Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | MARKETLINE WINTER 2013 EDITION

Tuesday, December 17, 2013 at 10:51AM

Tuesday, December 17, 2013 at 10:51AM Vol. 26, No. 4 | Dec. 17, 2013 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Pre-owned Market Sends Mixed Signals Throughout Industry

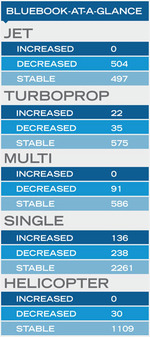

Into the Blue: Aircraft Bluebook At-a-Glance - Cessna Mustang

Ask Aircraft Bluebook: What Does the Trend column in the Aircraft Bluebook represent?

[Download the full Winter 2013 Marketline Newsletter and All Charts.]

Pre-owned Market Sends Mixed Signals Throughout Industry:

By Dennis Rousseau | President and Founder | AircraftPost.com

For current generation business jets (turbofan, EFIS, FANS capable, etc.), we’ve taken a random sampling representative of the medium- and long-range category aircraft. Nearly the same percentage of the available fleet (~10 percent) is on the market through December 2013 as was at the end of 2012. In the case of the GIV, Challenger 605 and G550, the percent increase/decrease was negligible. Overall, pre-owned inventory for this class aircraft is up slightly over last year. As displayed in the percentage of market data sheet [see page 2], later generation, current production aircraft show less aircraft on the market, as a percentage of the fleet, than those out of production. In normal markets, less than 10 percent of an available fleet would be considered average. However, for the last five years our markets have swayed from any semblance of normalcy.

For current generation business jets (turbofan, EFIS, FANS capable, etc.), we’ve taken a random sampling representative of the medium- and long-range category aircraft. Nearly the same percentage of the available fleet (~10 percent) is on the market through December 2013 as was at the end of 2012. In the case of the GIV, Challenger 605 and G550, the percent increase/decrease was negligible. Overall, pre-owned inventory for this class aircraft is up slightly over last year. As displayed in the percentage of market data sheet [see page 2], later generation, current production aircraft show less aircraft on the market, as a percentage of the fleet, than those out of production. In normal markets, less than 10 percent of an available fleet would be considered average. However, for the last five years our markets have swayed from any semblance of normalcy.

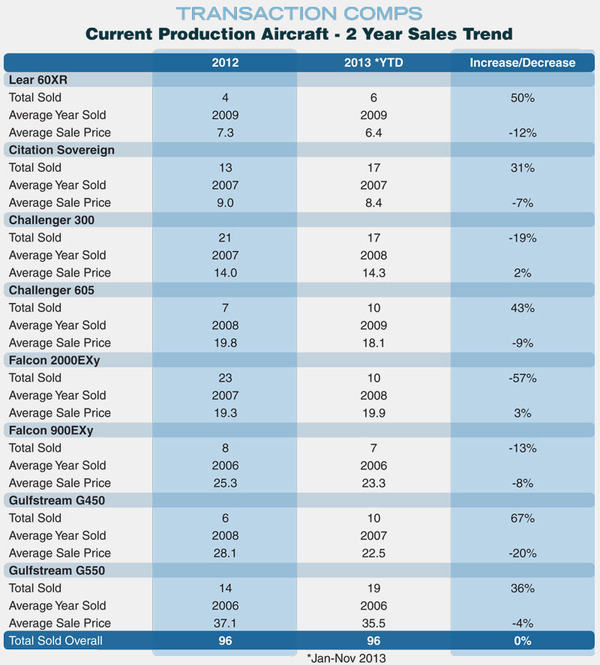

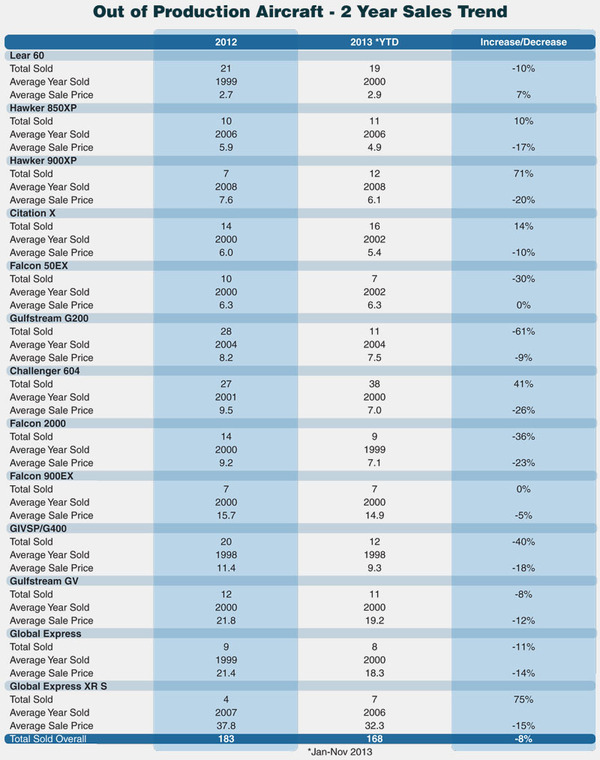

When viewing pre-owned transactions for current production aircraft (see Transaction Comps below and on page 4), the total sold is the same for 2012 as the first 11 months of 2013. Year-to-year selling price increases typically are associated with the average year of manufacture being newer (i.e., Challenger 300, Falcon 2000EXy, Lear 60). When price declines exceed 10 percent, as in the case of the G450, it typically is because the average year of manufacture is older than the prior year. The Gulfstream G550, Falcon 900EXy and Citation Sovereign are good representations of year-over-year nominal depreciation.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.