Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  CMS,

CMS,  Current Market Strength,

Current Market Strength,  pre-owned aircraft in

pre-owned aircraft in  At-a-Glance,

At-a-Glance,  Newsletter

Newsletter  Tuesday, September 29, 2015 at 8:00AM

Tuesday, September 29, 2015 at 8:00AM CMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release. See chart below.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  CMS,

CMS,  Current Market Strength,

Current Market Strength,  pre-owned aircraft in

pre-owned aircraft in  At-a-Glance,

At-a-Glance,  Newsletter

Newsletter  Monday, June 15, 2015 at 9:00AM

Monday, June 15, 2015 at 9:00AM By Carl Janssens, ASA | Chief Appraiser | Penton Aviation

It’s hard to believe, but 2015 is already nearly halfway into the history books. For business aircraft transactions, it has been a steady course, fair weather kind of activity. Nothing negative, transactions are occurring. Values, for the most part, continue to show depreciation. The question of when are values going to stabilize appears to offer its own conclusion by what is revealed through the transparency in recent sales data. The answer: “never.”

Friday, March 13, 2015 at 1:25PM

Friday, March 13, 2015 at 1:25PM By Carl Janssens, ASA | Chief Appraiser | Penton Business Aviation Network

Business aircraft pricing in the pre-owned market appears to be soaring in ground effect.

The good news is that sales are occurring while, on the cloudy side, values, at best, try to maintain a flat trending posture.

Pre-owned aircraft pricing isn’t keeping time with commerce. From the sea, the West Coast ports of entry look like long-term parking lots for sea freighters: Lots of stuff awaiting their turn for deporting goods from the backlog created by labor disputes. Then, try driving on any Interstate. The amount of commerce on the move via countless eighteen wheelers is remarkable. And, don’t be caught waiting for a delayed flight during FedEx’s rush hour in Memphis. You might be there awhile. While all of this anecdotal evidence would indicate a more robust economy for pre-owned aircraft values, such is not the case.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Monday, June 6, 2011 at 9:07AM

Monday, June 6, 2011 at 9:07AM Vol. 24, No. 2 | June 6, 2011 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

News networks these days have few positive perceptions when reporting on the U.S. economic recovery. Stories cite home foreclosures, a lack of jobs and the price of gas as prospective signs of a weak economy.

While doubts persist about the United States in an economic recovery, the business aviation sector is not following suit. For instance, late-model, large-cabin, long-range aircraft are selling at or above values published in the Aircraft Bluebook.

While North American business aircraft transactions have been lackluster, increasing sales on other continents are supporting the overall business aircraft market. Whatever the reason, inventories for late-model aircraft for sale continue to shrink. This can be interpreted as an indication of values held in check.

New aircraft models designed and equipped with the latest technology are breathing new life into the industry. Legacy aircraft, on the other hand, will never experience an economic comeback. Darwin’s “survival of the fittest” affects business aircraft, too.

While the U.S. economy still struggles to make a better comeback, business aviation has wheels in the well for the long haul.

Bluebook-at-a-glance

Increased — 41

Decreased — 298

Stable — 583

Lear 35s are now being reported with MSP, and values trended upward due to the reported equipped price in Bluebook. Late-model Bombardier Global XRSes gained value by $1 million when compared to the previous quarter.

Bluebook-at-a-glance

Increased — 1

Decreased — 93

Stable — 511

Like the rest of the industry, turboprops continued to demonstrate some good signs of stability. Payload, range and cost of operation will be key factors to watch. As competition for commodities becomes more aggressive on a global level, bringing new services to remote regions of the world will also play a role in continued stability in this market segment.

Bluebook-at-a-glance

Increased — 10

Decreased — 32

Stable — 616

Bluebook-at-a-glance

Increased — 148

Decreased — 335

Stable — 2056

The multi and single markets are some of the best indicators of stability. A majority of these aircraft are represented by personal acquisition. Buyers and sellers agree on price, and financial institutions fund these transactions.

Bluebook-at-a-glance

Increased — 69

Decreased — 122

Stable — 865

The Robinson R44 and R22 gained slightly in value when compared to the previous quarter. The majority of models remained stable for another quarter.

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

Monday, June 6, 2011 at 8:44AM

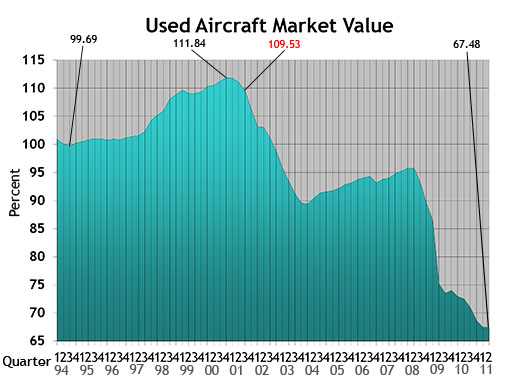

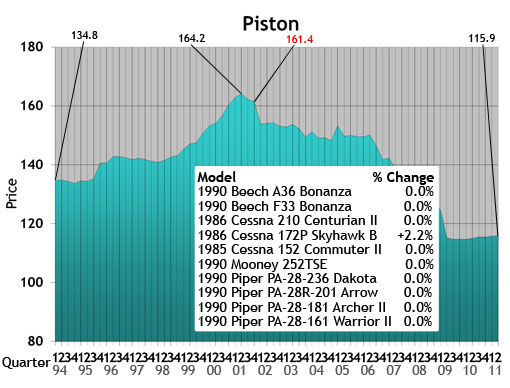

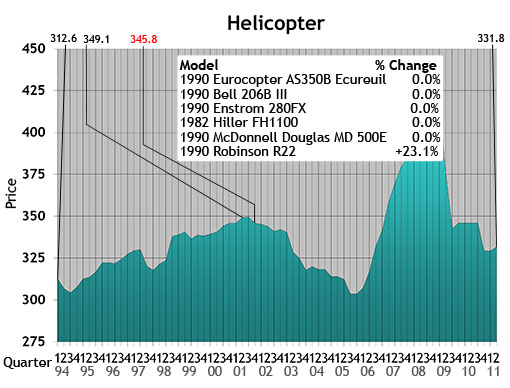

Monday, June 6, 2011 at 8:44AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

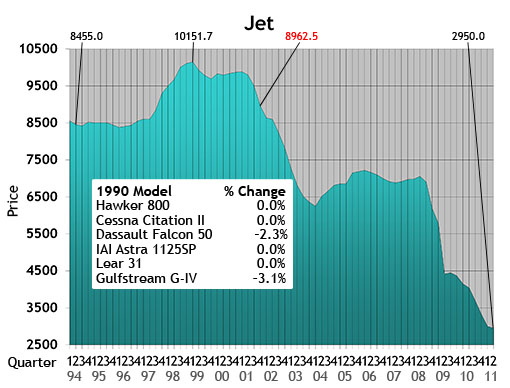

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

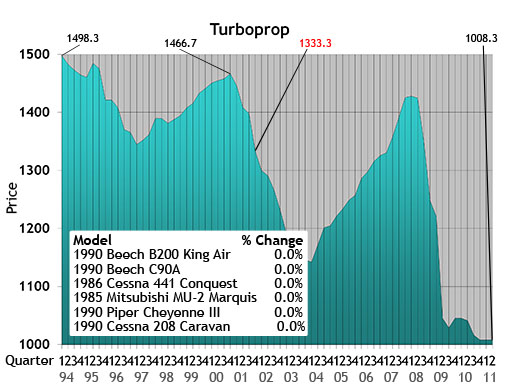

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

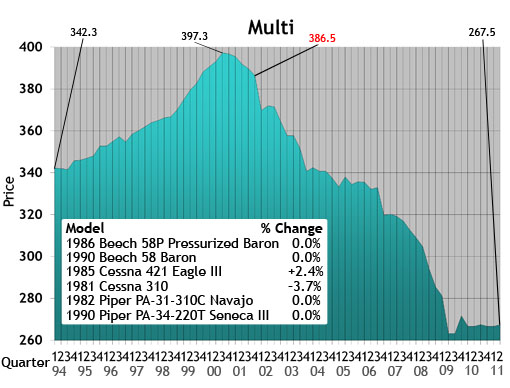

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

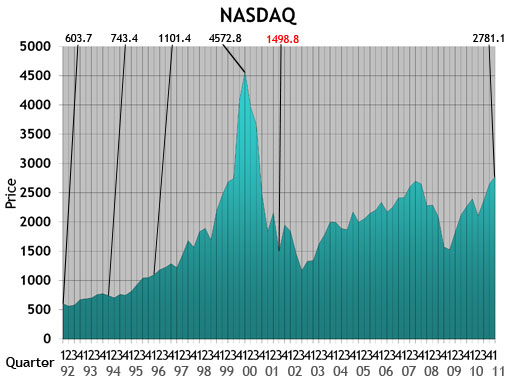

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

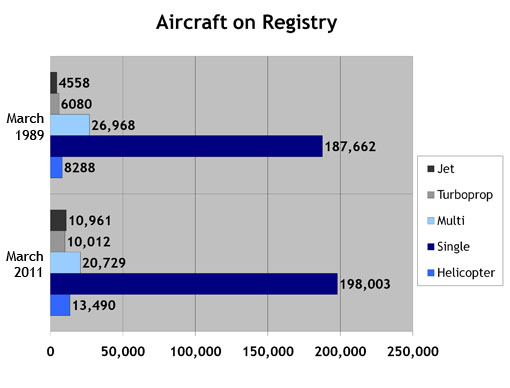

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

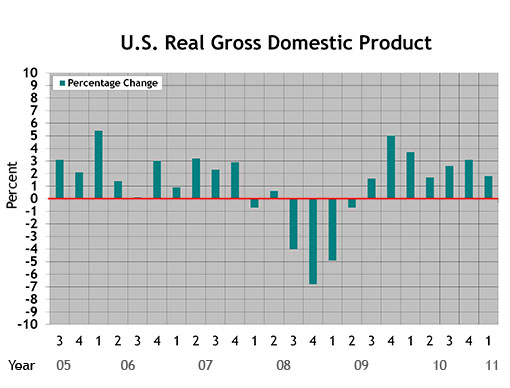

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

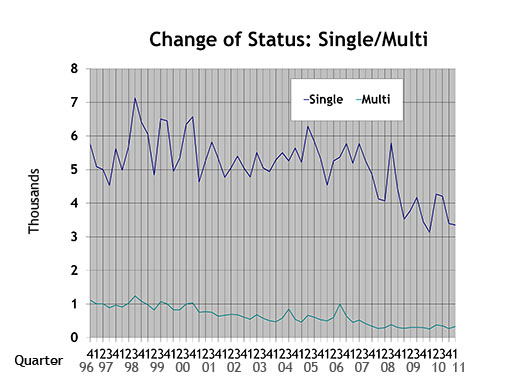

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

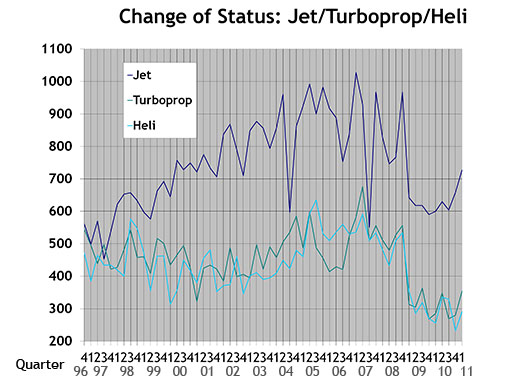

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

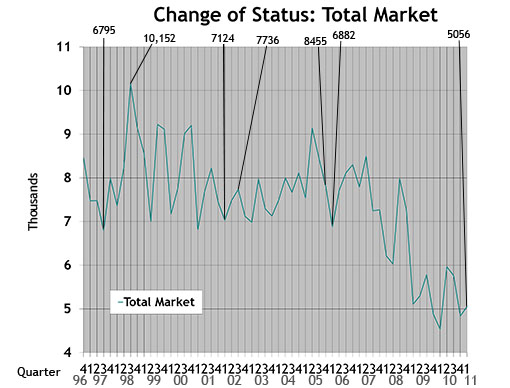

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.