Beech,

Beech,  Cessna,

Cessna,  Eurocopter AS350B Ecureuil,

Eurocopter AS350B Ecureuil,  Piper,

Piper,  aircraft on registry,

aircraft on registry,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  piston,

piston,  pre-owned aircraft,

pre-owned aircraft,  turboprop,

turboprop,  used aircraft in

used aircraft in  Charts

Charts  Friday, December 10, 2010 at 10:27AM

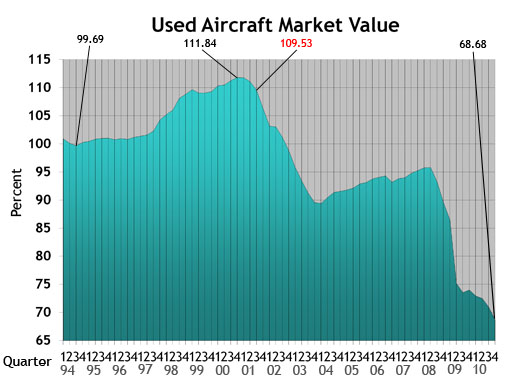

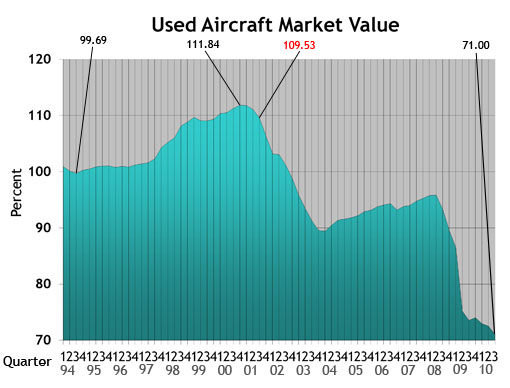

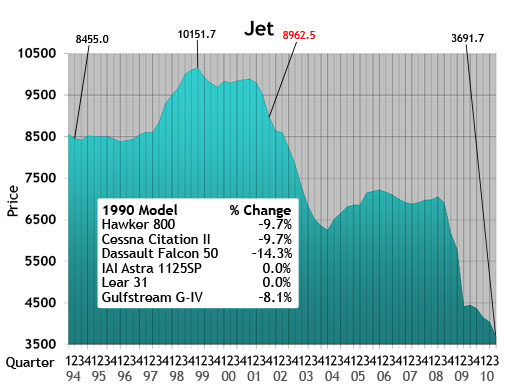

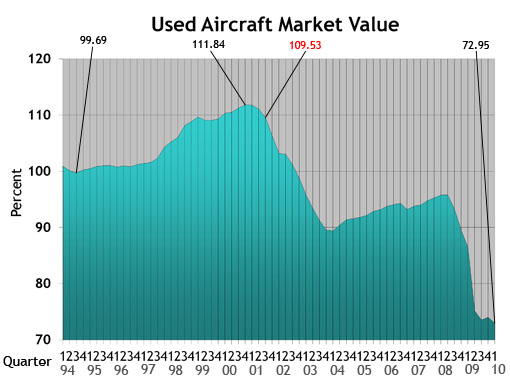

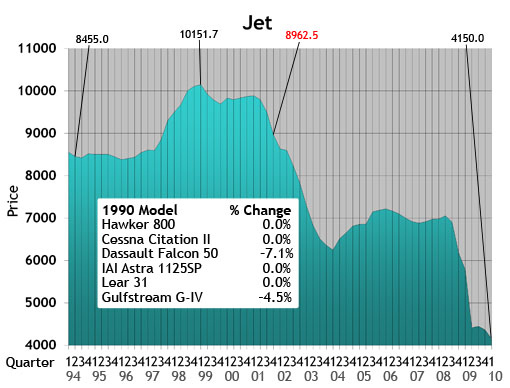

Friday, December 10, 2010 at 10:27AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

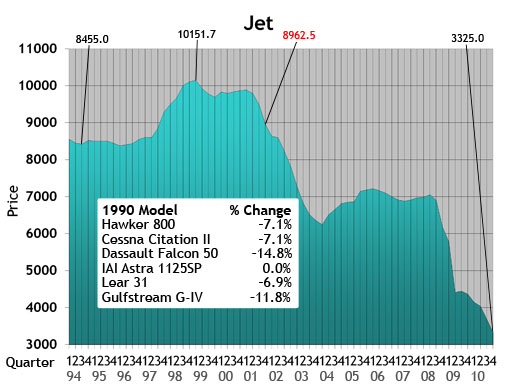

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

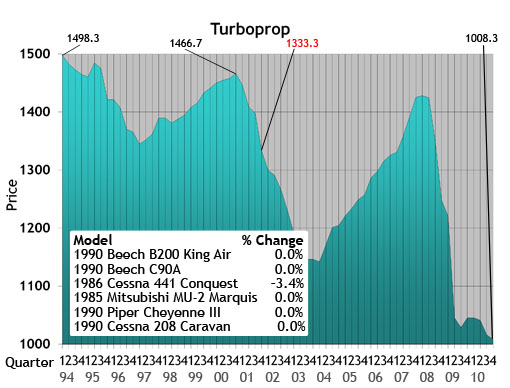

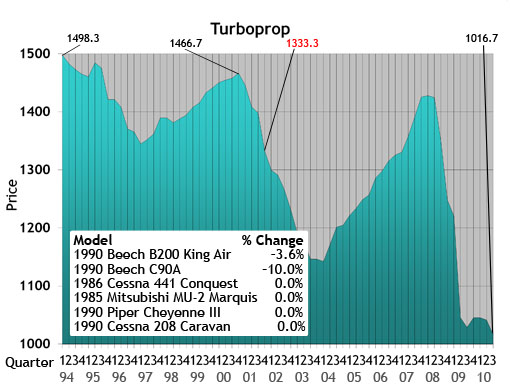

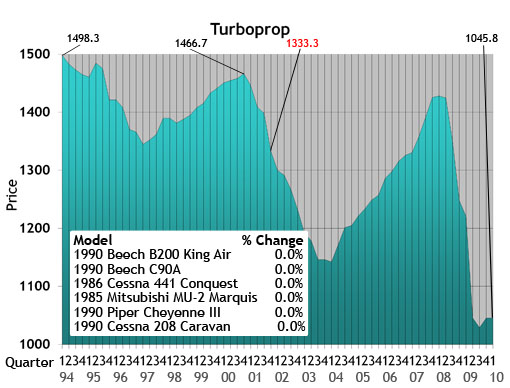

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

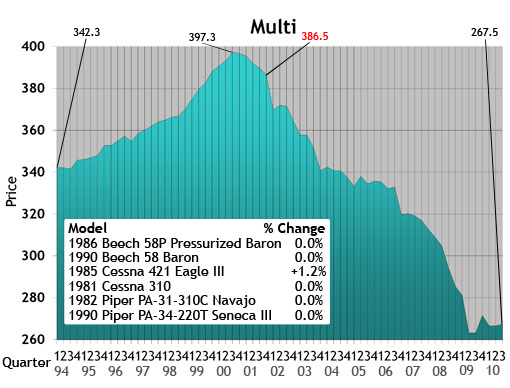

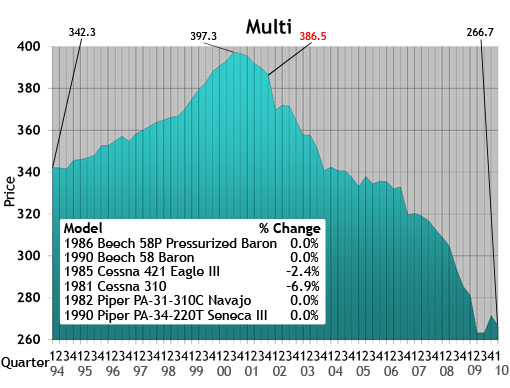

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

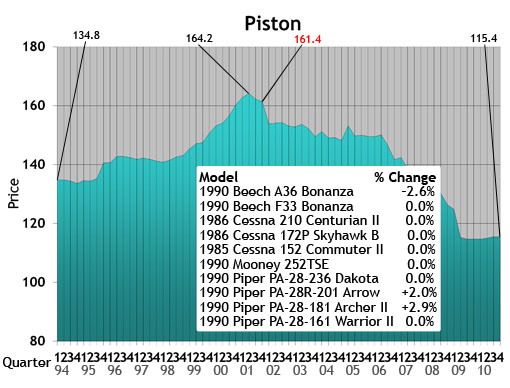

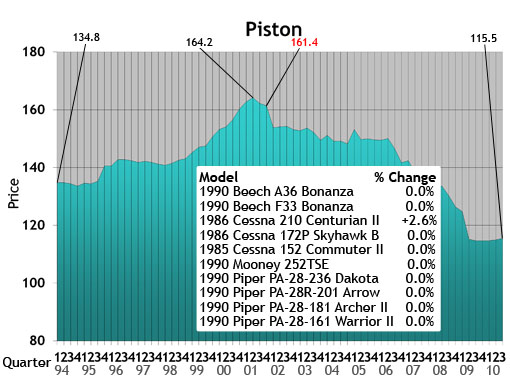

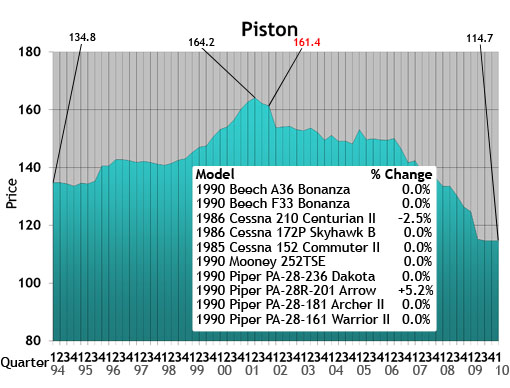

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

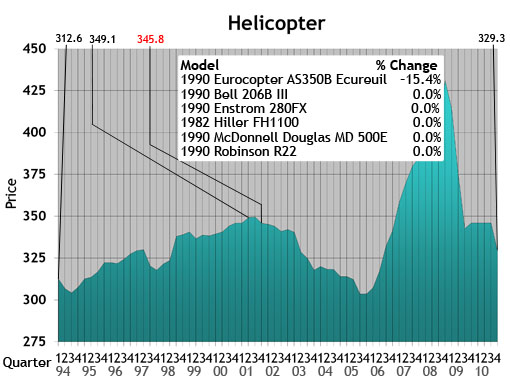

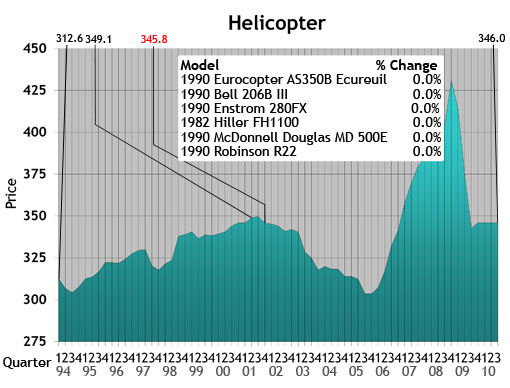

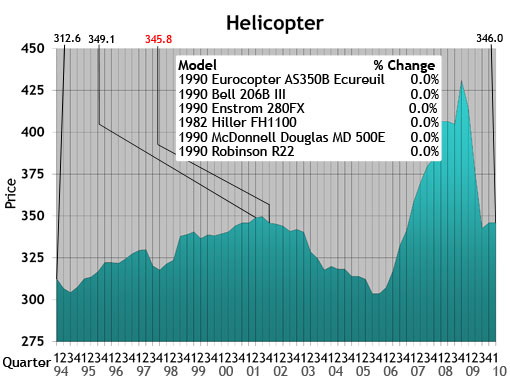

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

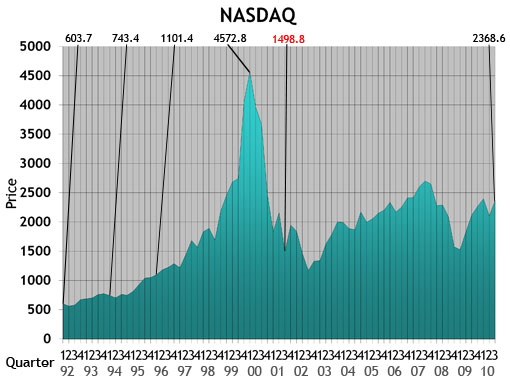

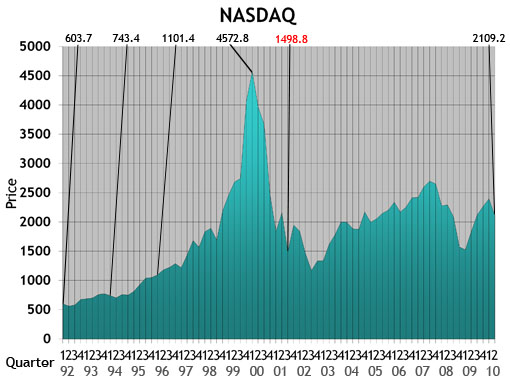

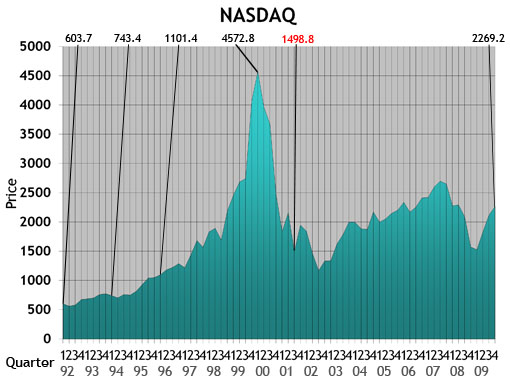

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

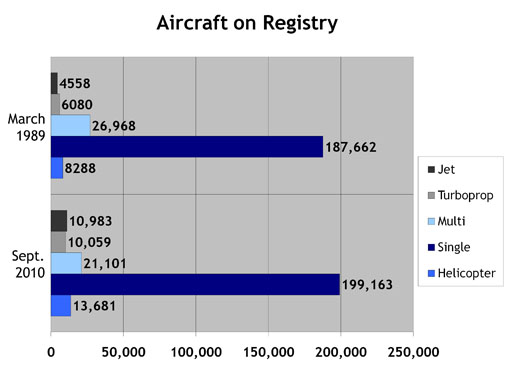

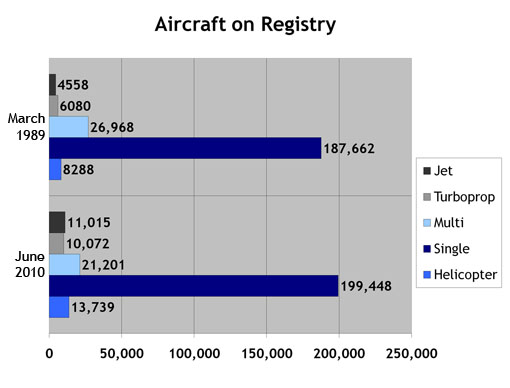

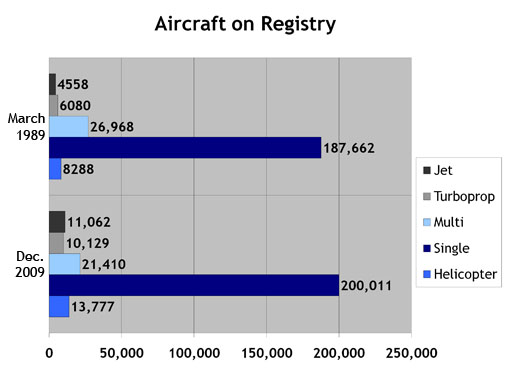

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

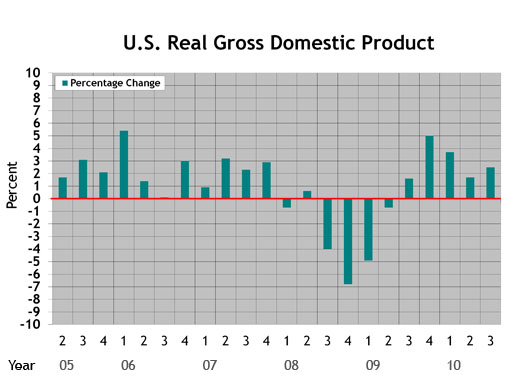

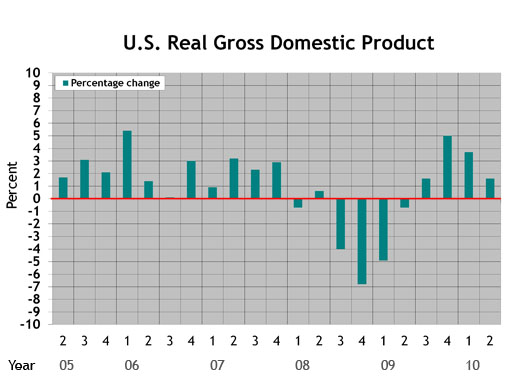

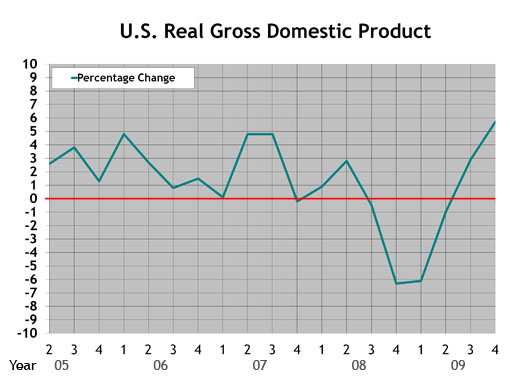

U.S. Real Gross Domestic Product (updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

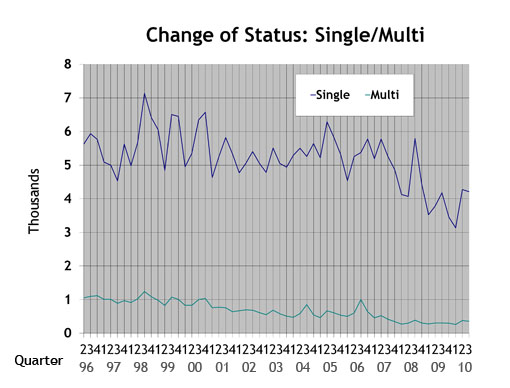

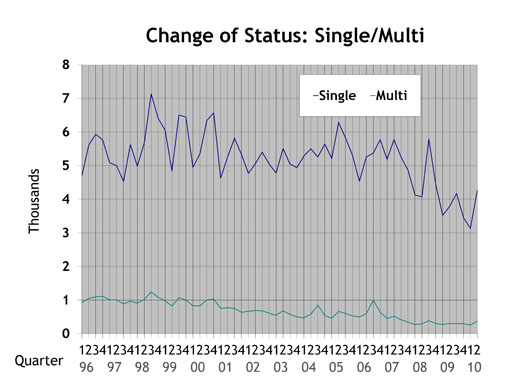

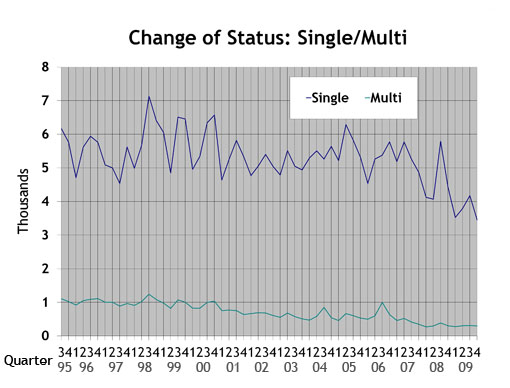

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

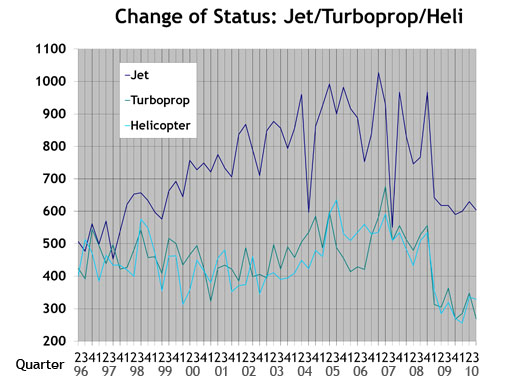

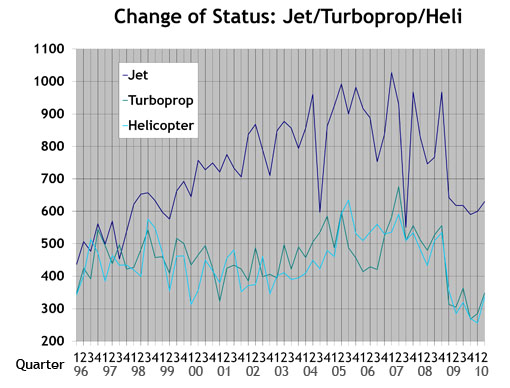

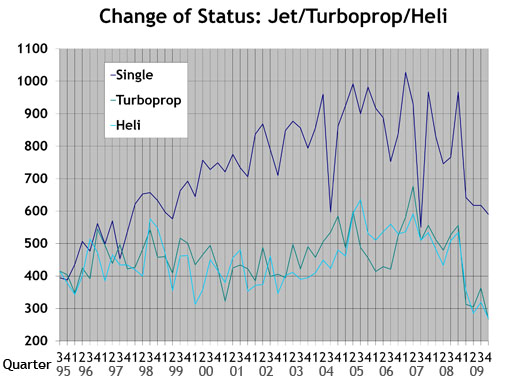

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

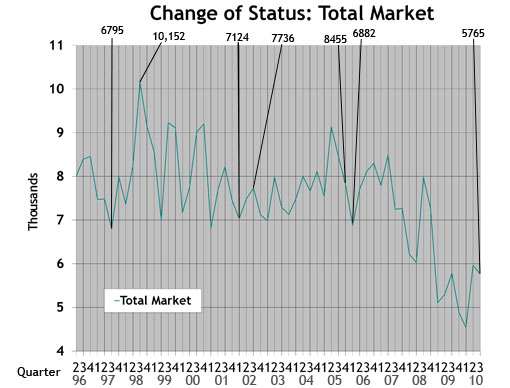

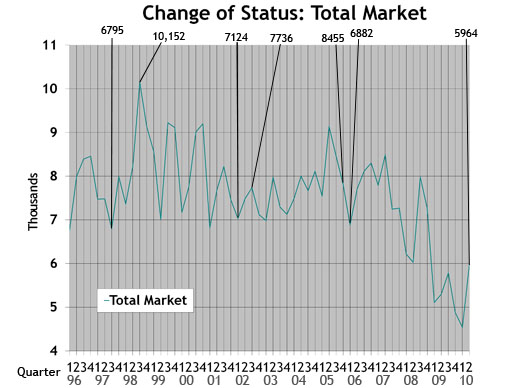

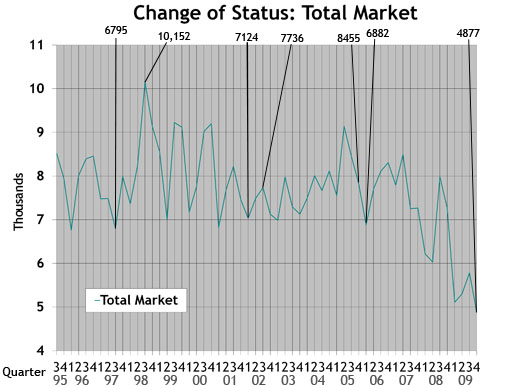

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Wednesday, August 18, 2010 at 3:07PM

Wednesday, August 18, 2010 at 3:07PM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

U.S. Real Gross Domestic Product (updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Aircraft Bluebook Marketline

Aircraft Bluebook Marketline

After the revised second quarter GDP estimate came out on Aug. 27, 2010, we updated the GDP graph to include most recent revisions.

Wednesday, May 26, 2010 at 9:22AM

Wednesday, May 26, 2010 at 9:22AM by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Finally, the pre-owned aircraft market moved in a positive direction in the first quarter of 2010. Late-model, large-cabin, long-range aircraft were selling at or better than values published in the Aircraft Bluebook.

External factors such as increased sales, a slight decline of available inventory and world market competition could all be considered causes for the improvement. Although this early indication of a slow recovery is in progress, it is too early to celebrate. Any positive sign going forward is far better than where the used aircraft market has been.

With the exception of the late-model, large-cabin class, most of the other business aircraft are not yet recovering in value. The good news is that values are showing more stability. Market activity is on the rise leaving a more optimistic perception that values are not exposed to the risks experienced in the last twenty months.

A couple considerations might be affecting values in the pre-owned aircraft market. The first is available credit for qualified buyers, and the second is the price of fuel. Part of the dilemma that played a major role in an injured economy was the lack of finance. Now, aircraft lenders are able to enable more transactions. This new reality will move the aircraft market into better days. At the same time, credit could indicate how aircraft values will rebound as elements of risks financial institutions are willing to take will have an indirect impact on value. Energy and the price of crude oil is the other factor that will impact further recovery. As long as there are no surprising jumps in the price of crude oil in a limited time frame, the aircraft market will be able to absorb the daily fluctuations in oil prices and prevent the cost of fuel from becoming a deterrent in this industry’s recovery.

Bluebook-at-a-glance

Increased — 5

Decreased — 410

Stable — 462

As reported above, late-model, large-cabin aircraft are retaining value. Select Gulfstream G550s were up $1 million with the remainder of these aircraft holding steady in value. The Gulfstream G-V market remained unchanged. The G-IV values were off an average of $500,000. Bombardier Global Express and the Global 5000 also held steady while inventories for sale decreased. The Bombardier Lear 45 series was off $200,000 on average. The Cessna Citation Excel series was down an average of $200,000 as well. Light jets such as the Beech Premier were off an average of $200,000. The Hawker 400 was down $100,000. The Citation 525 was off slightly as well.

Bluebook-at-a-glance

Increased — 55

Decreased — 86

Stable — 452

The ag market values improved slightly when compared to the previous quarter. Late-model Beechcraft King Airs remained stable. Earlier models generally also held on, though some models trended downward. Reduction in production for the King Air series might have some positive benefits. In time, limited production could cause limited inventories for sale in the pre-owned market, which would then cause values to strengthen. The Cessna Conquest was stable for yet another quarter. The Piper Meriden was down $50,000.

Bluebook-at-a-glance

Increased — 29

Decreased — 103

Stable — 523

The Beech Baron family of piston twins achieved some slight gains in value. Early-model 58s were up slightly. Select Baron 55 models also experienced narrow gains. For the most part, however, decreases in value were slight but across the board. Cessna 310 values were down, and the Diamond Twin Star was off $10,000.

Bluebook-at-a-glance

Increased — 311

Decreased — 267

Stable — 1909

Select ag planes generally made slight gains. Values of early-model Beech Bonanza A36s were up from the previous quarter. Late-model Cessna 172 Skyhawks and Cessna 206s reported slightly higher values for the summer release of Aircraft Bluebook. Commanders and Mooneys were generally off $5,000 to $10,000 when compared to the previous quarter. The majority of aircraft in this reporting segment remained stable.

Bluebook-at-a-glance

Increased — 52

Decreased — 170

Stable — 809

The Enstrom F28/280 series improved slightly from the previous quarter. Compared to the previous quarter, select models of the Eurocopter Twin Star were off $100,000. The Bell 430 also declined an average of $300,000 from previous reported values. The Enstrom 480 was down $50,000. The helicopter segment remained stable for the most part.

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

Beech,

Beech,  Bell,

Bell,  Cessna,

Cessna,  Citation,

Citation,  Diamond Twin Star,

Diamond Twin Star,  Enstrom,

Enstrom,  Gulfstream,

Gulfstream,  Hawker 400,

Hawker 400,  King Air,

King Air,  large-cabin,

large-cabin,  pre-owned,

pre-owned,  used aircraft in

used aircraft in  Newsletter

Newsletter  Wednesday, February 17, 2010 at 12:12PM

Wednesday, February 17, 2010 at 12:12PM by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

In the pre-owned aircraft market, bottom feeders are like red herrings.

Bottom feeders — corporate aircraft that have no significant issues with their history, maintenance or condition and are marketed below Bluebook wholesale values — continue to be great opportunities for the fortunate few who buy without a blink of an eye.

They also lead buyers into a false perception of value that only competition in the market can correct.

Reasons why such aggressive marketing maneuvers continue to appear are wide and varied. When a corporate aircraft with no issues with its condition, equipment or history sells for a low price, Aircraft Bluebook–Price Digest investigates to learn the whole story. Capital gains, tax shelters, foreclosures, and even new deliveries are just a few reasons behind these significantly discounted offerings. One common denominator in all of this is the element of time. An aggressive discount in price represents interest in an immediate sale. True, this moves the economy, but such a transaction does not fit the definition of Fair Market, which the Bluebook reports as Average Retail.

Pre-owned aircraft sales activity slowly is showing stability in the market, but news of another bottom feeder eclipses these transactions, and market perception has to be rebooted like after a computer crash.

Serious buyers are starting to see beyond all the drama when an unrealistic offering is being denied by the seller. Ready-to-fly, well-equipped aircraft with fresh maintenance are bringing some normalcy to aircraft values.

Although the market is still nothing to brag about, and trends still might adjust down, this market is nothing like the roller coaster ride of 2009. As the market slowly improves, attention to navigating through the economy is migrating from ground to traffic awareness.

Bluebook-at-a-glance

Increased — 2

Decreased — 455

Stable — 419

Late-model, large-cabin aircraft are retaining value. Don’t be surprised if supply and demand create more competition between buyers. This competition will start a slow upward tick in pricing. Now is really the time to buy in this market.

Citation X values remained steady while the Sovereign was off 2 percent from last quarter. Bombardier Global Express and the 5000 remained steady while the Challenger 604 declined 2.5 percent. The Falcon 7X held steady while the Falcon 50 was down 5 percent from last quarter. Late-model Gulfstreams held steady while earlier models were off 5 percent from the winter Bluebook.

Bluebook-at-a-glance

Increased — 13

Decreased — 62

Stable — 518

The ag market continued to show no changes in value when compared to the previous quarter. Late-model King Airs remained stable while earlier models generally also held on without trending. The Cessna Caravan was stable with later models down 1 percent or less. Some slight rays of sunshine were select Piper Cheyennes experiencing slight increases from the previous quarter.

Bluebook-at-a-glance

Increased — 30

Decreased — 105

Stable — 521

For the most part, late-model twins, the Beech Baron and Piper Seneca held steady for yet another quarter. Early-model twins such as the Cessna 421 and Beech Duke were off 2 percent from the winter Bluebook.

Bluebook-at-a-glance

Increased — 272

Decreased — 618

Stable — 1581

Ag planes generally remained unchanged. Amphibious models such as the Lake were up slightly in trending. The Piper Arrow was also in the positive column while most Maules were off slightly. Late-model Bonanzas and Cessna singles held steady while the Diamond Star was up 5 percent or more. For the most part, values remained steady.

Bluebook-at-a-glance

Increased — 13

Decreased — 99

Stable — 904

Helicopter models reported in Bluebook continue to level off. Piston helicopters such as Enstrom and Robinson were up slightly through select model years. Some turbines, such as the Eurocopter EC135, were off 5 percent from the previous quarter. Overall, the majority of models reported in Bluebook remained stable.

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

Beech,

Beech,  Cessna,

Cessna,  Challenger,

Challenger,  Dassault Falcon 50,

Dassault Falcon 50,  Diamond Star,

Diamond Star,  Enstrom,

Enstrom,  Eurocopter,

Eurocopter,  Gulfstream,

Gulfstream,  King Air,

King Air,  Maule,

Maule,  Piper,

Piper,  Robinson in

Robinson in  Newsletter

Newsletter  Wednesday, February 17, 2010 at 12:09PM

Wednesday, February 17, 2010 at 12:09PM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11. Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box. Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box. Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft. Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft. Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft. NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971. Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory. U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product: This graph represents real gross domestic product measured by the U.S. Department of Commerce. Each data point represents the percentage change from the 2005 baseline GDP. The study begins with the second quarter in 2005. Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis. Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters. Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Beech,

Beech,  Cessna,

Cessna,  Gulfstream,

Gulfstream,  Piper,

Piper,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  piston,

piston,  single,

single,  turboprop,

turboprop,  used aircraft,

used aircraft,  values in

values in  Charts

Charts