Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries in aircraft values (28)

CHARTS — June 10, 2013

Monday, June 10, 2013 at 8:28AM

Monday, June 10, 2013 at 8:28AM CURRENT MARKET STRENGTH

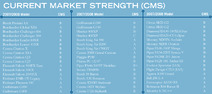

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

MARKETLINE CHARTS

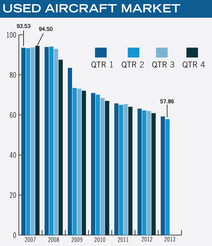

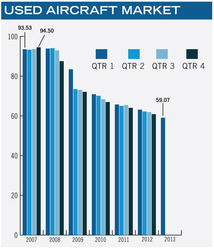

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click here to download a PDF of the full Marketline Newsletter, including articles and all Charts.

Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart

MARKETLINE SPRING 2013 EDITION

Monday, March 11, 2013 at 10:37AM

Monday, March 11, 2013 at 10:37AM Vol. 26, No. 1 | March 11, 2013 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Pre-Owned Transactions on the Rise

Into the Blue: Aircraft Bluebook At-a-Glance, Piper Malibu Meridian, PA-46-500TP series

Ask Aircraft Bluebook: Can I access Aircraft Bluebook from outside the United States?

[Download the full Spring 2013 Marketline Newsletter and All Charts.]

PRE-OWNED TRANSACTIONS ON THE RISE:

By Dennis Rousseau | President and Founder | AircraftPost.com

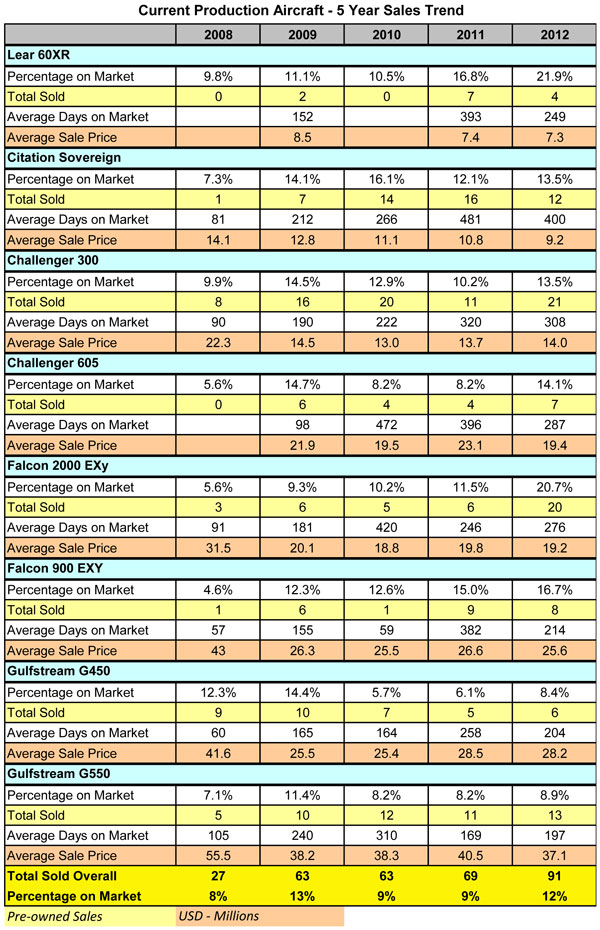

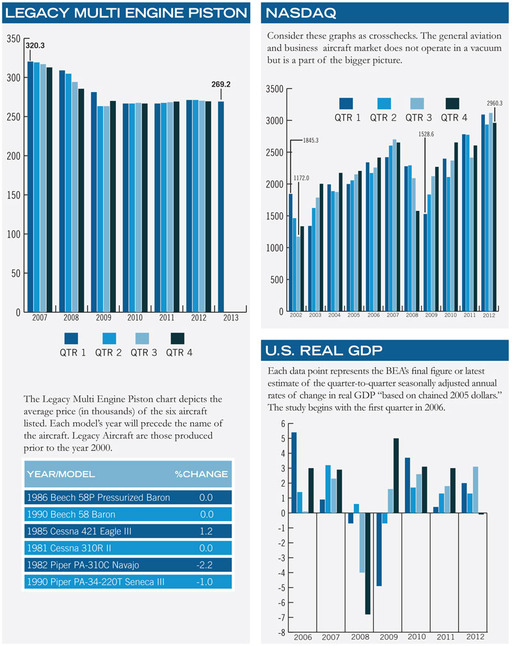

For the fifth consecutive year, pre-owned transactions for current generation business jets have shown a year over year increase. However, market inventories, expressed as a percentage of the fleet, are on the rise, while the average selling price continues a downward trend.

For the fifth consecutive year, pre-owned transactions for current generation business jets have shown a year over year increase. However, market inventories, expressed as a percentage of the fleet, are on the rise, while the average selling price continues a downward trend.

When we factor age-based depreciation over a 30-year lifecycle, we can garner some semblance of normalized value at any given point. However, when we consider economic events such as those over the last four years, values and selling prices can take a drastic downward turn. At the end of 2012, the average selling price for pre-owned, current production aircraft was reflecting a 17% decline in market value. Out of production aircraft slipped further to 33% under normalized values.

There are a number of factors contributing to the state of our market(s). The increase in transactions and current pricing suggests buyers are realizing substantial value in select aircraft. For example the G200, with its stand-up cabin, 3000 nm range and Pro Line 4 cockpit, had a record 27 transactions in 2012, an increase of over 300% from 2011. A 2008 year model, with a list price new of $22M, sold for $10M in the 4th Quarter 2012, with under 800 hours total time. The same $10M could buy a 2001 Challenger 604 or Falcon 2000 with 3500 hours, or a 2004 Challenger 300 with 7500 hours. Buyers seem to be looking more laterally with the perception of ‘how much value can I buy for the same dollar.’ Obviously, the newer aircraft open up greater financing opportunities as well.

Compared to 2008, when pre-owned aircraft were selling for more than they cost new, 2012 continued to adjust prices to a level commensurate with the global economic climate. On average, pre-owned business jets are selling 25% under normalized markets, which seems to be one of the driving factors for the increased transactions. Further, according to GAMA new business jet deliveries for the first nine months of 2011 and 2012 were 427 and 428 respectively. When current production pre-owned aircraft are selling for 40% less than they cost new, this can also stimulate the number of pre-owned transactions.

For the start of 2013, pre-owned inventories are on the rise; however activity levels (pre-purchase inspections, LOIs, Offers to Purchase, et al) are showing formidable signs for consistent activity.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

[Go to Charts.]

CHARTS — March 11, 2013

Monday, March 11, 2013 at 10:18AM

Monday, March 11, 2013 at 10:18AM CURRENT MARKET STRENGTH

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

MARKETLINE CHARTS

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click here to download a PDF of the full Marketline Newsletter, including articles and all Charts.

Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart

MARKETLINE WINTER 2012 EDITION

Thursday, March 7, 2013 at 12:36PM

Thursday, March 7, 2013 at 12:36PM Vol. 25, No. 4 | December 7, 2012 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Facing the Nation

Into the Blue: Aircraft Bluebook At-a-Glance, Cessna 152 Series

Ask Aircraft Bluebook: In the aircraft base average lines in the Bluebook we always see the “No Damage History” as a standard requirement, but if there is damage how does the Bluebook reflect this in terms of value?

[Download the full Winter 2012 Marketline Newsletter and All Charts.]

Ask Aircraft Bluebook:

In the aircraft base average lines in the Bluebook we always see the “No Damage History” as a standard requirement, but if there is damage how does the Bluebook reflect this in terms of value?

The short answer is that depends. Diminution of value is a very subjective concept in the aviation market. Even though most experts confirm its role in negotiating the purchase or sale of an aircraft, there are no specific techniques or principles that can be applied in every case of diminution. This aircraft characteristic (damage) is one of a multitude used during the negotiating process and is very hard to isolate its effects because every aircraft has a different history and a different perception of value. In transactions, the buyer will always be the final judge for the “value” of the aircraft and include the diminution factor in his or her evaluation.

With that said, it must be understood that when dealing with assessing the market value of an aircraft with a damage incident, a multitude of factors must be reviewed and analyzed in relationship to the market for a specific aircraft model. There is no set formula that can be accurately applied to determine diminution of value, if any, regarding damage. The only appropriate method to determine the market value involving the characteristic of damage on an aircraft is for a technically qualified, experienced appraiser to conduct an investigation of the aircraft and logs, review specific issues regarding the repairs, compile all of the elements of the damage event and subsequent maintenance history, and then apply the conclusions to market activity for the specific aircraft.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Ask ABB,

Ask ABB,  No Damage History,

No Damage History,  aircraft values in

aircraft values in  Newsletter

Newsletter MARKETLINE WINTER 2012 EDITION

Friday, December 7, 2012 at 8:56AM

Friday, December 7, 2012 at 8:56AM Vol. 25, No. 4 | December 7, 2012 | Go to Charts

IN THIS ISSUE

Bluebook Perspectives: Facing the Nation

Into the Blue: Aircraft Bluebook At-a-Glance, Cessna 152 Series

Ask Aircraft Bluebook: In the aircraft base average lines in the Bluebook we always see the “No Damage History” as a standard requirement, but if there is damage how does the Bluebook reflect this in terms of value?

[Download the full Winter 2012 Marketline Newsletter and All Charts.]

BLUEBOOK PERSPECTIVES:

Facing the Nation

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

It is all said and done. A new leader has been chosen. The challenges of this executive office are staggering. Creating jobs for the people in his charge, modification of the healthcare system and ongoing issues with a slowing economy are enormous.

It is all said and done. A new leader has been chosen. The challenges of this executive office are staggering. Creating jobs for the people in his charge, modification of the healthcare system and ongoing issues with a slowing economy are enormous.

Yes, the newly appointed leader of the People’s Republic of China, Xi Jinping, faces many complex challenges in the days ahead. Similar to President Barack Obama, how policies will be developed to benefit his countrymen have yet to be revealed. One thing is certain, China is focused on growing its economy, so much so that it is predicted to surpass the U.S. economy in less than five years – or so critics think.

Having visited Savannah, Georgia recently, one would see a boom town of growth. Construction is everywhere around the Gulfstream campus. So, if there are such great opportunities to sell aircraft, why aren’t prices more stable these days? I suggest prices are stable, with the exception of Hawker aircraft, for reasons already clear to the aviation community. OEMs are selling new aircraft and making money.

Dealing with the pre-owned market is a bit more challenging. The pre-owned market is being re-defined by the velocity of transactions. It takes more than just a few transactions to make the pre-owned market move in the right direction. Price is always a concern. Sellers want maximum return on their assets. Buyers want compensation for future values up front — in the form of discounts. Similar to the way politics are supposed to work, somewhere in the middle, at least in the playing field of a deal, a resolution is made and a sale is complete. Both buyer and seller may not be happy, but the best outcome was agreed upon by both parties, while the old adage of economics; supply and demand referee. When it comes to the bottom line, the question should be: was the business tool, the corporate aircraft, a needed asset in growing profits by its ability to move folks in an efficient and timely manner? The answer will always be “yes.” Walking around sock-footed and beltless takes time- and time is money. Sure, things could be better, corporations could become more confident in the economy and make some capital investments in their transportation budget, and a legislative agenda for growing the economy could be revealed by President Obama. But none of that looks like it’s going to happen any time soon. One can always hope for better times, but don’t neglect the opportunities that are still available now.

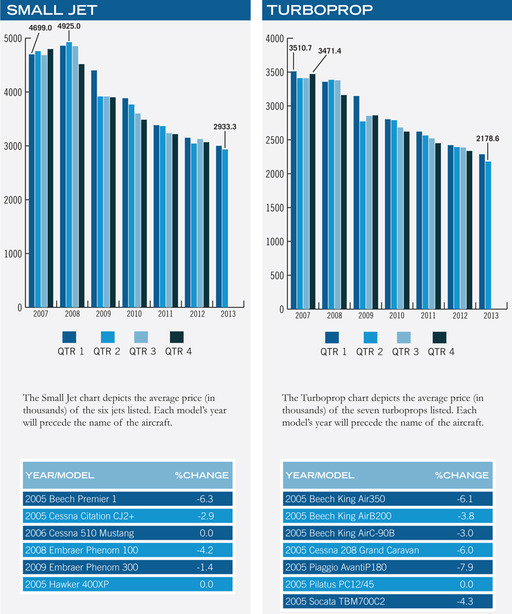

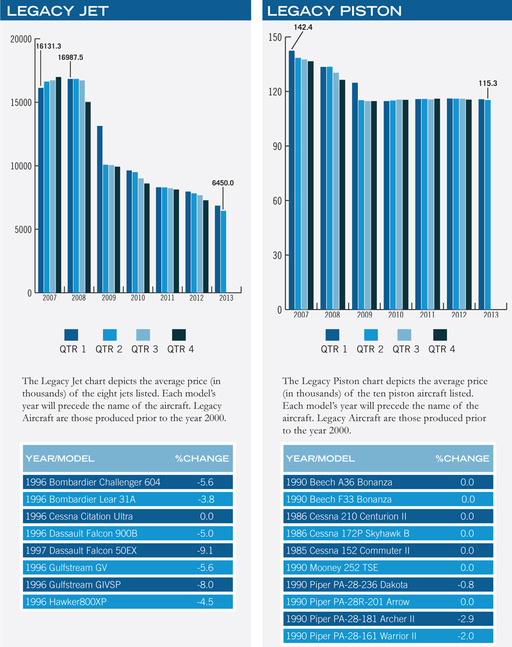

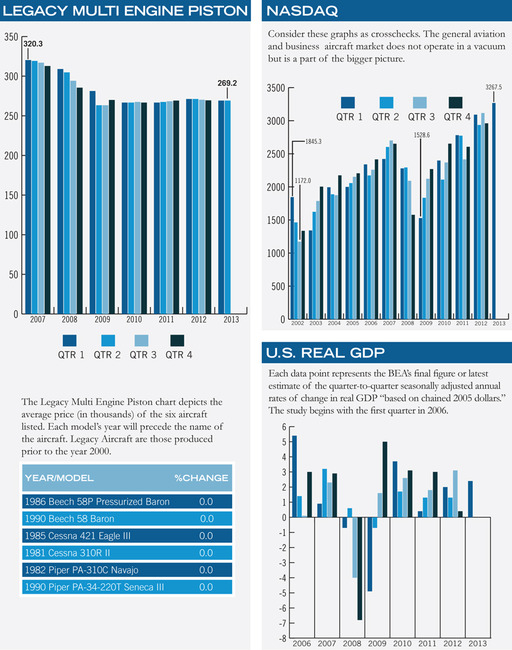

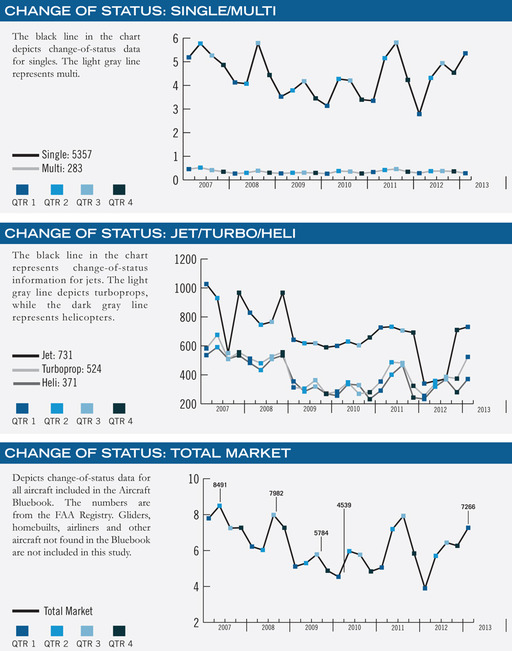

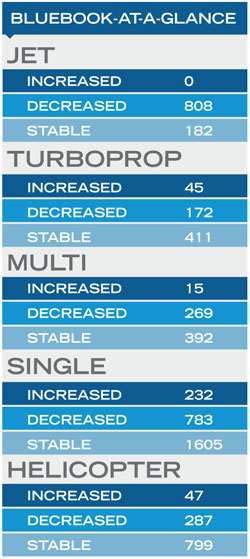

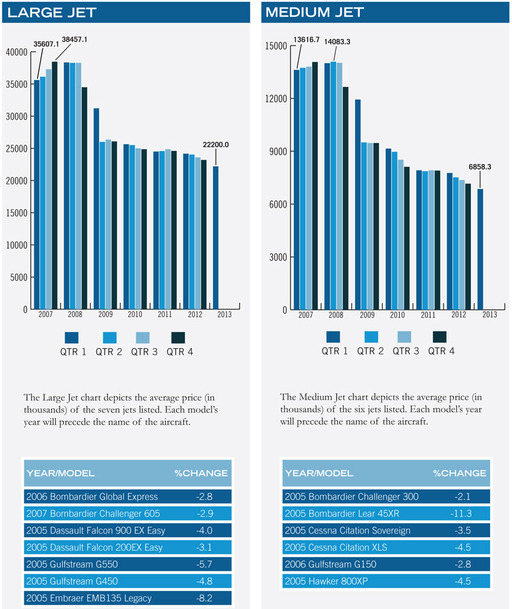

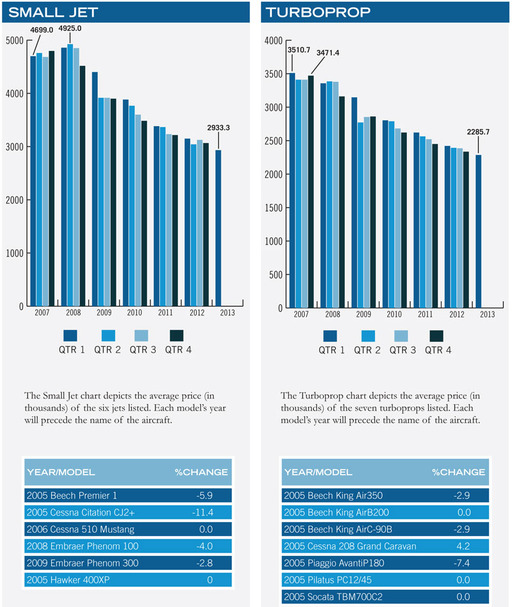

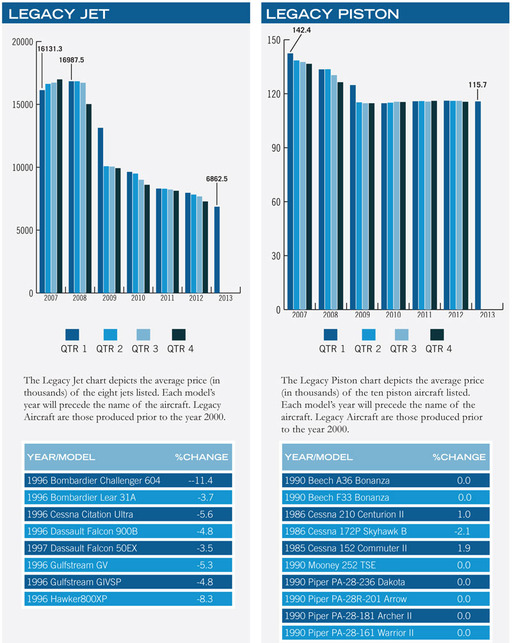

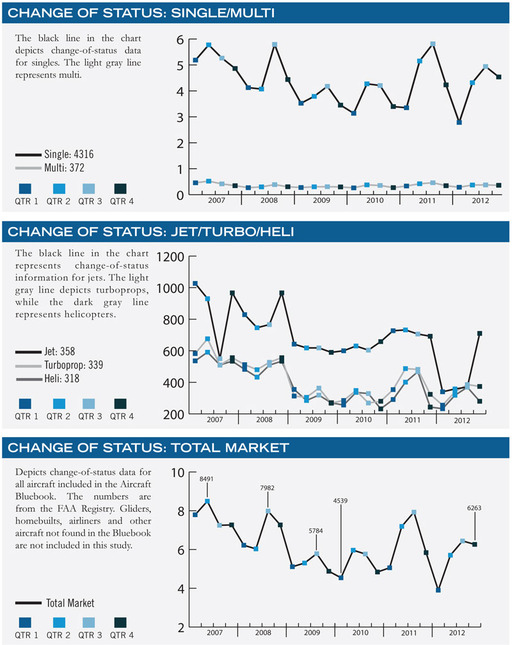

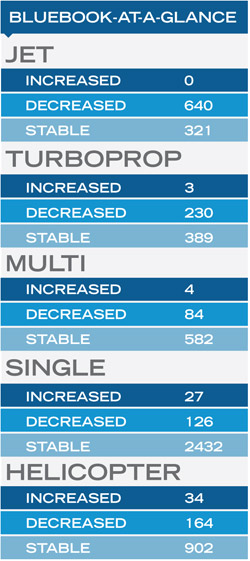

Looking at the BLUEBOOK-AT-A-GLANCE column (page 1) shows a market in motion. Prices for pre-owned aircraft continue to decrease quarter-to-quarter in the jet and turboprop category. Days on market for properly priced aircraft are moving on to new owners in a matter of months. Movement is good.

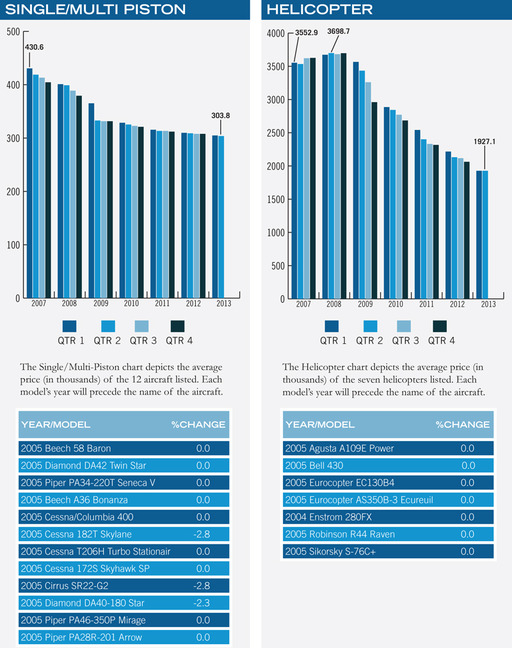

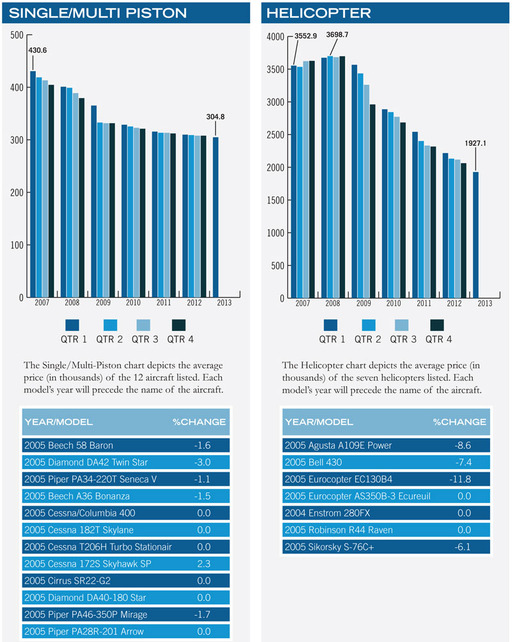

Fixed wing single and multi engine values remain stable, while the helicopter segment also is reporting a majority of models with no change in values, when compared to the previous quarter. To see what changes have occurred in values, refer to the newly released edition of Aircraft Bluebook – Price Digest®.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.