

Bell,  Cessna,

Cessna,  Cirrus,

Cirrus,  Eurocopter,

Eurocopter,  Hhelicopter,

Hhelicopter,  economy,

economy,  jet,

jet,  multi,

multi,  piston,

piston,  single,

single,  turboprop in

turboprop in  Newsletter

Newsletter  Monday, November 30, 2009 at 3:29PM

Monday, November 30, 2009 at 3:29PM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-status data for singles. The green line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-status data for singles. The green line represents multis.

Jet/Turboprop/Heli: The dark blue line in the Jet/Turboprop/Heli chart represents change-of-status information for jets. The green line depicts turboprops, and the light blue line represents helicopters.

Jet/Turboprop/Heli: The dark blue line in the Jet/Turboprop/Heli chart represents change-of-status information for jets. The green line depicts turboprops, and the light blue line represents helicopters.

Total Market: Depicts change-of-status data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-status data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.