Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries in Challenger (3)

Market Report

Thursday, December 6, 2018 at 3:01PM

Thursday, December 6, 2018 at 3:01PM The Challenger 300

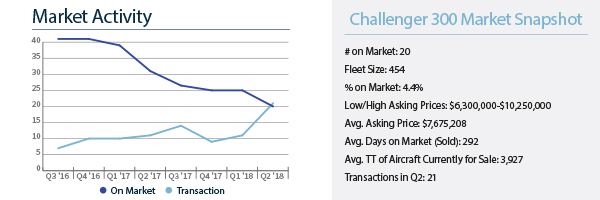

Is it possible for the number of transactions in a quarter to exceed the number available for sale? In

this current Challenger 300 market it certainly is. Q2 of 2018 brought 21 transactions with just 20 aircraft listed for sale. Looking back a year ago, Q2 of 2017 produced only 11 sales, with 31 Challenger 300’s on the market. Even when compared to the 1st quarter of 2018, inventory has dropped 20% with transactions jumping from 14 to 21 aircraft sold in Q2 2018. Pricing is strong and has been for the past few quarters. With declining inventory and increasing demand, this makes...

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Subscribe to the Aircraft Bluebook Marketline newsletter.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | PRE-OWNED AIRCRAFT MARKET DISTRACTED BY BOTTOM FEEDERS

Wednesday, February 17, 2010 at 12:12PM

Wednesday, February 17, 2010 at 12:12PM Vol. 23, No. 1 | Feb. 17, 2010 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

In the pre-owned aircraft market, bottom feeders are like red herrings.

Bottom feeders — corporate aircraft that have no significant issues with their history, maintenance or condition and are marketed below Bluebook wholesale values — continue to be great opportunities for the fortunate few who buy without a blink of an eye.

They also lead buyers into a false perception of value that only competition in the market can correct.

Reasons why such aggressive marketing maneuvers continue to appear are wide and varied. When a corporate aircraft with no issues with its condition, equipment or history sells for a low price, Aircraft Bluebook–Price Digest investigates to learn the whole story. Capital gains, tax shelters, foreclosures, and even new deliveries are just a few reasons behind these significantly discounted offerings. One common denominator in all of this is the element of time. An aggressive discount in price represents interest in an immediate sale. True, this moves the economy, but such a transaction does not fit the definition of Fair Market, which the Bluebook reports as Average Retail.

Pre-owned aircraft sales activity slowly is showing stability in the market, but news of another bottom feeder eclipses these transactions, and market perception has to be rebooted like after a computer crash.

Serious buyers are starting to see beyond all the drama when an unrealistic offering is being denied by the seller. Ready-to-fly, well-equipped aircraft with fresh maintenance are bringing some normalcy to aircraft values.

Although the market is still nothing to brag about, and trends still might adjust down, this market is nothing like the roller coaster ride of 2009. As the market slowly improves, attention to navigating through the economy is migrating from ground to traffic awareness.

Jet

Bluebook-at-a-glance

Increased — 2

Decreased — 455

Stable — 419

Late-model, large-cabin aircraft are retaining value. Don’t be surprised if supply and demand create more competition between buyers. This competition will start a slow upward tick in pricing. Now is really the time to buy in this market.

Citation X values remained steady while the Sovereign was off 2 percent from last quarter. Bombardier Global Express and the 5000 remained steady while the Challenger 604 declined 2.5 percent. The Falcon 7X held steady while the Falcon 50 was down 5 percent from last quarter. Late-model Gulfstreams held steady while earlier models were off 5 percent from the winter Bluebook.

Turboprop

Bluebook-at-a-glance

Increased — 13

Decreased — 62

Stable — 518

The ag market continued to show no changes in value when compared to the previous quarter. Late-model King Airs remained stable while earlier models generally also held on without trending. The Cessna Caravan was stable with later models down 1 percent or less. Some slight rays of sunshine were select Piper Cheyennes experiencing slight increases from the previous quarter.

Multi

Bluebook-at-a-glance

Increased — 30

Decreased — 105

Stable — 521

For the most part, late-model twins, the Beech Baron and Piper Seneca held steady for yet another quarter. Early-model twins such as the Cessna 421 and Beech Duke were off 2 percent from the winter Bluebook.

Single

Bluebook-at-a-glance

Increased — 272

Decreased — 618

Stable — 1581

Ag planes generally remained unchanged. Amphibious models such as the Lake were up slightly in trending. The Piper Arrow was also in the positive column while most Maules were off slightly. Late-model Bonanzas and Cessna singles held steady while the Diamond Star was up 5 percent or more. For the most part, values remained steady.

Helicopter

Bluebook-at-a-glance

Increased — 13

Decreased — 99

Stable — 904

Helicopter models reported in Bluebook continue to level off. Piston helicopters such as Enstrom and Robinson were up slightly through select model years. Some turbines, such as the Eurocopter EC135, were off 5 percent from the previous quarter. Overall, the majority of models reported in Bluebook remained stable.

Aircraft Bluebook–Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

Beech,

Beech,  Cessna,

Cessna,  Challenger,

Challenger,  Dassault Falcon 50,

Dassault Falcon 50,  Diamond Star,

Diamond Star,  Enstrom,

Enstrom,  Eurocopter,

Eurocopter,  Gulfstream,

Gulfstream,  King Air,

King Air,  Maule,

Maule,  Piper,

Piper,  Robinson in

Robinson in  Newsletter

Newsletter AIRCRAFT VALUES NEUTRALIZE AFTER DESCENT

Wednesday, August 19, 2009 at 4:10PM

Wednesday, August 19, 2009 at 4:10PM Vol. 22, No. 3 | Aug. 19, 2009 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Aircraft values reported in the previous quarter were in a spiral dive, but the economy’s pilot now appears to have neutralized the rapid descent.

For the most part, values have arrived at ground level. Inventories have shown signs of stability with little or no growth in units for sale. Other market indicators show signs of neutralization as well. Aircraft dealers and brokers report that interest has increased. Phones are ringing more with potential buyers on the line. Compared to the 2005 baseline real gross domestic product, GDP declined 1.0 percent in the second quarter of 2009 after declining 6.4 percent in the first quarter. These indicators support the signs of neutralization in the marketplace, though the used aircraft market has no reason to rally.

Maybe the market has not yet reached the dawn of a recovery, but the market has absorbed the fallen values. The jet segment is the most volatile portion of the aircraft market. Flight departments that were liquidated are no longer creating a frenzy of drastic value reductions. Manufacturers finding new homes for new aircraft in default maintain nearly full sales values. The only difference is that deposits from contracts in default allow discounts to the new buyers. Once these sales are complete, the discounts will end.

Jet

Bluebook-at-a-glance

Increased — 143

Decreased — 49

Stable — 665

Bluebook’s attention has focused on late-model large-cabin new deliveries that may take as long as two years or more for interior completion and delivery. Some of the increase in value can be found in the fall edition of Aircraft Bluebook. Examples include the Bombardier Global family as well as the Challenger 605 and Dassault Falcon 900 and 2000 series.

Turboprop

Bluebook-at-a-glance

Increased — 75

Decreased — 114

Stable — 399

Socata fared better in this reporting period. Sales demonstrated that values were better than previously reported; therefore, stronger values appear in the new release of Bluebook. Turboprop ag planes continue to demonstrate improved values with limited inventories available in the world market. The Piaggio was up 9 percent from the previous quarter as well.

Multi

Bluebook-at-a-glance

Increased — 0

Decreased — 110

Stable — 545

For the most part, values remained unchanged for this reporting period in the multipiston category. Nothing increased in value. Most late models held on to their values without loss. Early model Cessnas as well as some Twin Commanders trended downward slightly.

Single

Bluebook-at-a-glance

Increased — 117

Decreased — 220

Stable — 2108

Ag planes kept a positive note in the single category. Select models experienced modest increases. Some of the decreases included American Champions, such as the 8-KCAB, and Beech 35. Both were reported down from the previous quarter. For the most part, however, most single-engine pistons remained steady for this reporting period.

Helicopter

Bluebook-at-a-glance

Increased — 4

Decreased — 828

Stable — 177

Helicopter values experienced a decline in this quarter. Part of the decline may relate to lower values on earlier models with limited mission capabilities when compared to newer helicopters. Early-model Sikorsky aircraft as well as Bell and Eurocopter models were down. Decreases averaged 8 percent or more. In the piston category, values were lower, too.

Aircraft Bluebook — Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

Beech,

Beech,  Bombardier,

Bombardier,  Cessna,

Cessna,  Challenger,

Challenger,  Dassault Falcon,

Dassault Falcon,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  single,

single,  turboprop,

turboprop,  used aircraft,

used aircraft,  values in

values in  Newsletter

Newsletter