Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Marketline Spring 2016: Pre-Owned Aircraft Inventories Grow

Friday, April 1, 2016 at 10:48AM

Friday, April 1, 2016 at 10:48AM It appears the first quarter of 2016 is demonstrating what pace the pre-owned aircraft market is likely to follow going forward this year. New deliveries of business aircraft seem to have created a greater inventory of available pre-owned aircraft in the marketplace. Trading is still consistent with levels of activity experienced in the fourth quarter of 2015. What appears to be lacking is an increase in buyers that would have otherwise offset the growth in inventories of business aircraft currently being offered for sale or lease.

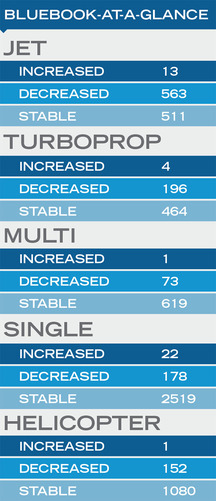

The jet category in Aircraft Bluebook continues to harbor the most vulnerability in the area of value retention. Fifty-two percent of the jet category reported in Aircraft Bluebook continues to demonstrate a decline in prices. A couple of exceptions include the Cessna Citation XLS+ and Beech Premier 1A, which were reported with modest price increases when compared to the winter edition of Aircraft Bluebook. A follow-up with regard to market saturation within the jet category in Aircraft Bluebook is further discussed in the accompanying article by Dennis Rousseau from AircraftPost.

The turboprop market also demonstrated some signs of cooling down when compared to previous quarters reported in the Aircraft Bluebook. Formerly resting in a stable price environment, based on published pricing in the previous winter release of Aircraft Bluebook, turboprop values are now in the decline. Thirty percent of this market segment reported a decrease in values in Aircraft Bluebook. The Twin Commander 1000 was the exception with reported increases of $100,000 in value when compared to the previous quarter. Cessna, Beech, Quest and Socata experienced declines in pricing.

The piston twin category experienced little change when compared to values posted in the previous edition of Aircraft Bluebook. Most of this market remained consistent with 619 model variants remaining unchanged out of a total of 693 models. A point of observation in the multipiston market segment: Limited production impacts value retention.

A mirror to the piston twin is the single-piston aircraft segment reported in Aircraft Bluebook. Although the single-piston category is the largest by number of models represented in Aircraft Bluebook, only 178 of 2719 models experienced a decline in value when compared to the previous quarter. A sizeable portion of the piston singles are legacy aircraft, those aircraft that are in excess of 20 years in age. At the same time, a piston single’s value could range from a mere $14,000, as in a 1946 Aircoupe, to a new Piper Mirage with a price tag of well over $1 million. Also, there are more potential buyers in this range that can afford pilot-owned and operated aircraft.

The helicopter segment reported in Aircraft Bluebook is the second largest category of models with a total of 1233 models currently reported within Bluebook. The helicopter market has suffered largely from the decline in the price of crude oil. In many ways, little or no activity has nearly paralyzed this market, which is approaching the uncertainty the business jet market experienced in the economic collapse of 2008. Unlike 2008, though, the broader economy is healthy. Values in the helicopter market appear stable because helicopter trading is light at the moment. Once crude oil prices rebound and more helicopter sales occur, real values will become more apparent with the increased sales volume.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |