Newsletter

Newsletter Entries by Aircraft Bluebook Marketline (178)

BUSINESS JET BUYERS, SELLERS DON'T AGREE ON VALUES

Wednesday, February 18, 2009 at 4:49PM

Wednesday, February 18, 2009 at 4:49PM Vol. 21, No. 44 | Feb. 18, 2009 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

What else can be said that hasn’t already been analyzed, scrutinized and editorialized with regard to the state of the U.S. economy and business jet sales? Nothing! To sum up, jet sales are no longer in a cool-down mode. This industry has been pickled.

While President Obama seeks a silver bullet for the economy, there aren’t any handouts in store for aircraft OEMs. Unlike its automotive brethren, the business jet segment has not been offered an economic recovery parcel. There is not even a crash cart with paddles waiting. We’re on our own.

Looking at the few jet sales that occurred in the final three months of 2008, it is interesting to attempt to identify the types of transactions. Are the sale prices considered fair market values, or are they more along the lines of distressed liquidation values? It depends on the side of the bargaining table. For the seller, chances are the distress in the negotiated sale price has to do with some urgency to liquidate the asset. On the other hand, the buyer who is the end user will argue the sale price is fair market value because he would not be willing to pay more for the aircraft.

With too many buyers and sellers still riding the fence, it is hard to know what to call the sale. One thing is certain: If the present economy is our OK Corral, it is getting close to high noon. With the showdown at hand, one side or the other will be the first to break leather. After the smoke clears, everyone will know who the winner is. Time will tell.

Jet

Bluebook-at-a-glance

Increased — 0

Decreased — 563

Stable — 262

Little surprise for the jet market tracked by Aircraft Bluebook: No aircraft in this category experienced gains in value. Most models of every jet manufacturer experienced yet another quarterly loss. Large-cabin jets such as the Bombardier Globals, Falcons and Gulfstreams continued the downward trend. Even before the ink dries, values of some models continue to fall.

The Cessna Citation X and Sovereign were examples of the few jets that, for the most part, had no decreases in values when compared to the previous quarter. This was the case for select Hawkers and Learjets as well.

Turboprop

Bluebook-at-a-glance

Increased — 6

Decreased — 209

Stable — 415

Socata and Pilatus generally kept the turboprop market stable for another quarter. Most of the decreases in value for other turboprop manufacturers were kept to a modest 3 to 5 percent reduction when compared to the winter 2008/2009 Bluebook. The turboprop market might have received a slight bounce from jet operators scaling back to jet-prop-driven power.

Multi

Bluebook-at-a-glance

Increased — 1

Decreased — 178

Stable — 494

Late-model twins continued to bleed off value while the majority of early-model aircraft remained stable. Late-model Beech Barons and Piper Senecas were down in excess of $30,000. Well-equipped reconditioned aircraft, such as the Lock & Key Piper Chieftain, still command a respectable value when returned to the resale market.

Single

Bluebook-at-a-glance

Increased — 163

Decreased — 512

Stable — 1786

Ag planes kept a positive note in the single category. Select models experienced modest increases. Late-model aircraft generally experienced decreases in value. Beech Bonanzas were down 4 percent, and Cirrus experienced a 3 percent loss when compared to the previous reporting period. For the most part, 20-year-old or older aircraft remained unchanged when compared to winter 2008/2009 Bluebook values.

Helicopter

Bluebook-at-a-glance

Increased — 4

Decreased — 174

Stable — 814

Helicopter values appear to have reached a plateau. With only a minor increase in early-model Eurocopters, the majority of values remained stable when compared to the previous quarter. Most piston-powered ships as well as some single-engine turbines were in the loss column.

