Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries in helicopter (17)

Aircraft Values and Indicators

Thursday, February 28, 2019 at 3:08PM

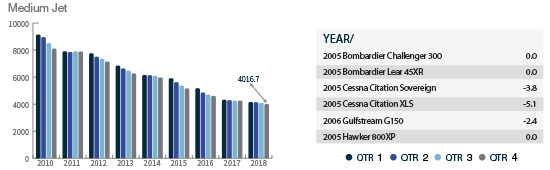

Thursday, February 28, 2019 at 3:08PM Medium Jet

The Medium Jet chart depicts the average price (in thousands) of the six jets listed. Each model’s year will precede the name of the aircraft.

Download the full winter 2018 issue of Aircraft Bluebook Marketline to read more.

Aircraft Values and Indicators

Thursday, December 6, 2018 at 3:38PM

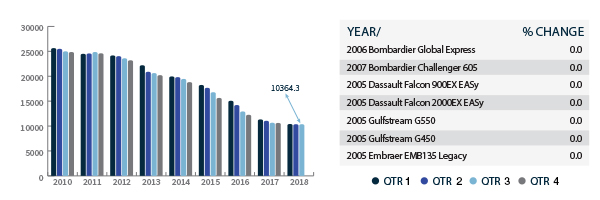

Thursday, December 6, 2018 at 3:38PM Large Jet

The Large Jet chart depicts the average price (in thousands) of the seven jets listed. Each model’s year will precede the name of the aircraft.

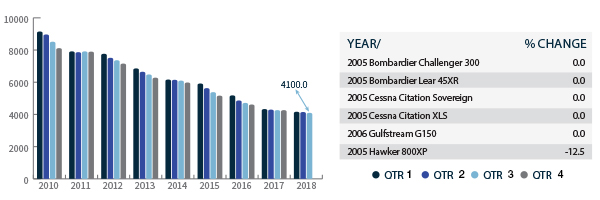

Medium Jet

The Medium Jet chart depicts the average price (in thousands) of the six jets listed. Each model’s year will precede the name of the aircraft.

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Subscribe to the Aircraft Bluebook Marketline newsletter.

Situational Awareness

Thursday, December 6, 2018 at 2:33PM

Thursday, December 6, 2018 at 2:33PMGeneral Dynamics Buys Nordam Nacelle Line for Gulfstreams

Gulfstream maker General Dynamics (GD) said Oct. 1 it acquired the Nordam Group’s nacelle manufacturing line for the Gulfstream G500 and Gulfstream G600, ending a drama that saw the latter file for bankruptcy and threats arise to one of industry’s high-profile business jets.

GD said it will continue to operate the line at Nordam’s Tulsa, Oklahoma, facility. A federal bankruptcy judge approved the transfer Sept. 26, clearing the way for the acquisition. Terms will not be disclosed, the company added.

According to GD, a deal for the line was filed in court in September. What is more, GD had been operating the line “since early September” under a sublease as parties worked to address Nordam’s bankruptcy, filed July 22.

“Gulfstream has a 60-year history of manufacturing and product excellence that will serve our customers well as we assume responsibility for nacelle production,” Gulfstream President Mark Burns said. “The manufacturing of this component is firmly in our wheelhouse, especially since we also manufacture the wings and empennages for these aircraft.”

Family owned Nordam filed for bankruptcy protection after a protracted contract dispute with Pratt & Whitney Canada over the PW800 nacelle system used in G500s and G600s. The company said the bankruptcy was due to this dispute only and other programs were not affected.

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Current Market Strength of 50 Pre-Owned Aircraft Models: Spring 2018

Wednesday, June 20, 2018 at 10:55AM

Wednesday, June 20, 2018 at 10:55AM Aircraft Bluebook Marketline’s Current Market Strength represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release. March 1, 2018, is the effective date for the data represented in the table below.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Current Market Strength of 50 Pre-Owned Aircraft Models: Winter 2017

Monday, February 12, 2018 at 3:49PM

Monday, February 12, 2018 at 3:49PM CMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release — Dec. 1, 2017, in this case. See the chart below.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Late-Model Jet Values Are Competitive

Thursday, June 23, 2016 at 3:45PM

Thursday, June 23, 2016 at 3:45PM As the days of summer have grown, so have available inventories of late-model business jets in the global market. What makes these days most interesting are the volumes of late-model jets for sale with competitive pricing.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |