Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | The Bright Side of Business Aviation

Monday, October 5, 2015 at 2:25PM

Monday, October 5, 2015 at 2:25PM By Carl Janssens, ASA | Chief Appraiser | Aviation Week Network

If anyone has any doubts with regard to the overall health and stability of the business aviation market, its overall performance over the last 90 days is an objective testament. The volatility in the global markets, sluggish news of economic growth indicators such as housing and employment statistics, the decline in crude oil pricing and a mix of fundamental principles targeted at humanity as a whole would suggest a very poor economic environment for business aviation. Granted, these days are not the best of times, but like the old adage goes, they’re not the worst of times either. If anything, it is a demonstration of the determination to make each market segment within our industry more identifiable. There are more choices with greater flexibility on pricing versus mission/range/performance and cabin environment. This makes something for every business need. As for holding value, unless you have a set of keys to a Gulfstream G650, Cessna Citation CJ4 or an Embraer Phenom 300, expect some moderate form of depreciation. Depreciation should be expected in the jet and turbine business aviation segments.

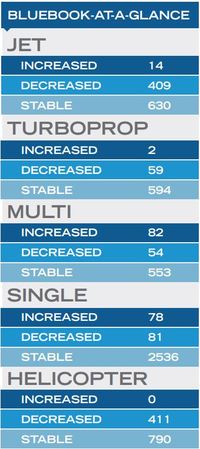

As reflected in the BLUEBOOK-AT-A-GLANCE table on the right, trending continues to have a downward trend for the jet market. The good news is that there is some stability in pricing. Though markets will continue to decrease annually, there are some momentary plateaus. If one is curious about “what’s up” this quarter, it turned out to be the Learjet 35, which is reported to have gained value from an otherwise stagnant historical performance. It was a 60/40 mix for the majority of the jet market for trending between stability and a downward trend from the summer quarter.

The turboprop market held firm for this reporting period with the majority of aircraft in this category holding value. The turboprop market continues to etch its character into mission-specific operations. Limited inventory of ready-to-fly aircraft opportunities are far less available than in the jet category making this a more competitive market.

For the multi-engine piston category, increases in value were experienced in the Beech Baron segment, as well as select Piper twins. Time and condition contribute to time in market. Late model and early models modified with performance and technology upgrades tend to have limited market exposure when market priced. The single-piston category shadows the multi-piston market. Operating costs have a defining impact when compared with the multi-twin and turbine market. This market segment demonstrated little trending when compared to the previous quarter. Helicopters have become more susceptible to adverse market conditions, especially noted in the energy segment. Values have trended downward primarily due to less need of fossil fuel extraction.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |