Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  2020,

2020,  Business Trends,

Business Trends,  business aircraft in

business aircraft in  Situational Awareness

Situational Awareness  Tuesday, March 10, 2020 at 3:20PM

Tuesday, March 10, 2020 at 3:20PM

Molly McMillin | Editor in Chief | The Weekly of Business Aviation

Key trends to watch for in business aviation in 2020 include an acceleration in electric aircraft, an increase in sustainability communication, a resolution of Brexit, more industry consolidation and other issues, says Adam Twidell, CEO of PrivateFly, an on-demand private charter company.

“The next 12 months are set to bring more innovation and growth–including steps forward in our technology and more exclusive on-demand offerings for our clients,” Twidell said. “But what can the wider industry expect to see in 2020? Here are my predictions for the year ahead.”

First, acceleration in business aircraft.

Business aviation will be the first subsector to implement electric aviation. The first generation of certified electric aircraft will include...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  2020,

2020,  Business Trends,

Business Trends,  business aircraft in

business aircraft in  Situational Awareness

Situational Awareness  Tuesday, October 15, 2019 at 3:19PM

Tuesday, October 15, 2019 at 3:19PM Beechcraft King Air 350i, the second-generation Model B300, is significantly quieter, more comfortable and more capable than the original aircraft. It’s been in production since 2009 and more than 440 units have been delivered, including 35 to launch Wheels Up, the model’s launch customer.

The 350i features triple-layer skin panel insulation, dynamically tuned vibration dampers, thicker thermal insulation and an acoustically isolated interior shell. The package is tuned to sop up noise at 1,500 prop rpm, reducing the interior sound level by 4 dB, resulting in a 78-dB cabin in cruise.

There are six 115 VAC outlets in the cabin and one more in the cockpit. A Collins Venue inflight entertainment system is standard...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Kbeech King Air 350i,

Kbeech King Air 350i,  business aircraft,

business aircraft,  business jet in

business jet in  BCA

BCA  Thursday, April 18, 2019 at 12:21PM

Thursday, April 18, 2019 at 12:21PM | Aviation Week & Space Technology

Chinese demand for business aircraft has flopped again, disappointing manufacturers for a second time this decade. Economic weakness is one of many factors; politics, never far below the surface in China, is another. Usage of business aircraft in China is also falling behind expectations, especially operations by foreign owners. It looks like international interest in trade and investment deals in China has dropped and, with it, the need for top executives to go there. Dassault has most...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  China,

China,  business aircraft,

business aircraft,  demand in

demand in  Aviation Week & Space Technology

Aviation Week & Space Technology  Thursday, January 17, 2019 at 10:26AM

Thursday, January 17, 2019 at 10:26AM A more positive note crept back into business aviation in 2018 as new models key to the market’s recovery checked off program milestones. We took a look at events in business aviation in 2018.

Thursday, December 6, 2018 at 3:01PM

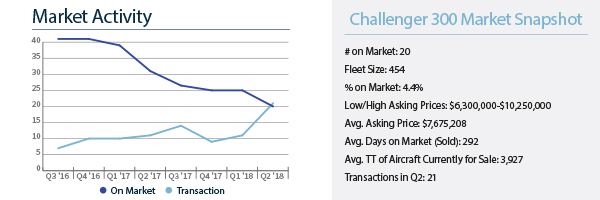

Thursday, December 6, 2018 at 3:01PM The Challenger 300

Is it possible for the number of transactions in a quarter to exceed the number available for sale? In

this current Challenger 300 market it certainly is. Q2 of 2018 brought 21 transactions with just 20 aircraft listed for sale. Looking back a year ago, Q2 of 2017 produced only 11 sales, with 31 Challenger 300’s on the market. Even when compared to the 1st quarter of 2018, inventory has dropped 20% with transactions jumping from 14 to 21 aircraft sold in Q2 2018. Pricing is strong and has been for the past few quarters. With declining inventory and increasing demand, this makes...

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Subscribe to the Aircraft Bluebook Marketline newsletter.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |