Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Stock Prices Soar While Pre-Owned Aircraft Prices Remain in Ground Effect

Friday, March 13, 2015 at 1:25PM

Friday, March 13, 2015 at 1:25PM By Carl Janssens, ASA | Chief Appraiser | Penton Business Aviation Network

Business aircraft pricing in the pre-owned market appears to be soaring in ground effect.

The good news is that sales are occurring while, on the cloudy side, values, at best, try to maintain a flat trending posture.

Pre-owned aircraft pricing isn’t keeping time with commerce. From the sea, the West Coast ports of entry look like long-term parking lots for sea freighters: Lots of stuff awaiting their turn for deporting goods from the backlog created by labor disputes. Then, try driving on any Interstate. The amount of commerce on the move via countless eighteen wheelers is remarkable. And, don’t be caught waiting for a delayed flight during FedEx’s rush hour in Memphis. You might be there awhile. While all of this anecdotal evidence would indicate a more robust economy for pre-owned aircraft values, such is not the case.

It is possible to conclude that all of the observed “chatter” in commerce is nothing more than what it takes to keep the U.S. economy afloat and not gains in momentum. Granted, if such observed activity were solely the results of global export, values in the pre-owned market would likewise have a different story to tell. But, it is what it is, even with historic low prices for crude oil. Jay Mesinger of Mesinger Jet Sales coined a phrase a couple of years ago concerning the recovery of pre-owned aircraft values.

“Flat is the new recovery,” he said. Oh, if that were only true. At best one can hope for minimal depreciation in values.

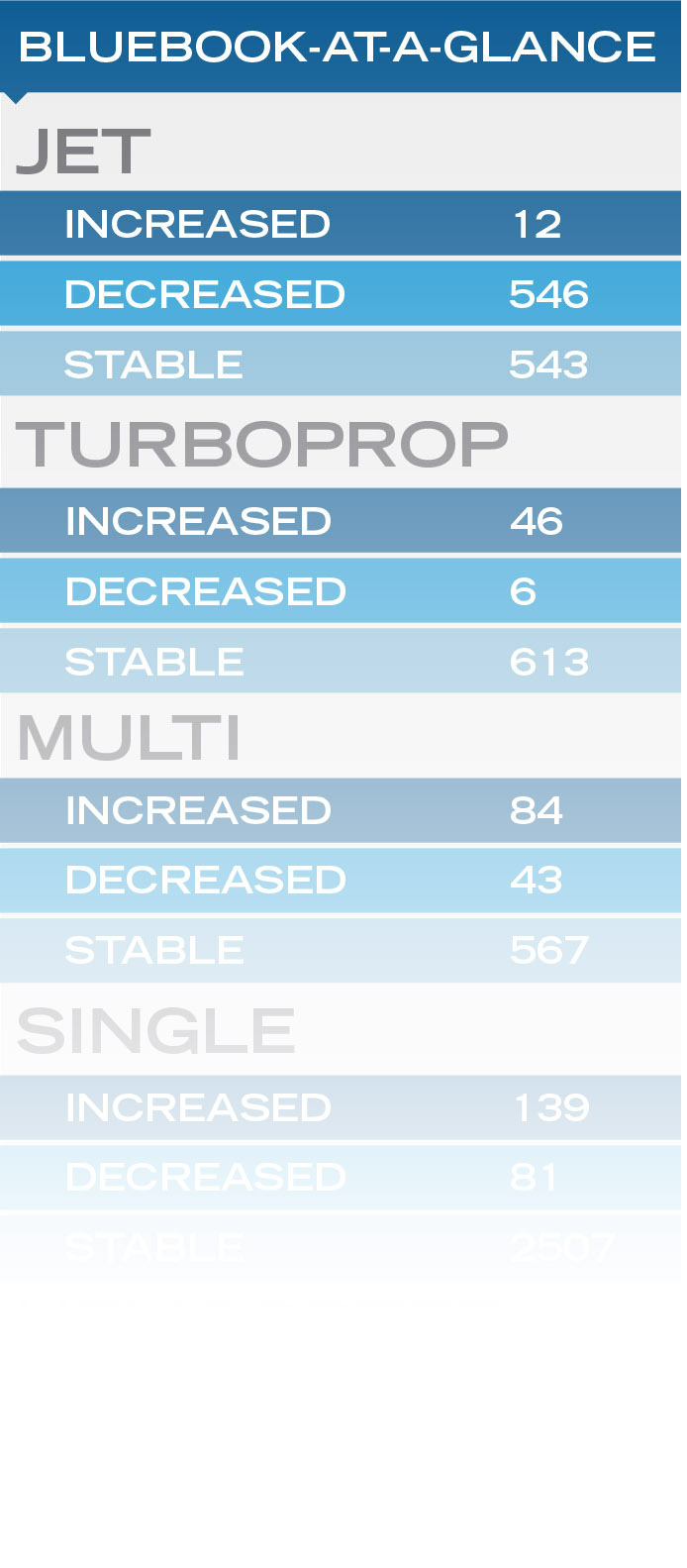

Looking to the right at the Bluebook-At-a-Glance marque, a more or less stable environment of quarterly values is presented. In the Jet category, about a third of the reported fleet declined in value while two-thirds remained stable. The large cabin segment, such as the Bombardier Global Express, Gulfstream G550 and the Dassault Falcon 900, were on a downward trend. There was some extended life in legacy jets, such as the Falcon 20, 20-5, Lear 31 and Hawker 400A, which were reported with no pricing changes since last quarter.

In the Turboprop category, the picture was a bit brighter. The Pilatus PC-12 market is alive and competitive with limited inventories available in the pre-owned market coupled with strong market interest. Beech King Air’s, likewise for the most part, remained stable. Legacy turboprops such as the Cessna Conquest and Piper Cheyenne also remained unchanged in values when compared to the previous quarter.

For the Twin and Single piston category, life is all about time and condition. Well-equipped and maintained aircraft will sell well while the less fortunate fleet will remain on the market for extended times.

In the Helicopter world, it was again a stable environment. There was interest in well-equipped legacy ships as well. The Bell 212 and 412 experienced positive pricing adjustments in the Bluebook. Time and condition are significant factors when valuing rotor craft. Good component times, upgraded equipment and maintenance are key factors that will push an offering into the sold column.

This article originally appears in a slightly different form in the Spring 2015 issue of Marketline. Click here to read the full issue.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |