Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Newsletter

Newsletter  Saturday, December 1, 2007 at 9:57AM

Saturday, December 1, 2007 at 9:57AM by Carl Janssens, ASA | Aircraft Bluebook – Price Digest

In the midst of all the usual confusion with the economy, real-estate woes and the subprime lending practices offering fuel for a possible recession, general and corporate aviation value trends continue to remain generally stable. Even the nearly $100 per barrel price for crude oil seems to get at the most a raised eyebrow at the pump. After a possible grumble, it’s wheels up, and life goes on. It’s the American way.

Bluebook-at-a-glance

Increased — 175

Decreased — 122

Stable — 491

Late-model wide-body pond hoppers continue to soar in value. As an example, of the 193 Gulfstream G-V’s reported in global inventory by AMSTAT, there are only three known for sale or lease. Aircraft Bluebook reports gains in the $1 million range for the G-V when compared to the previous quarter. Likewise, Global Express, Falcon 900s, Gulfstream G-IVSP, Challenger 604 and 605 as well as the aforementioned next generation Gulfstream 450/550 series are all riding the “hi yo” silver lining of the million-dollar-plus increases in value when compared to the previous fall quarter.

Other late-model jets, such as the Hawker 800XP, Lear 45XR, Citation Sovereign 680 and the Falcon 50EX, remained stable for another quarter. Gulfstream G150s, Hawker 400XPs and Citation Excel were other examples of a stable environment. The exception was the Challenger 300, which enjoyed the million-dollar-plus gains when compared to

last quarter.

The Citation Jet CJ3 was up $200,000 while the Beech Premier remained stable.

Bluebook-at-a-glance

Increased — 188

Decreased — 36

Stable — 491

The turboprop market demonstrated stability in values. Late-model King Airs remained unmoved in value with regard to the previous reporting period. The Pilatus PC-12s were up $100,000 for the winter edition of Bluebook while the Piaggio P180 remained unchanged for the most part with a few late models showing gains in value when compared to last quarter. Socota TBM 700 and 850 series also remained unchanged with a few model years in the plus column for price change. Piper Meridian was the only late-model turboprop to show a decrease in value. The Cessna Caravan 208 series were up a modest $25,000 from last quarter in Bluebook.

Bluebook-at-a-glance

Increased — 66

Decreased — 184

Stable — 2416

Of the 2,666 multi-engine aircraft tracked in Aircraft Bluebook, for the most part, everything remained pretty close to steady. There were fewer decreases in value and even fewer gains for the reporting period. One thing is for certain: These real property assets are more sensitive to the nation’s economy. In this category, individuals—not corporations—hold the majority of interests in aircraft. On the positive side, most aircraft financing is based on prime lending versus the subprime lending practices in real estate. This means balances and crosschecks are more financially stable, thus lessening the risk of loan foreclosure.

Bluebook-at-a-glance

Increased — 157

Decreased — 583

Stable — 1648

Approximately two-thirds of the single-piston market was reported stable from the previous quarter. Some Beech Bonanzas as well as select American Champion series aircraft reported slight gains. Most other models were either unchanged or slightly down from the previous Bluebook reporting period. Normal depreciation was the main cause for slight downturns. The single-piston market remained confident even in the midst of slow growth as reported in new aircraft sales in this category.

Bluebook-at-a-glance

Increased — 167

Decreased — 29

Stable — 722

For a third straight quarter, values in helicopters continued to move upward. Most of the gains were modest in comparison to the total values. Nonetheless, with global interest in late-model turbine helicopters, values continued to rise. The Bell 430 reported increases of $50,000 while the remaining turbine models remained stable or gained in the $20,000 range. Eurocopters experienced the same value trends with value increases in the $20,000 range. MD Helicopters followed suit with remaining models such as Sikorsky and Enstrom 480 remaining stable. Decreases for the quarter were slight and were reflected in the piston models.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Newsletter

Newsletter  Saturday, December 1, 2007 at 9:56AM

Saturday, December 1, 2007 at 9:56AM

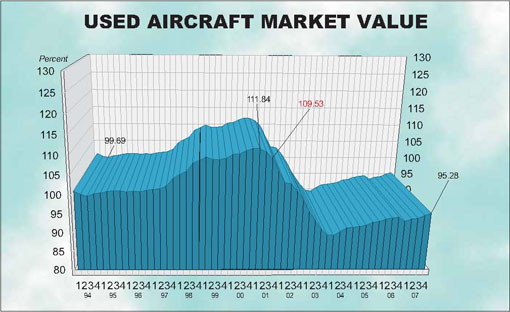

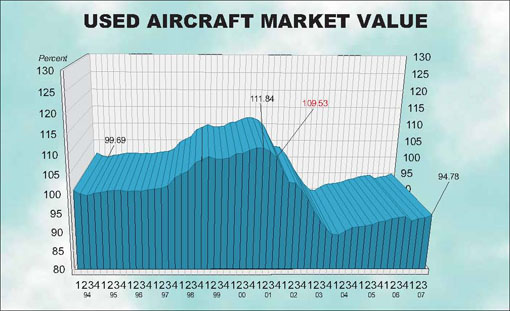

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

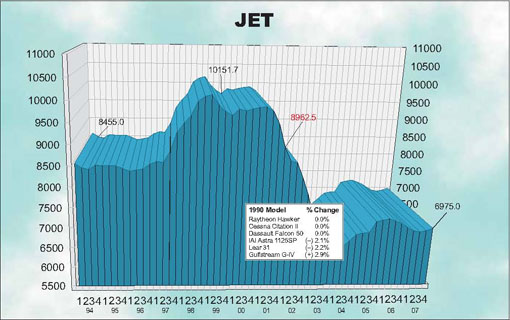

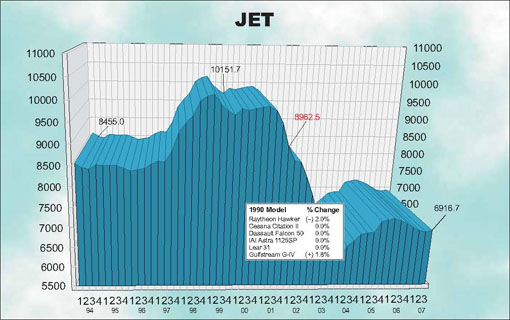

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

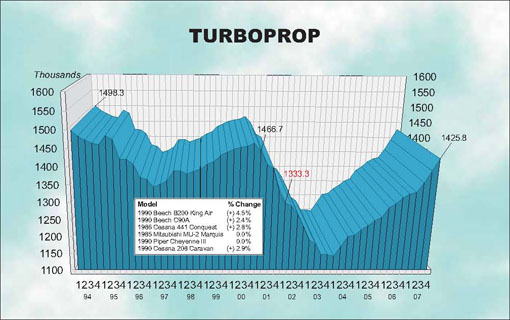

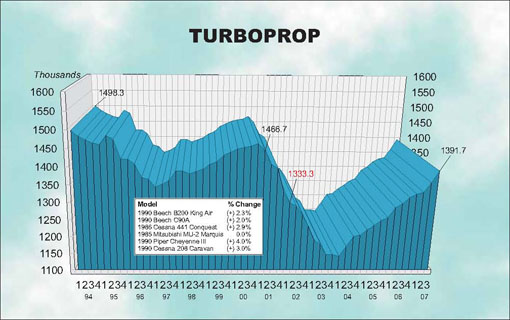

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

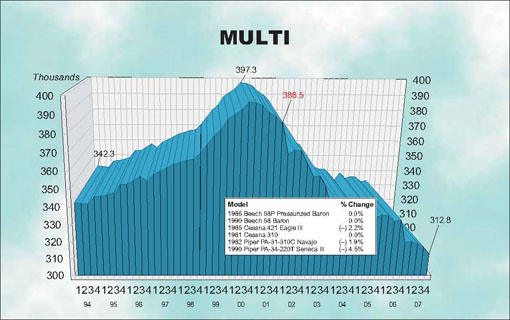

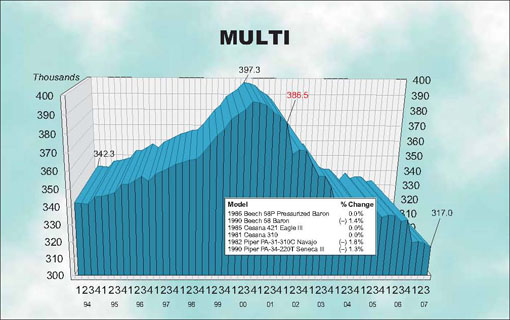

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

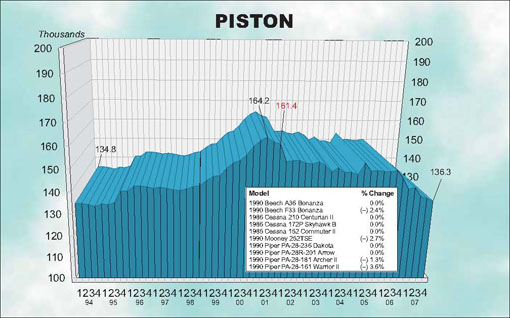

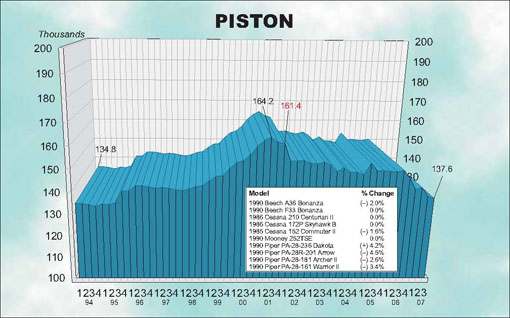

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

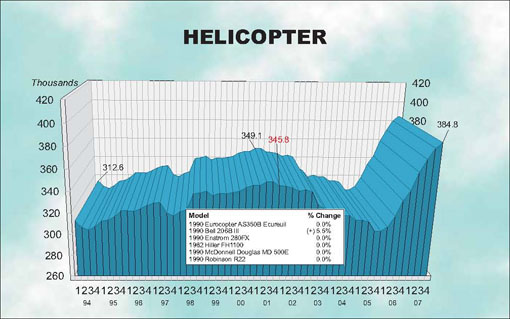

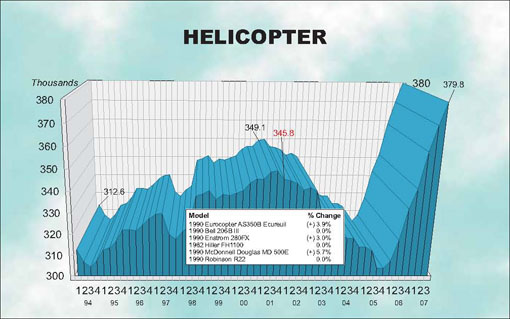

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

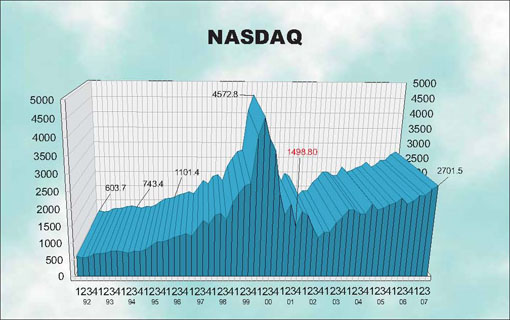

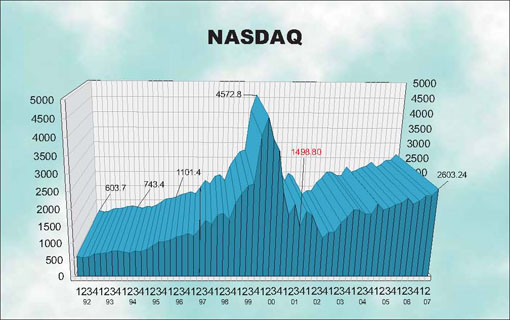

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

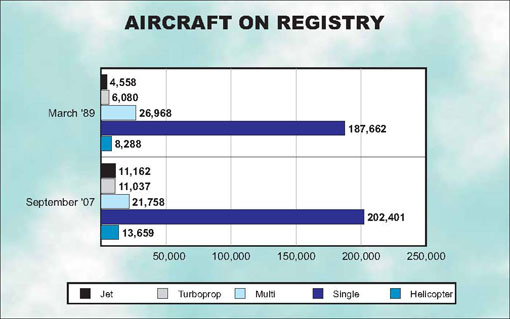

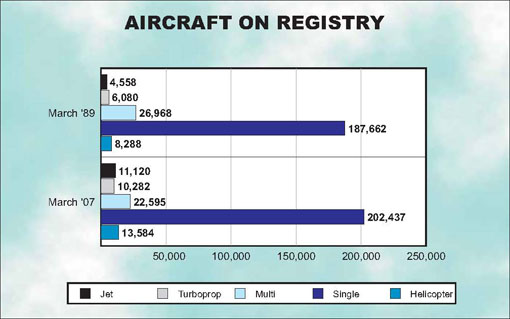

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

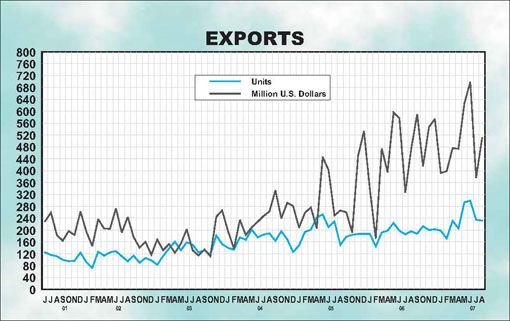

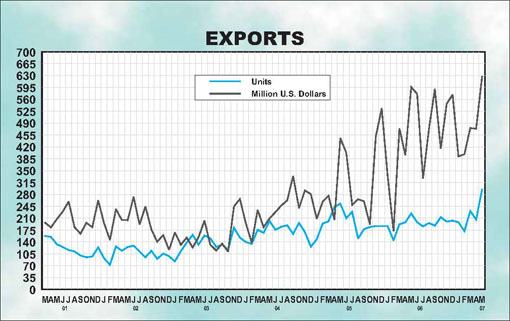

Export Data: These numbers include both airplanes and helicopters. The numbers do not include aircraft that have empty weights in excess of 33,069 lbs.

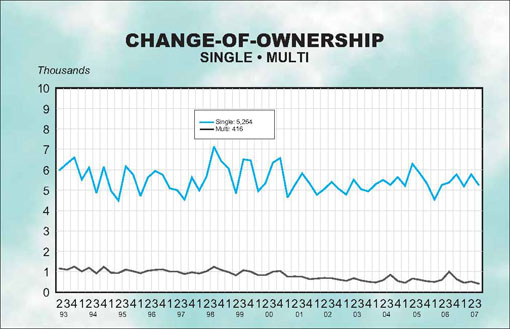

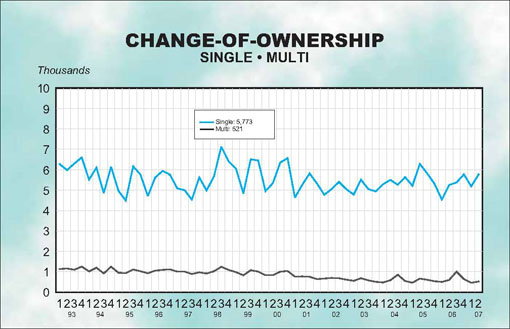

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

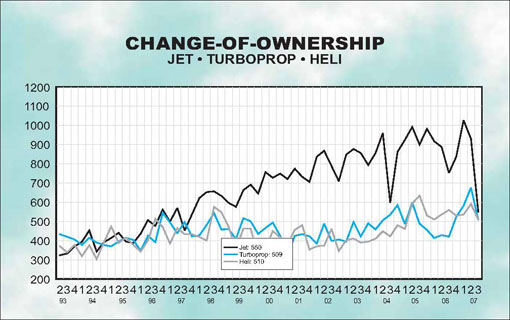

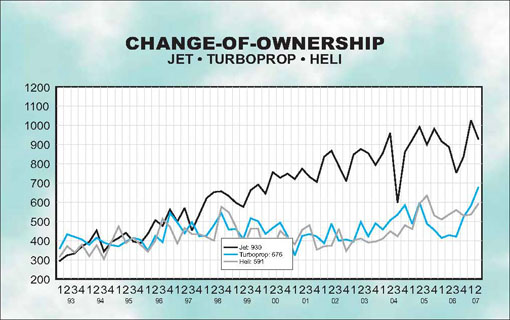

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

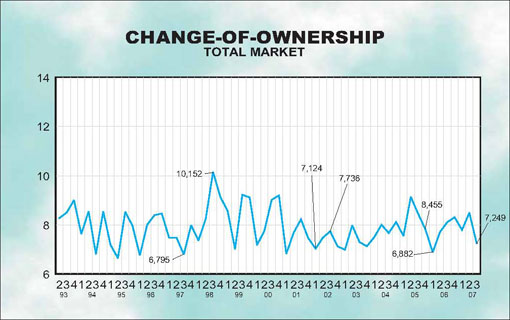

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Charts

Charts  Saturday, September 1, 2007 at 9:52AM

Saturday, September 1, 2007 at 9:52AM by Carl Janssens, ASA | Aircraft Bluebook – Price Digest

If there were any question that amergence of a global economy is a reality, one would only have to look at the impact U.S. markets had on global markets during the second week of August. The jitters experienced in U.S. markets with noticeable declines in a wide range of stocks set a rippling effect into world markets. While negative speculation created a wave of sell-off frenzies, the seasoned investor, like a professional pilot flying through unexpected turbulence, remained steady knowing their knowledge, expertise and skills would see them through into calmer air. Behind every cloud is a silver lining.

As markets recover from a case of jitters, it is a proven fact a global market does exist even though each market is an independent entity. The good news is products and services remain strong, and the opportunity for economic growth is limitless.

Bluebook-at-a-glance

Increased — 151

Decreased — 254

Stable — 380

Corporate aviation is the efficient action of time and resources that creates growth in our economy. This is a simple insight with a huge impact. With all of this opportunity for growth, corporate aviation has met the challenge to bring people together that makes businesses grow. No wonder late-model, large cabin-volume, long-range aircraft continue to increase in value at record pace. The investment in these aircraft is well rewarded in the corporate portfolio’s economic growth. The jet market is like mid-August weather in the Midwest: It’s hot!

Mid-range corporate jets are no slackers either. Values currently reflectmore traditional depreciation curves. Inventories remain steady with backlogs for new aircraft extending outward past a year-and-a-half or more. Light-range jets, including the Cessna CJ series, Hawker 400XPs and Premier, remain active as well. Interest in the upcoming VLJ market has added new interest to these light jets with most that are properly priced on the resale market finding new homes in eight months or less. The ratio of aircraft on market for resale and total inventory remains manageable.

Older jets manufactured prior to 1990 are enjoying the contrails of their later-model relatives. Depreciation in values has shown some signs of slowing. Factory-authorized modifications to airframe, engines and avionics have added new life and value to these aircraft.

Bluebook-at-a-glance

Increased — 196

Decreased — 67

Stable — 349

The turboprop market remains competitive. Increases in value have outweighed decreases while the rest of the models tracked by Aircraft Bluebook remain stable. While new technologies are focusing on the jet market, the tried and true workhorse has not found its match or replacement for that matter.

For the late model years, the Beechcraft family of King Airs enjoyed a stable if not positive value increase. Pilatus and the venerable PC-12 continued to show strong market support with increased values. Cessna Caravans were in the plus column for yet another quarter. Socata TBM 700 experienced increases of $100,000 across most of its model years. The Piper Meridian market remained stable.

Earlier-model turboprops — those older than 20 years—mostly experienced positive increases when compared to the previous Bluebook quarter. In all, no jitters were found in the confidence of the turboprop market.

Bluebook-at-a-glance

Increased — 109

Decreased — 315

Stable — 241

The average composite score of the multi-engine market defined by Aircraft Bluebook continues to trend slightly downward. No, the sky isn’t falling, and the market is not falling apart. Aside from aircraft in this category being less exposed to business use versus private, it is more vulnerable to the affects of outside economic forces such as the cost of 100LL and insurance.

The Piper Chieftain did not follow the normal trend of its multi-piston brethren. Chieftains experienced a significant increase over the previous quarter. Although Bluebook is only reporting “history,” it is interesting nonetheless to see what other stimuli are contributing to the upward value trend. One such factor is Mike Jones Aircraft Sales, which specializes in the total refurbishment of select Chieftains and Navajos. Restoration includes new Colemill Panther engine conversions, airframe restoration and modifications along with new avionics. Completed aircraft are selling in the $1 million range. Although these restored aircraft are in a niche market, the average PA31 has experienced stronger values in sales, which do affect Bluebook values.

Bluebook-at-a-glance

Increased — 579

Decreased — 964

Stable — 820

The single market continues to be an active market. According to FAA data, there were approximately 4000 transactions in the previous quarter. Like the multi-piston market, fuel, insurance and mission have indirectly impacted this market. Late-model singles follow the standard depreciation curve while early-model singles for the most part remain steady.

There has been interest and discussion regarding these older single-engine aircraft and what will happen to their values. The answer has been proven in the market and it is quite simple: Reconditioned, modified aircraft are holding value. The affordability of these aircraft has a wider audience with values generally less than $100,000. With the FAA’s diligence in monitoring airframe fatigue factors, these Fifties and Sixties vintage aircraft are a long way from becoming obsolete.

Bluebook-at-a-glance

Increased — 491

Decreased — 65

Stable — 360

The helicopter market continues to flex its muscle with positive growth in values. Late-model single and twin-turbine helicopters are in great demand. Like oil, the global need is far greater than the available resources of these ships. All of the helicopter manufacturers in Aircraft Bluebook experienced shared stability in values with current in-production models. Because of specific distinct missions associated with this market, values will no doubt continue to hold strong.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Newsletter

Newsletter  Saturday, September 1, 2007 at 9:51AM

Saturday, September 1, 2007 at 9:51AM

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Export Data: These numbers include both airplanes and helicopters. The numbers do not include aircraft that have empty weights in excess of 33,069 lbs.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Charts

Charts  Friday, June 1, 2007 at 12:02PM

Friday, June 1, 2007 at 12:02PM

by Paul Wyatt, Managing Editor | Aircraft Bluebook – Price Digest

General aviation hitches its horse to one very important wagon: a wagon filled with corporate profits from companies all over the world. When the coffers are full, businesses turn to aviation to maximize their efficiency further.

Corporate profits impact not only the new and used long-range business jet, but they even affect the newly minted pilot’s ability to purchase a used single-engine piston. If corporate America is posting record gains, as it has for the last four years, those profits “trickle down” (remember Ronald Reagan?) to everyone involved in aviation.

And even if corporate profits begin to level out in 2009 (as many predict), an emerging international interest in general aviation (both new and used) will be there to pick up the slack. Of course, this assumes the global economy will continue to flourish in the shadow of war, terrorism and another impending energy crisis.

Bluebook-at-a-glance

Increased — 114

Decreased — 293

Stable — 358

As has been the case for two straight years, the jet market remains the strongest segment of the industry. Manufacturer backlogs are still breaking records; the demand for new aircraft combined with newly strong international interest in business aviation has fueled furious competition for late-model jets. However, peddling aircraft more than 10 years old continues to be tough as inventories bulge at the seams.

Again, brokers and dealers report that the market is super-tight for long-range jets, and offers arrive seemingly the minute planes come available. Gulfstream prices continue into the stratosphere with 2005 and 2006 G-550s receiving a $3 million adjustment. The G-V models were up $2 million. The G-IVSP market remains hot with prices up $1 million. Demand for straight G-IVs remained stable, and prices were unchanged.

The prices of the Global Express were also up $3 million for the 1999 through 2001 models. Challenger 604 prices are stable; however, high inventories of Challenger 601s resulted in a $300,000 loss for 1A, 3A and 3R derivatives.

Late-model Falcon 2000s were up slightly with the EX option being the most desirable. This was reflected by a $500,000 rise in value.

For mid-size corporate transportation needs, the Citation Sovereign was up $500,000. Learjet 40 series have cooled, and

prices were down as much as $200,000 for the 40XR. The Lear 60 also declined with a loss of $200,000 for late models. Astra 1125s were off the pace and were down $100,000. Sabreliners continue to ebb away with 60 and 75A models down $20,000.

For small jet offerings, all versions of what is now called the Hawker 400XP (once known as the Mitsubishi 300 and the

Beechjet 400/400A) remained flat, with only the 2006 model experiencing the average one-year depreciation. The Citation CJ3 led the Citations with a $400,000 bump for late models. The CJ2+ was right behind with a $300,000 increase. The Encores and Excels are both active with a $50,000 and $100,000 increase respectively.

Falcon 100s fell by $100,000, and the Lear 35 and 36 models remained firm.

Bluebook-at-a-glance

Increased — 202

Decreased — 169

Stable — 231

The turboprop market continues to mirror the jet market. It’s a simple equation: When the economy percolates, flight departments upgrade their equipment. However, the same dynamic between new and old is just as pronounced in this market; planes younger than 10 years old often sell quickly while the older aluminum sits forlornly in the back of

the hangar.

Single turboprops continue to sell well, and prices have climbed. The venerable Cessna Caravan, Grand Caravan and Cargomaster were up $25,000 for early models and as much as $50,000 for new versions. Piper Meridians are on the move and experienced a $50,000 boost as well. Pilatus PC-12 prices have stabilized, but the model is still in great demand. The Socata TBM was the only turboprop single to slip and declined $50,000 for several year-models.

On the eve of the great VLJ revolution, used turboprop twins (whose prices were expected to crash as a result) continue to be strong. The Cessna Conquest I and II have bounced up $50,000 and $100,000 respectively. Mid-eighties versions of the King Air B200 were up $100,000. The C90B and E-90 King Airs are trading briskly and got a $50,000 boost for many year-models. The 300 King Air continues to hum along with another $100,000 increase.

The older turboprops faired less favorably. Nearly every model from Fairchild continues a long, slow descent. Merlin IIs, IIIs and IVs all slipped anywhere from $10,000 to $30,000. Mitsubishi MU-2s once again lost $10,000 across the board.

Bluebook-at-a-glance

Increased — 160

Decreased — 385

Stable — 99

After briefly stabilizing during the winter months, the piston twin market is again flailing. The soaring price of avgas (what now seems to be an annual rite of summer), is pummeling the planes with two gas hogs mounted on the wings.

There are exceptions to the rule, however, and again age is the main factor when looking at value direction. Twins that bucked the overall trend included late model Piper Seneca Vs. Late models were up as much as $20,000. Decent Piper Chieftains are still sought after and remain in the $200,000 to $300,000 range. Many year-models moved up as much as

$10,000.

The appreciation winner in this market segment was the Aerostar 601P. Several strong sales resulted in a 20 percent increase for mid-1970s models.

More than 385 model years of piston twins fell in value. Leading the pack was the Baron 58P, which took at $20,000 hit. Fuel burn, maintenance issues and sky-high insurance premiums continue to dog this former standout.

The Cessna 414A offerings are peppered with very tired aircraft, and prices fell $20,000 for the last ones produced in 1984 and ’85.

Piper Seminoles round out the batch of descending twins. Even late models were down $20,000.

Bluebook-at-a-glance

Increased — 482

Decreased — 1401

Stable — 478

As we moved into the prime spring selling season for piston singles, many dealers and owners came to grips with reality: This market segment has adjusted substantially downward. More than 1400 year-models in the Bluebook lost ground—the most ever in a single quarter.

Many believe this market has seen a correction that most likely will never reverse. As we’ve said before, no one is looking for a “project.” Singles in excellent condition with updated avionics still sell relatively quickly, but a plane with a high-time engine and original gauges seems to have no market whatsoever.

Conventional economic wisdom dictates that when prices fall low enough, buyers should emerge with the desire and resources to buy a diamond in the rough that can be resuscitated back to a shiny new life. Evidently these individuals have become hypnotized as they stare into the glass cockpits of several new piston singles.

One New Jersey dealer summed it up this way: “These tire kickers out there all want these planes for nothing, and then they expect perfection at the pre-buy.”

The ubiquitous Cessna Skyhawk has always been a mainstay for used aircraft dealers decade after decade, but now bloated inventory is putting downward pressure on prices. Some late model 172s (the ones with the steam gauges) fell as much as 10 percent in the last quarter.

Late model Skylanes are suffering the same fate and were also down a similar amount.

Newer Mooney Ovations slipped $10,000 or more. Piper Archers from the late 1990s were off substantially and were adjusted down as much as $12,000. The Arrows of the same age lost as much as $20,000.

Early Saratogas were down $4,000, and later models of the Saratoga SP fell as much as $15,000 for early 1990s offerings.

Planes that experienced a boost in value were few by comparison. The Cessna 180/185 markets remain strong, and prices were up $5,000 for many iterations. Commander 114Bs saw renewed interest and increased by $15,000.

Bluebook-at-a-glance

Increased — 131

Decreased — 261

Stable — 525

The used helicopter market continues to show considerable strength, though the main beneficiaries continue to be the newer models. While theOEMsstruggle to meet demand, many “slightly” used ships are actually bringing more than the new MSRP.

While everyone else bemoans the recent rise of prices at the pump, the helicopter industry (both new and used) is reaping the rewards of renewed oil exploration, particularly in the Gulf of Mexico.

In addition, the law enforcement and EMS market segments are “trading up” in record numbers. Again, the backlogs of new helicopters are forcing several public municipalities to enter the used market for the first time.

The models that experienced increases included the Eurocopter AS 350B series, which experienced a $100,000 increase for all models. The Agusta A109C was up a strong $100,000 as well. The Bell 206 L-4 moved up $50,000, and the Bell 222 was also up $100,000 for mid-1980s models.

The Sikorsky S-76 also received a bump of $100,000.

On the down side, trading of Eurocopter SA 315s has slowed, and prices received a $50,000 adjustment. Bell 206Bs fell $20,000. Robinson R44s were off slightly and were down $10,000 throughout the production cycle.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Newsletter

Newsletter