Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries in resale market (24)

Marketline Summer 2014: Contributor’s Perspectives in the Value Equation

Tuesday, June 17, 2014 at 9:11AM

Tuesday, June 17, 2014 at 9:11AM The summer issue of the the Aircraft Bluebook Marketline newsletter is now available for download. This issue features:

CONTRIBUTOR'S PERSPECTIVES IN THE VALUE EQUATION

By Carl Janssens, ASA | Chief Appraiser | Aircraft Bluebook

Aircraft Bluebook Marketline offers timely intelligence information for the discerning aviation professional who is involved in any one of the many facets of business aircraft markets.

MARKET DIRECTION...UP, DOWN OR SIDEWAYS

By Dennis Rousseau | President and Founder | AircraftPost.com

There is considerable rhetoric regarding the state of the pre-owned business jet market. When a slightly used G650 sells for $10M more than its original cost new, the general consensus is our market is on the rebound.

VALUING AN AIRCRAFT'S MAINTENANCE CONDITION

By Tony Kioussis | Asset Insight, Inc.

An aircraft’s maintenance condition represents its greatest value “wild card” and a figure that can dramatically impact the asset’s value.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Marketline Spring 2014: Price Perspectives

Monday, March 10, 2014 at 10:56AM

Monday, March 10, 2014 at 10:56AM The spring issue of the the Aircraft Bluebook Marketline newsletter is now available for download. This issue features:

PRICE PERSPECTIVES

By Dennis Rousseau | President and Founder | AircraftPost.com

On average, five – seven percent of the available fleet on the resale market is considered ‘normal.’ Should the percentile lean more in the 10 – 20 percent range, we then tend ...

HONEYWELL PREDICTS SALES OF 5,500 COMMERCIAL HELOS TO 2018

By Anthony Osborne | Aviation Week's Aviation Daily

Commercial helicopter operators will buy between 4,800 and 5,500 helicopters during 2014-2018, according to a survey and market forecast by Honeywell ...

AIRCRAFT BLUEBOOK AT-A-GLANCE: CESSNA CITATION V ULTRA

By Chris Reynolds, ASA | Aircraft Bluebook

Aircraft Bluebook-At-a-Glance has reviewed the current market status of the Cessna Citation V Ultra series aircraft ...

To read the full issue:

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | MARKETLINE WINTER 2013 EDITION

Tuesday, December 17, 2013 at 10:51AM

Tuesday, December 17, 2013 at 10:51AM Vol. 26, No. 4 | Dec. 17, 2013 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Pre-owned Market Sends Mixed Signals Throughout Industry

Into the Blue: Aircraft Bluebook At-a-Glance - Cessna Mustang

Ask Aircraft Bluebook: What Does the Trend column in the Aircraft Bluebook represent?

[Download the full Winter 2013 Marketline Newsletter and All Charts.]

CHARTS — Dec. 17, 2013

Tuesday, December 17, 2013 at 9:15AM

Tuesday, December 17, 2013 at 9:15AM CURRENT MARKET STRENGTH

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

MARKETLINE FALL 2013 EDITION

Tuesday, September 10, 2013 at 2:20PM

Tuesday, September 10, 2013 at 2:20PM Vol. 26, No. 3 | Sept 10, 2013 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Value Retention In Today's Market

Into the Blue: Penton Completes Acquisition of Aviation Week Group From McGraw Hill Financial

Ask Aircraft Bluebook: How can I submit information to Aircraft Bluebook?

[Download the full Fall 2013 Marketline Newsletter and All Charts.]

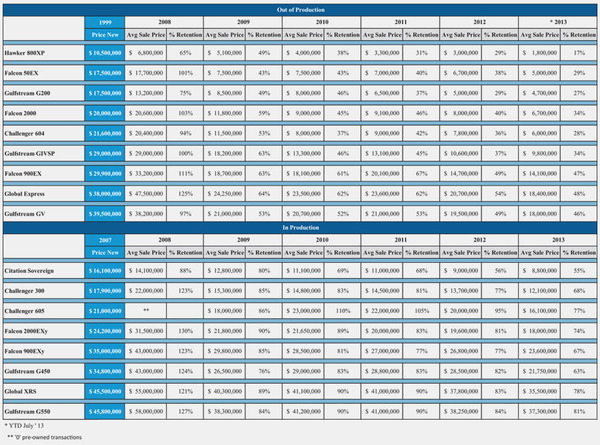

Value Retention In Today's Market:

By Dennis Rousseau | President and Founder | AircraftPost.com

There has been conversation and many questions over the last few years relating to residual values, value retention, value as a percentage of cost new, values coming back, et al. For years, our industry used a 3 to 4 percent annualized depreciation schedule to gauge future values for business jets. Due to the fact our business was in its infancy, we did not possess formidable history to determine the validity of the schedule. When we buy-in to the fundamental assumption that aircraft are depreciating assets with a 30-year life cycle, most business jets will reflect an average midlife (15 years) value retention of 50 percent, when compared to the original cost new.

There has been conversation and many questions over the last few years relating to residual values, value retention, value as a percentage of cost new, values coming back, et al. For years, our industry used a 3 to 4 percent annualized depreciation schedule to gauge future values for business jets. Due to the fact our business was in its infancy, we did not possess formidable history to determine the validity of the schedule. When we buy-in to the fundamental assumption that aircraft are depreciating assets with a 30-year life cycle, most business jets will reflect an average midlife (15 years) value retention of 50 percent, when compared to the original cost new.

As illustrated in the data sheet, we’ve made every attempt to compare aircraft in an equal light. For out of production aircraft we use a 1999-year model reflecting 14-years in service. For current production business jets, a 2007-year model is used reflecting 6-years in service. Regardless of the term, each make/model is generating nine to ten percent annualized depreciation. For each year through 2013 we’ve calculated the average [pre-owned] selling price for the respective model. The original price new reflects the average contract price for each make/model for the stated year.

Clearly, these numbers should not be construed as ‘one size fits all.’ Each transaction and make/model comes with its own set of dynamics. However, aircraft with greater capability (higher passenger loads, transcontinental range, increased performance, later generation avionics, etc.) tend to retain a higher percentage of their original cost new. In the majority of cases, there seems to be a corollary between the total aircraft manufactured and lower resale value—the greater the number built, competitive landscape increases and value retention erodes quicker. As of July 2013, AircraftPost calculated an average ten percent of current generation business jet fleets on the market. The range is from 2 percent of the fleet for the G550 to 22 percent for the Lear 60XR. In the case of the former, an anomaly exists. There are now over 425 G550s in-service which would lend one to believe, based on the above-mentioned criteria, that early year models should be retaining less of their original cost new. Current data however, reflects the opposite.

As evidenced recently in pre-owned markets, selling prices continue a downward trend. As newer generation avionics are installed in the next iteration aircraft (i.e., Global Express/XRS/Global 6000; Lear 60/60XR; GIV/IVSP/450, etc.), these newer aircraft will place more pressure on pre-owned aircraft. The rate selling prices decline is determined in part by the above-mentioned and also driven by global economic factors. With the eroding geopolitical situation in the Middle East, South America and Asia, countries like the U.S. and Japan accruing debt of $16 and $10 trillion, respectively, it’s a wonder our markets are generating the sales they are.

Where do we go from here? In a nutshell, if our dollar continues to lose value, the price of most everything goes up. Does that include pre-owned aircraft that have been selling well under ‘normalized markets?’

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.