Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries in Dassault Falcon (20)

CHARTS — June 6, 2012

Tuesday, June 5, 2012 at 3:17PM

Tuesday, June 5, 2012 at 3:17PM CURRENT MARKET STRENGTH

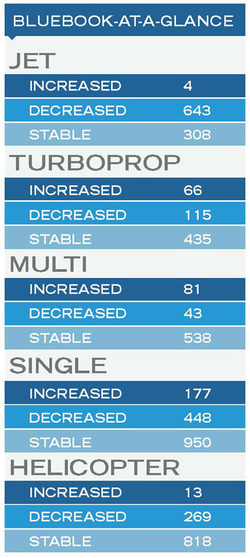

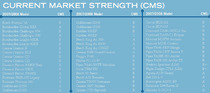

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

MARKETLINE CHARTS

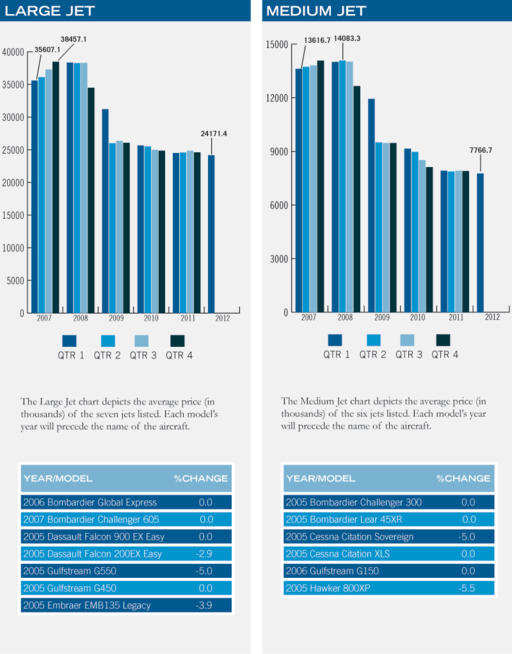

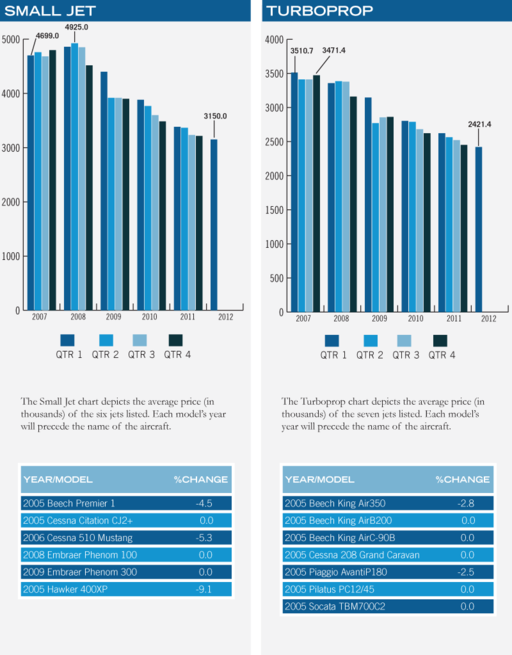

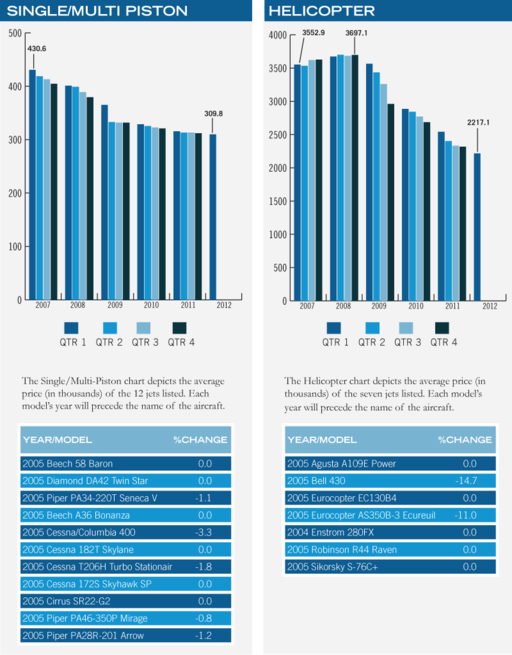

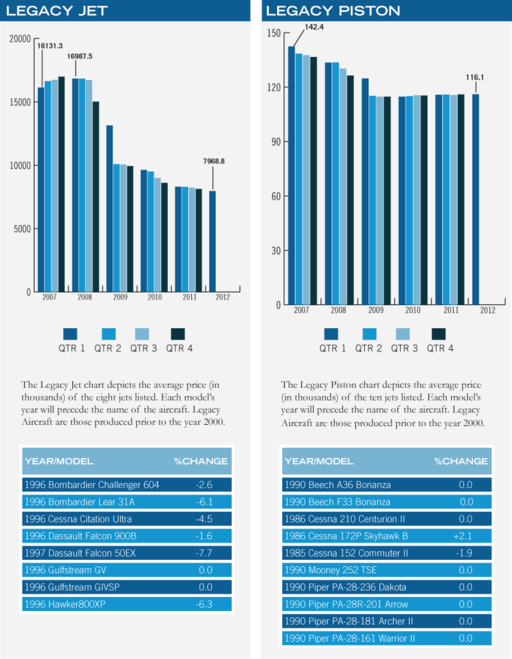

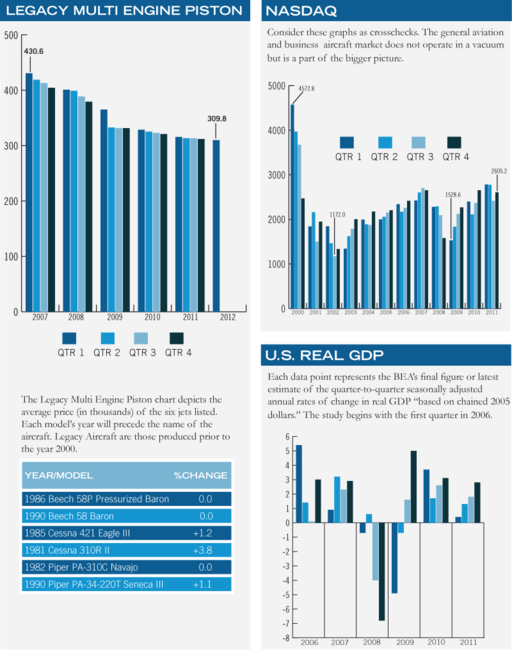

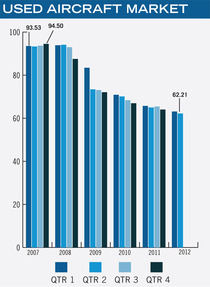

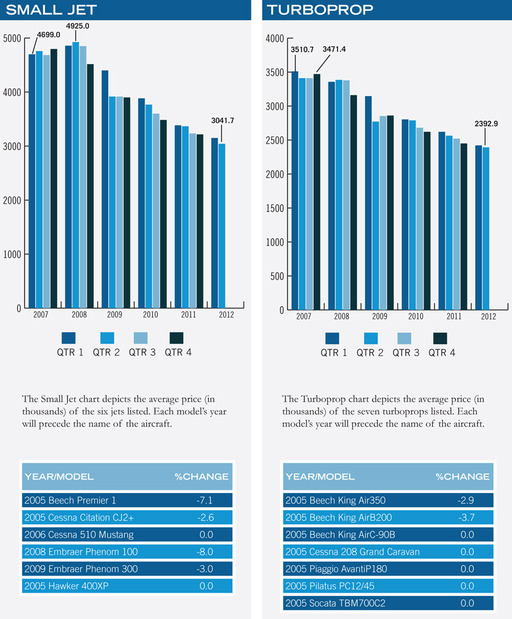

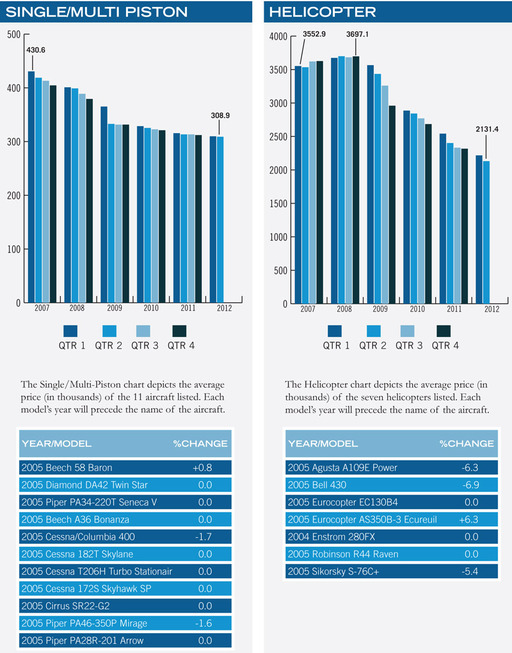

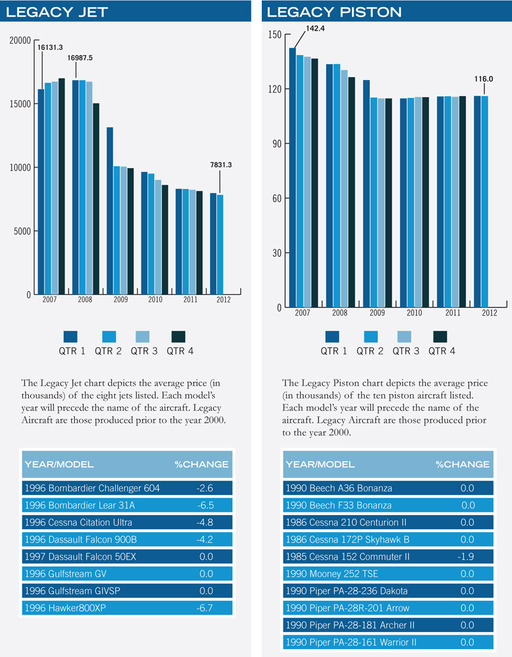

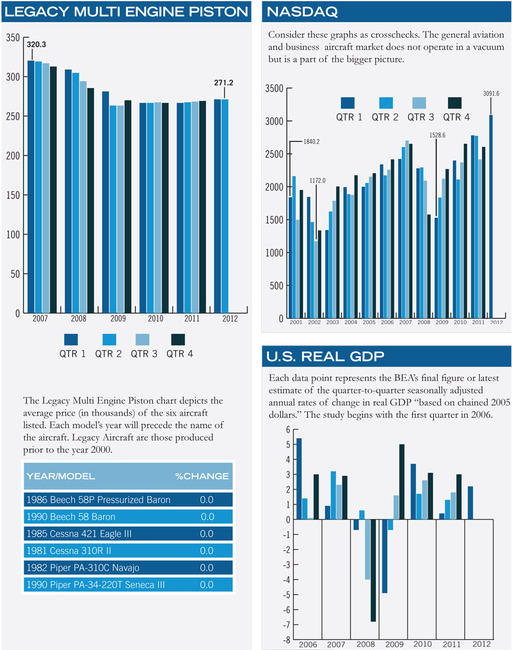

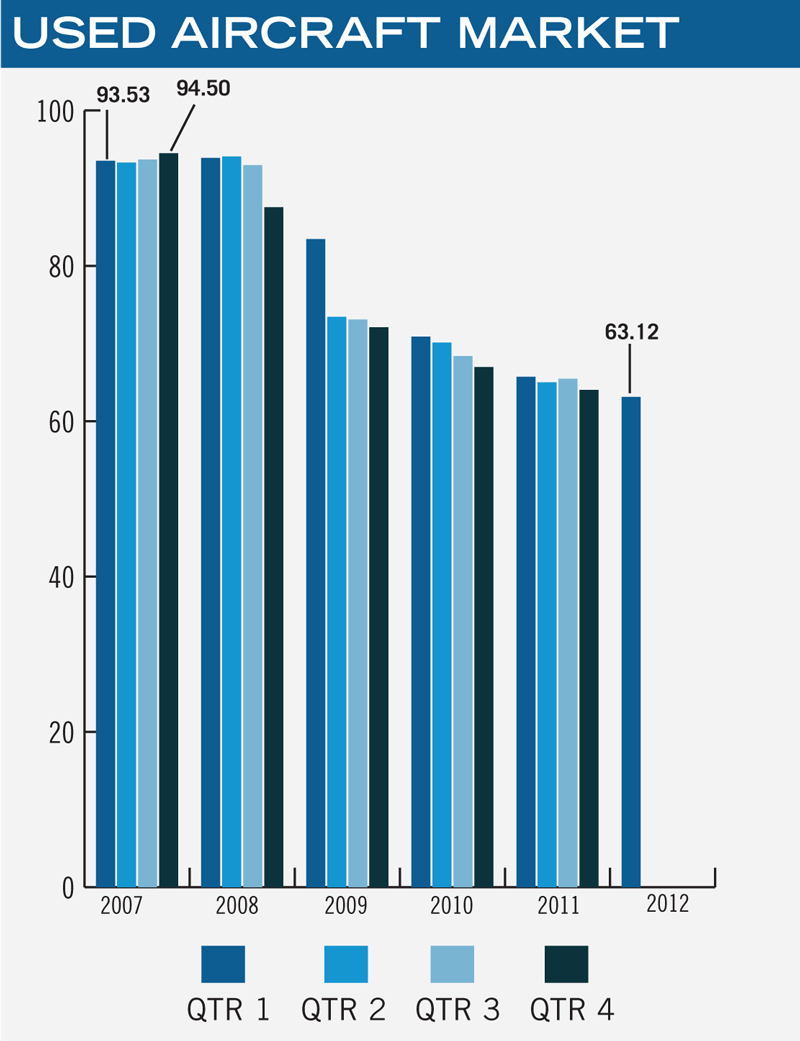

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click here to download a PDF of the full Marketline Newsletter, including articles and all Charts.

