Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Ask ABB,

Ask ABB,  kit aircraft in

kit aircraft in  Newsletter

Newsletter  Thursday, August 16, 2012 at 8:48AM

Thursday, August 16, 2012 at 8:48AM Bluebook Perspectives: Thumps and Bumps in the Pre-Owned Market

Into the Blue: 12th Annual EBACE Convention Shines in Geneva

Ask Aircraft Bluebook: Why can't I find my kit aircraft in the Aircraft Bluebook?

[Download the full June 2012 Marketline Newsletter and All Charts.]

Kit aircraft present a unique challenge to the Aircraft Bluebook – Price Digest. With the individual becoming the manufacturer, there is no guarantee of uniformity in the areas of quality assurance for how or who built the aircraft, where it was built and the conditions located therein, or even how long the building process has taken to complete. These aircraft are often very unique which can create dissimilar copies even when building a similar kit. For uniformity standards Aircraft Bluebook only represents aircraft that are produced and assembled by manufacturers in accordance with Federal Regulations or their permissible alternatives.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Ask ABB,

Ask ABB,  kit aircraft in

kit aircraft in  Newsletter

Newsletter  Friday, August 3, 2012 at 8:30AM

Friday, August 3, 2012 at 8:30AM Bluebook Perspectives: Thumps and Bumps in the Pre-Owned Market

Into the Blue: 12th Annual EBACE Convention Shines in Geneva

Ask Aircraft Bluebook: I have a run-out Lycoming IO-360 and the Bluebook says that the overhaul for this engine is...

[Download the full June 2012 Marketline Newsletter and All Charts.]

The Aircraft Bluebook prices piston aircraft with midlife engine(s). This means that the point of reference for adjustments is from mid-life, not from zero. If an engine has a 2,000 TBO limit, then the adjustment is based on the engine’s relationship from mid-life or 1,000 hours in this example. At mid-life the Bluebook has accounted for half of the engine’s value being used and half of it remaining, so if the engine time is now adjusted to be run-out, all that is left to deduct is the remaining half (which in this case would be $12,500). Conversely, a zero-time engine would get a $12,500 credit for the same reasons just explained.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Ask ABB,

Ask ABB,  TBO amount in

TBO amount in  Newsletter

Newsletter  Monday, July 23, 2012 at 11:32AM

Monday, July 23, 2012 at 11:32AM Bluebook Perspectives: Thumps and Bumps in the Pre-Owned Market

Into the Blue: 12th Annual EBACE Convention Shines in Geneva

Ask Aircraft Bluebook: Why can’t I find my kit aircraft in the Aircraft Bluebook?

[Download the full June 2012 Marketline Newsletter and All Charts.]

Given the mixed economic conditions in Europe, I wasn’t sure what to expect at the 12th Annual EBACE Convention this month. The only European exhibition focusing solely on business aviation, EBACE 2012 proved to be a lively and fruitful show, with more exhibits than ever before and an abundance of foot traffic representing many different regions – the Middle East, North America, Asia and Africa.

According to organizers, the number of attendees was comparable to last year’s show. Final figures tallied 12,638, from an impressive 99 countries. 2012 was a watershed year in terms of exhibitors, with 2,280 booths spanning the exhibit halls of the Geneva Palexpo. The 60 aircraft on display at the static broke a record for being the largest EBACE Static Display to date.

The European Business Aviation Association (EBAA) President Brian Humphries said, “This year’s show was a tremendous success. The numbers demonstrate that EBACE remains the most important European business aviation event, even in – and perhaps especially in – tough economic times in the region.”

EBACE 2012 launched the debut of the African Business Aviation Association (AfBAA), a long-awaited organization to raise safety and operational standards and to create a single voice to lobby the continent’s regulators. Its founding chairman, Tarek Ragheb, also was involved in forming the successful Middle East Business Aviation Association (MEBAA).

Gainjet Aviation, one of AfBAA’s 14 founding members, housed the organization under its booth. “20-30 percent of our foot traffic was for AfBAA – which we were happy to see,” said Gainjet’s Marketing Director Andrew Hallak.

Recipients of the 2012 European Business Aviation Awards were David MacMillan, director general of Eurocontrol, and Don Spruston, director general of The International Business Aviation Council (IBAC). The awards were presented at a luncheon on May 14th, the opening day of the convention.

In addition to the exhibits, there was a series of interesting and enlightening EBACE education sessions, with industry experts addressing the current state of topics such as safety, illegal flights, SESAR, and business aviation across the world.

As usual, there was no shortage of wine, champagne, beer and hors d’euvres lining the tradeshow floor, providing the atmosphere with a light, festive feeling.

Next year’s show will take place in Geneva from Tuesday, May 21 through Thursday, May 23, 2013. For more information, including Twitter feeds and a downloadable EBACE app, visit www.ebace.aero.

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  EBACE,

EBACE,  Geneva in

Geneva in  Newsletter

Newsletter  Wednesday, June 6, 2012 at 8:25AM

Wednesday, June 6, 2012 at 8:25AM Bluebook Perspectives: Thumps and Bumps in the Pre-Owned Market

Into the Blue: 12th Annual EBACE Convention Shines in Geneva

Ask Aircraft Bluebook: Why can’t I find my kit aircraft in the Aircraft Bluebook?

[Download the full June 2012 Marketline Newsletter and All Charts.]

Optimists see the silver lining behind the cloud while the pessimist only sees the cloud. Optimism continues to be the silver lining in the pre-owned aircraft market. However, reality of the dark cloud dictates an awareness and calculated approach.

Such are the conditions in the current ever-evolving pre-owned market. For the most part, the glory days of aircraft values being treated as premium investment opportunities are now nothing more than a faded memory. Knowledgeable buyers and sellers are keenly aware of this. Change of ownership continues at a slow to steady pace while values for the most part show continued depreciation. The exceptions are late model long range executive business jets.

So, why haven’t values had some sort of rally? The answer still remains in the old school of supply and demand. While inventories for pre-owned aircraft are continuing to deflate ever so slightly, the abundance of low time, well maintained business aircraft available in the open market have an economic impact on what the market will bear on any given aircraft sale price. Throw in more financial regulations on behalf of the lender and the result is a not-so-much-room to rally premium sale prices.

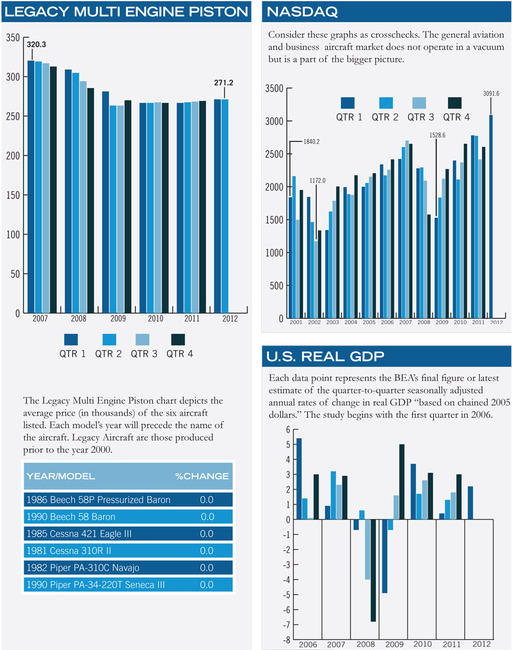

Other economic indicators are pointing to limited domestic growth in the near future. Some predictions include another recession in the coming months, concerns for Homeland Security and the impact it will have on corporate aviation along with the cost of energy (fuel). While all of this is really pessimistic, the reality still remains that this is the environment the pre-owned business aircraft market operates in. It’s our bubble inside the big bubble, so to speak.

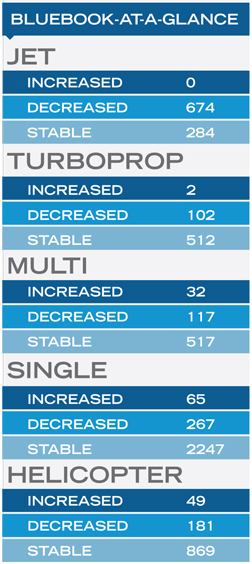

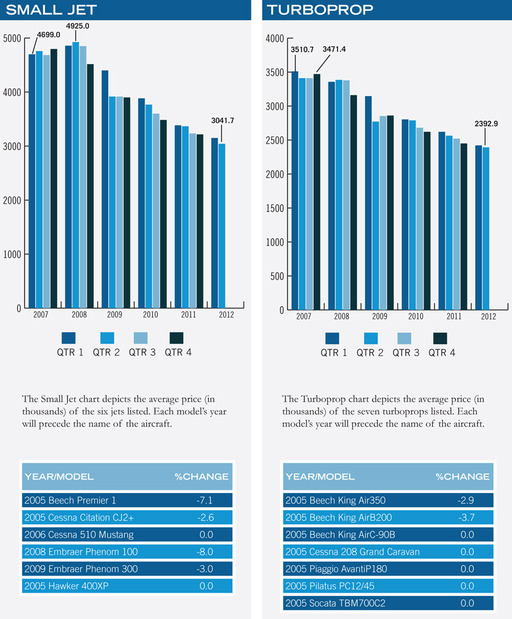

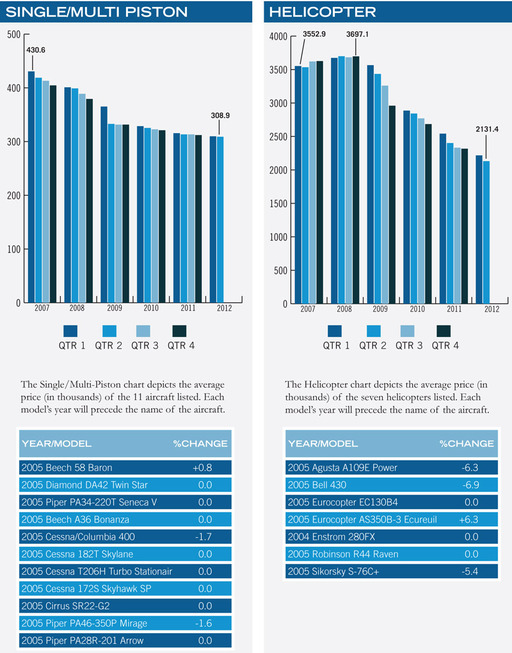

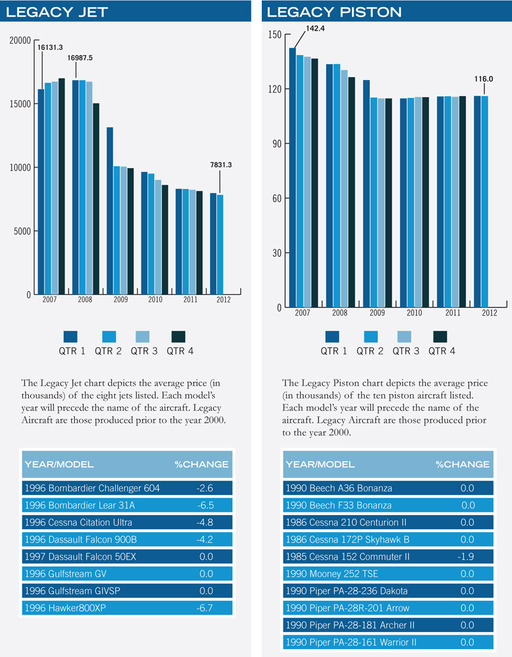

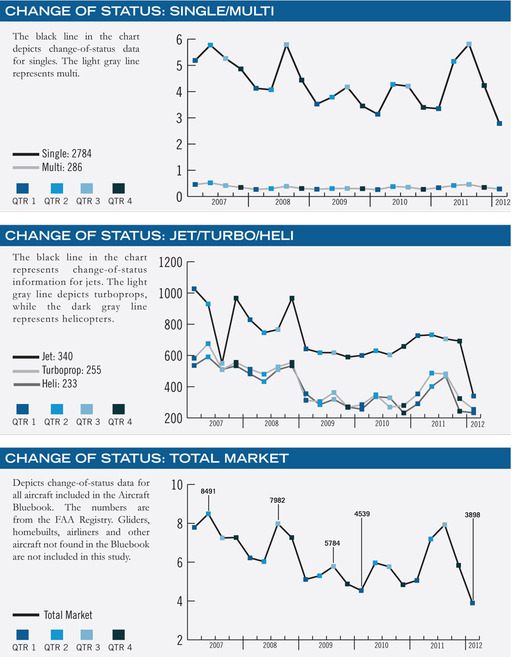

The marquis referencing Bluebook-at-a-glance changes on the right is the reality of an average pre-owned market. For machinery and equipment, which aircraft are classified as, depreciation is the norm rather than the exception. For whatever the cause, the effects are recorded as +/- in the average retail column as it relates to the previous (Spring 2012) values of Aircraft Bluebook – Price Digest. In this market, it is important to remember that transactions between buyers and sellers are more important than actual values. Without movement, there is no market.

In the Jet category, there were no aircraft that increased in average retail value in the Bluebook. Most of the decreases were a reflection of weaker sold prices reported. A number of jets did remain unchanged. Most were in the long range late model class of jets.

For the Turboprop category, the 2006 & 2007 King Air C90GT reported modest increases in average retail. For the most part, values remained unchanged. Decreases in reported average retail in this category were merely another reflection of market activity when compared to the previous quarter.

Much was the same for the Multi and Single piston category. Increases in retail value were reported to include legacy models, those manufactured in the 20th century. Stability in pricing when compared to the previous quarter dominated these market segments.

In the Helicopter category, most models remained stable. Component life and condition play a major role in sale prices. Helicopters that reported an increase in average retail included the Eurocopter AS350 series. For the most part, values were unchanged when compared to the previous quarter.

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

Tuesday, June 5, 2012 at 3:17PM

Tuesday, June 5, 2012 at 3:17PM  Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

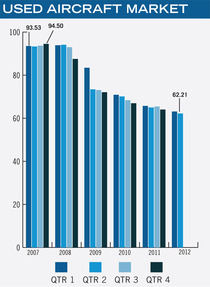

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click to View Full Size ChartAll of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click here to download a PDF of the full Marketline Newsletter, including articles and all Charts.

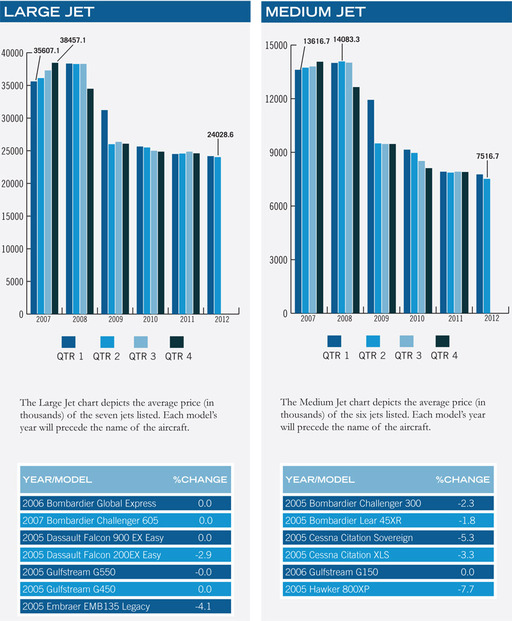

Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart  Click to View Full Size Chart

Click to View Full Size Chart