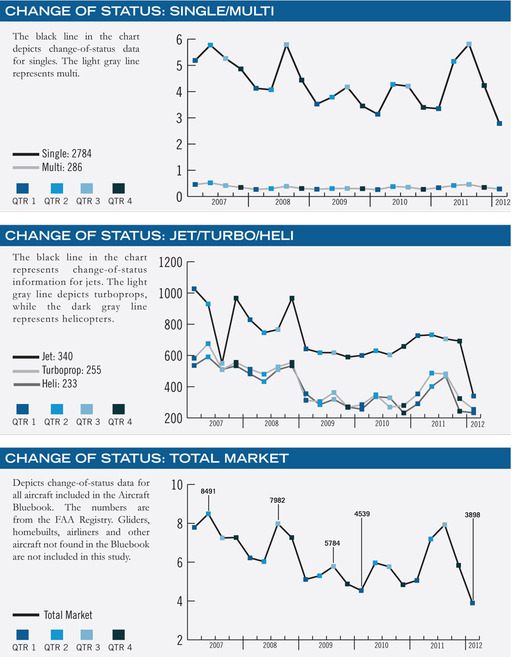

Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart

CHANGE IS IN THE AIR

Thursday, March 1, 2012 at 10:17AM

Thursday, March 1, 2012 at 10:17AM Exceptional Values for Late Model Cabin Class Jets

Vol. 25, No. 1 | March 1, 2012 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

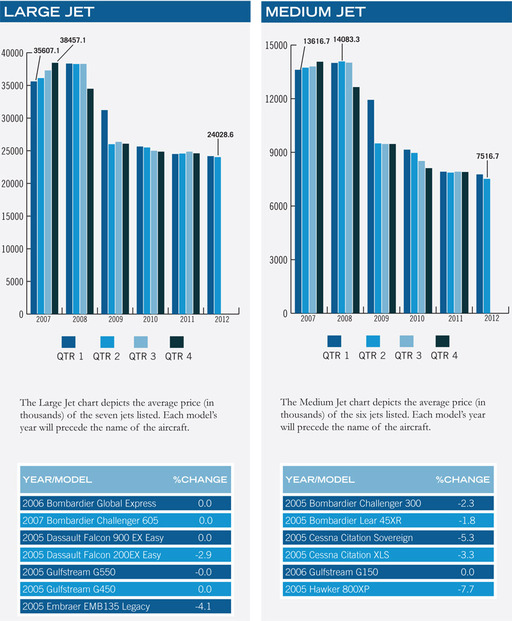

Change is in the air, literally. Market activity for late model large cabin class business jets is on the rise. These new or late models jets are experiencing competitive pricing. Could this be considered a price war? In addition to all of this, an increasing number of sales are bound for export to Asia. 2012 appears to be on a jump start for transactions. For buyers, this has become one of the best opportunities for acquisitions. At some point, supply will no longer be able to meet the demand for the late model large cabin jet. All of the evidence points to a not-so-soft market. As history is cyclic and the market is in a trough for values, can you guess where pricing is heading in this market segment?

For the mid-range and light jet business aircraft, values continue to slightly decline. One of the reasons is the adequate supply of inventory available for sale. Outside of pricing, these are the workhorses of business aviation. These jet segments are more impacted by the volume of well-equipped late models available for sale. Until inventories of bargain-priced jets have been eliminated, expect values to remain artificially low. Buyers no doubt recognize these great opportunities not so much as an investment in equity but a means to get the job done for revenue growth. And who knows, when artificially low pricing is exhausted by demand, it may be the icing on the cake so to speak as these values become firm.

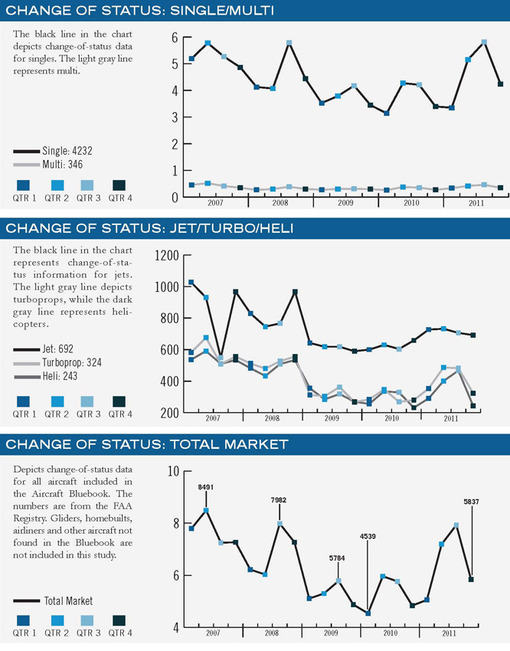

In the turboprop market, activity continues to improve while values continue experience stability. Age, condition and equipment continue to be dominating factors. At the same time, legacy turbo props, those manufactured in the 20th century, appear to be enjoying an active market. Noting the Aircraft Bluebook– at–a–Glance monitor (see chart on right), this market segment is relatively stable when compared to the previous quarter.

In the turboprop market, activity continues to improve while values continue experience stability. Age, condition and equipment continue to be dominating factors. At the same time, legacy turbo props, those manufactured in the 20th century, appear to be enjoying an active market. Noting the Aircraft Bluebook– at–a–Glance monitor (see chart on right), this market segment is relatively stable when compared to the previous quarter.

For agriculture turbo props, late model agriculture sprayers are in short supply. And, if one is shopping new, expect delays as current production is already spoken for. Pricing will continue to hold strong for these late model aircraft. Overall, this industry segment remains stable. Check your Bluebook for values.

In the multi and single piston market, values appear to be for the most part stable as displayed on the Aircraft Bluebook–at–a–Glance monitor. More opportunities for the majority of the pilot population here in the USA are represented in this segment. This means those folks who fly and maintain the “big stuff” may have one of these in their hangar for personal or business use.

This segment is also a stepping stone. For some, it is part of the transition process of moving up to more complex aircraft, and, for others, the opposite. In any case, lots of activity makes for a healthy market. For the helicopter market, the recession is over. Values are stable and there is a broad base of activity in this market segment. Two key factors that keep this industry on the go are quality of life issues that are always on the forefront: security and energy.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

[Go to Charts.]

[Download or print PDF of this article and All Charts.]

CHARTS — MARCH 1, 2012

Tuesday, February 28, 2012 at 12:15PM

Tuesday, February 28, 2012 at 12:15PM CURRENT MARKET STRENGTH

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

MARKETLINE CHARTS

All of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

All of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click any chart to view it Full Size

Click here to download a PDF of the full Marketline Newsletter, including articles and all Charts.

DISPARATE PRE-OWNED AIRCRAFT MARKETS EMERGE

Tuesday, September 13, 2011 at 11:45AM

Tuesday, September 13, 2011 at 11:45AM What Goes Around Comes Around During Economic Recoveries

Vol. 24, No. 3 | September 13, 2011 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Pick your adjective.

A wide disparity exists in today’s pre-owned business aircraft market, and just about any adjective will accurately describe some part of the market.

Great can be used to describe late-model large-cabin global business jets, which include models such as the Global XRS, Dassault Falcon 7X and Gulfstream G550.

Then there is the awful when dealing with a legacy business jet punching through its 30th anniversary of service.

For a while now, there have been at least two distinct markets. This scenario is not news, yet many in this industry seem puzzled about market dynamics.

Why does the pre-owned market appear to be good, bad and confused? The answer is the closed traffic pattern around the economy. As the recovery stumbles along, confidence remains shaky. We can’t break out of the pattern. To make matters murkier, the preseason presidential election rallies are in full swing with the all-out campaigns next. Oh joy.

For this edition of Marketline, I could not find an angle that hasn’t already been explored by someone else. I went to the Bluebook archives and pulled out an Aircraft Bluebook Marketline from 1992 for inspiration, and I think I have found a good way to predict what’s next in the economy. Even in this lethargic economic recovery, what goes around comes around. Historically, there has always been an economic recovery followed by a peak and then another slow down.

Marketline has done a pretty good job at reporting trends. The pre-owned market knows its position in this cycle. Someone out there is bound to make the calculated decision to buy now rather than later realizing the upswing is on the way.

Jet

Bluebook-at-a-glance

Increased — 9

Decreased — 353

Stable — 561

The jet segment experienced few positive moves. Early Citation Sovereigns edged upward. The Gulfstream G550 saw the greatest value increase — by more than $2 million.

Decreases affected all categories. The majority of the jet market was reported as stable, though.

Turboprop

Bluebook-at-a-glance

Increased — 23

Decreased — 74

Stable — 508

The turboprop market continued to demonstrate signs of stability, which are good signs of an economic recovery in progress. Turbine-powered ag planes continue to be nearly nonexistent in the resale market. Late-model twins, such as the Beech King Air 350i and the B200GT, likewise are nearly unavailable. Inventories available for sale held in check or slightly increased when compared to the previous quarter.

Multi

Bluebook-at-a-glance

Increased — 58

Decreased — 17

Stable — 582

Single

Bluebook-at-a-glance

Increased — 144

Decreased — 225

Stable — 2174

The piston segment has had the least amount of price change activity. Even though sale prices were stationary when compared to last quarter, transactions were on the rise. (Refer to the graphs that follow.) Bargain hunters also appeared to have given up their quest for the deal of the day and have taken their place on the fence to wait and see. Wait too long, and it might cost more to buy tomorrow.

Helicopter

Bluebook-at-a-glance

Increased — 65

Decreased — 92

Stable — 910

Helicopters are continuing to show some signs of stabilization. Reported values for the majority of this segment remained unchanged when compared to the previous quarter. The Robinson R44 and R22 continued to edge upward about $8000 to $9000 in retail value.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

[Go to Charts.]

AIRCRAFT VALUES NEUTRALIZE AFTER DESCENT

Wednesday, August 19, 2009 at 4:10PM

Wednesday, August 19, 2009 at 4:10PM Vol. 22, No. 3 | Aug. 19, 2009 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Aircraft values reported in the previous quarter were in a spiral dive, but the economy’s pilot now appears to have neutralized the rapid descent.

For the most part, values have arrived at ground level. Inventories have shown signs of stability with little or no growth in units for sale. Other market indicators show signs of neutralization as well. Aircraft dealers and brokers report that interest has increased. Phones are ringing more with potential buyers on the line. Compared to the 2005 baseline real gross domestic product, GDP declined 1.0 percent in the second quarter of 2009 after declining 6.4 percent in the first quarter. These indicators support the signs of neutralization in the marketplace, though the used aircraft market has no reason to rally.

Maybe the market has not yet reached the dawn of a recovery, but the market has absorbed the fallen values. The jet segment is the most volatile portion of the aircraft market. Flight departments that were liquidated are no longer creating a frenzy of drastic value reductions. Manufacturers finding new homes for new aircraft in default maintain nearly full sales values. The only difference is that deposits from contracts in default allow discounts to the new buyers. Once these sales are complete, the discounts will end.

Jet

Bluebook-at-a-glance

Increased — 143

Decreased — 49

Stable — 665

Bluebook’s attention has focused on late-model large-cabin new deliveries that may take as long as two years or more for interior completion and delivery. Some of the increase in value can be found in the fall edition of Aircraft Bluebook. Examples include the Bombardier Global family as well as the Challenger 605 and Dassault Falcon 900 and 2000 series.

Turboprop

Bluebook-at-a-glance

Increased — 75

Decreased — 114

Stable — 399

Socata fared better in this reporting period. Sales demonstrated that values were better than previously reported; therefore, stronger values appear in the new release of Bluebook. Turboprop ag planes continue to demonstrate improved values with limited inventories available in the world market. The Piaggio was up 9 percent from the previous quarter as well.

Multi

Bluebook-at-a-glance

Increased — 0

Decreased — 110

Stable — 545

For the most part, values remained unchanged for this reporting period in the multipiston category. Nothing increased in value. Most late models held on to their values without loss. Early model Cessnas as well as some Twin Commanders trended downward slightly.

Single

Bluebook-at-a-glance

Increased — 117

Decreased — 220

Stable — 2108

Ag planes kept a positive note in the single category. Select models experienced modest increases. Some of the decreases included American Champions, such as the 8-KCAB, and Beech 35. Both were reported down from the previous quarter. For the most part, however, most single-engine pistons remained steady for this reporting period.

Helicopter

Bluebook-at-a-glance

Increased — 4

Decreased — 828

Stable — 177

Helicopter values experienced a decline in this quarter. Part of the decline may relate to lower values on earlier models with limited mission capabilities when compared to newer helicopters. Early-model Sikorsky aircraft as well as Bell and Eurocopter models were down. Decreases averaged 8 percent or more. In the piston category, values were lower, too.

Aircraft Bluebook — Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

Beech,

Beech,  Bombardier,

Bombardier,  Cessna,

Cessna,  Challenger,

Challenger,  Dassault Falcon,

Dassault Falcon,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  single,

single,  turboprop,

turboprop,  used aircraft,

used aircraft,  values in

values in  Newsletter

Newsletter