Aircraft Bluebook — Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concerns in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

CHARTS — FEB. 18, 2009

Wednesday, February 18, 2009 at 3:34PM

Wednesday, February 18, 2009 at 3:34PM

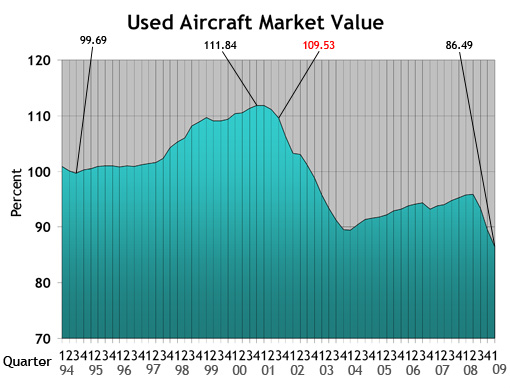

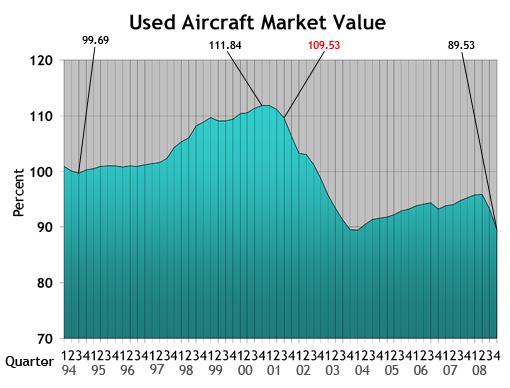

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

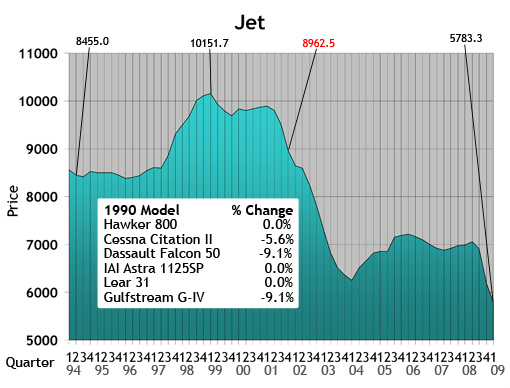

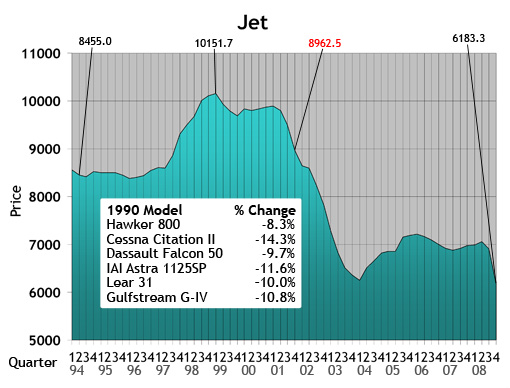

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

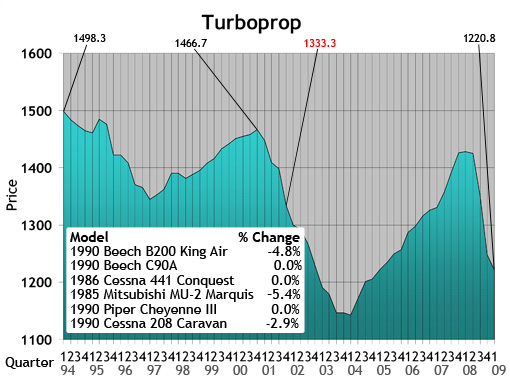

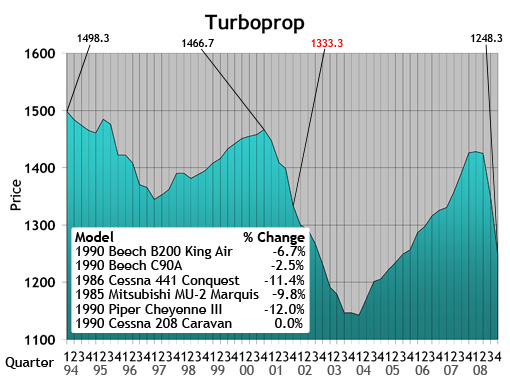

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

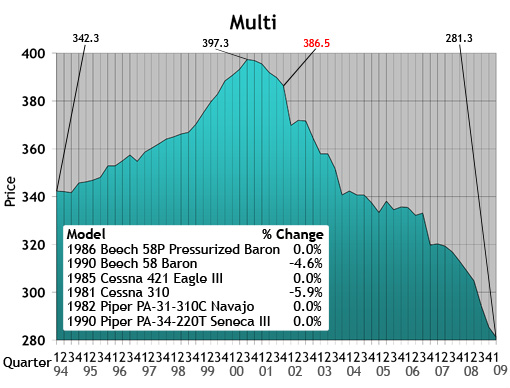

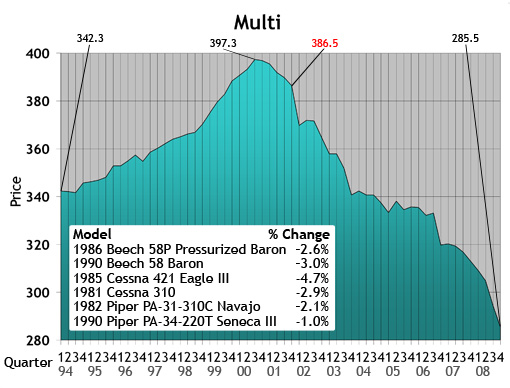

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

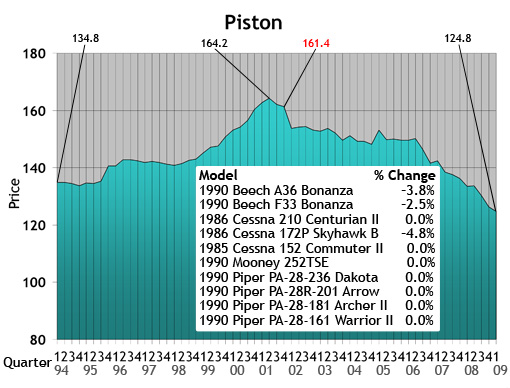

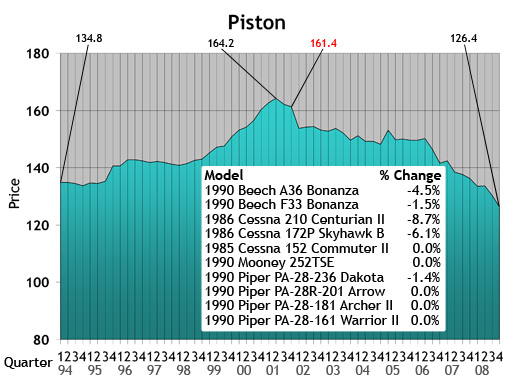

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

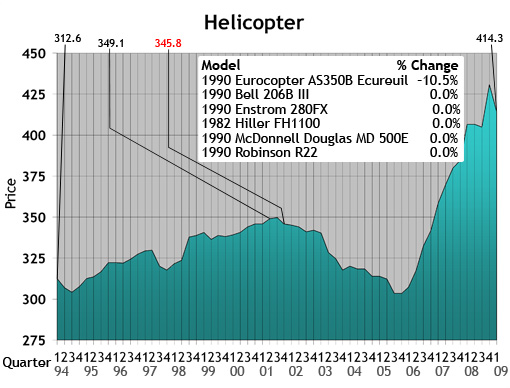

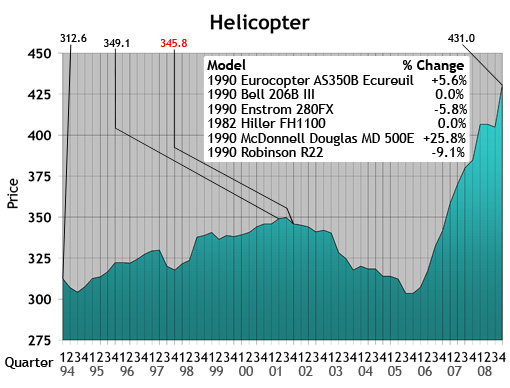

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

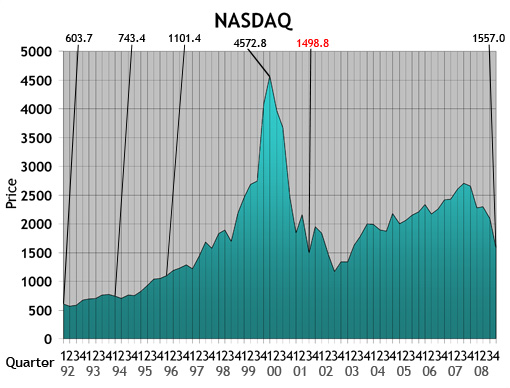

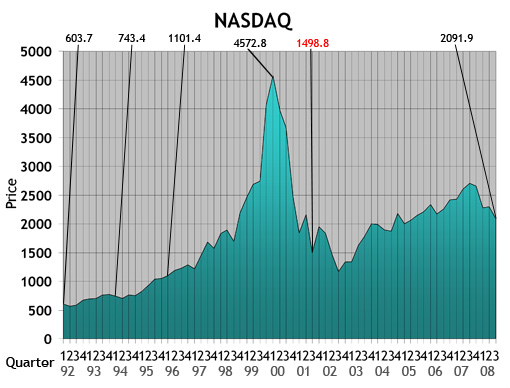

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

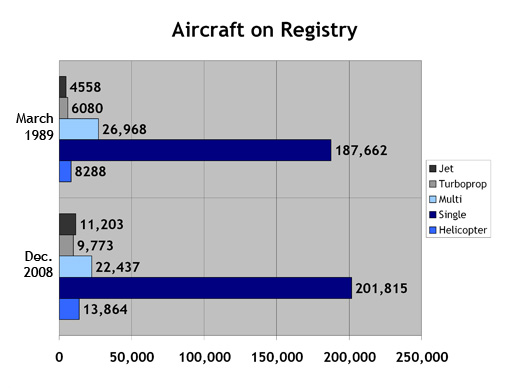

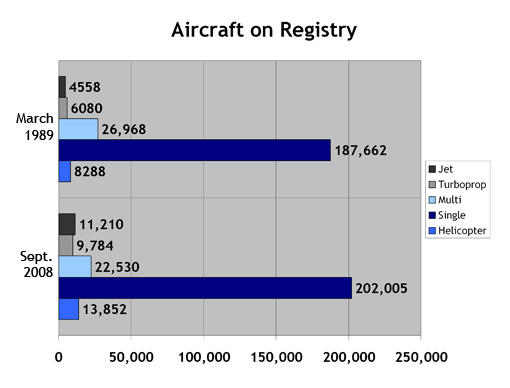

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

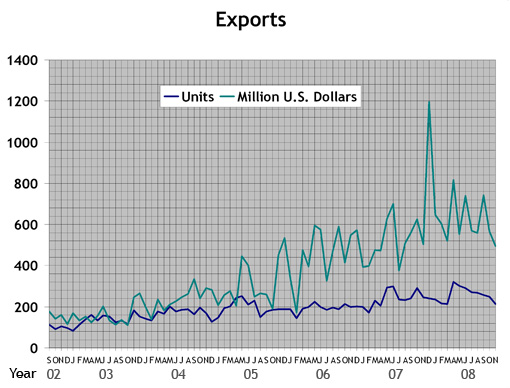

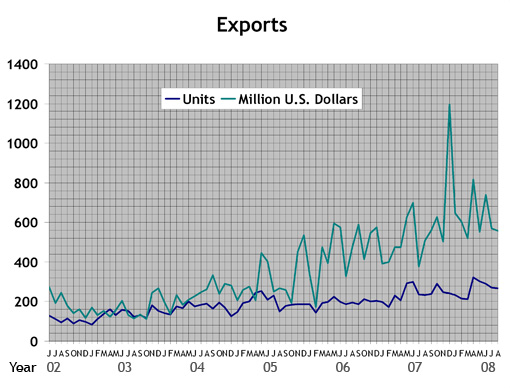

Export Data: These numbers include both airplanes and helicopters. The numbers do not include aircraft that have empty weights in excess of 33,069 lbs.

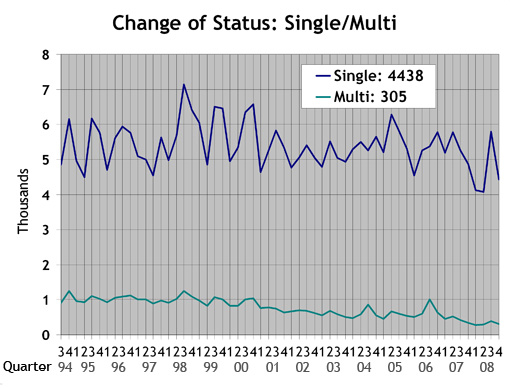

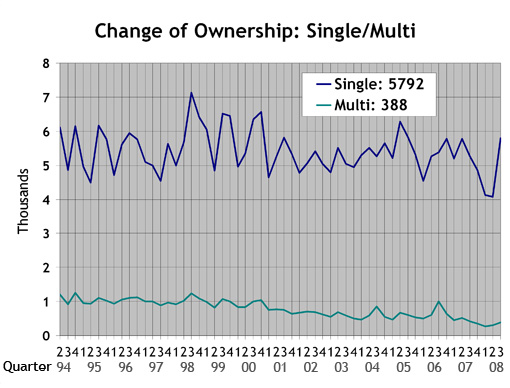

Single/Multi: The blue line in the Single/Multi chart depicts change-of-status data for singles. The green line represents multis.

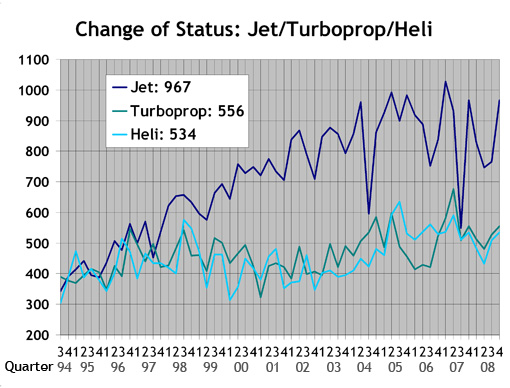

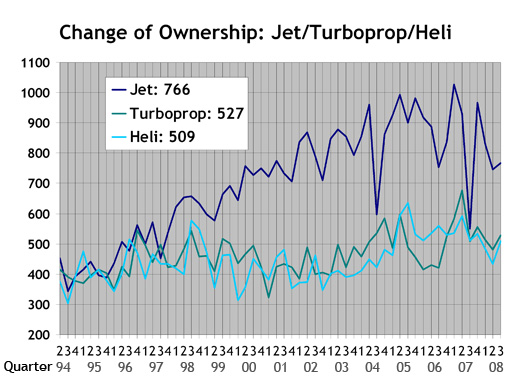

Jet/Turboprop/Heli: The dark blue line in the Jet/Turboprop/Heli chart represents change-of-status information for jets. The green line depicts turboprops, and the light blue line represents helicopters.

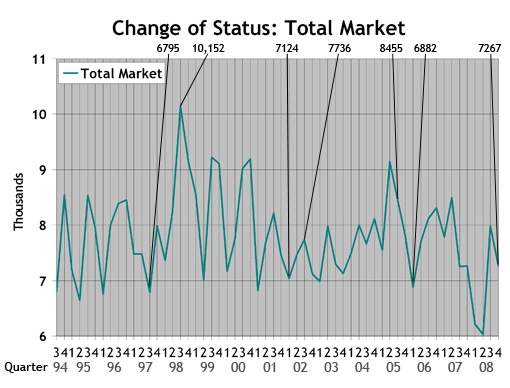

Total Market: Depicts change-of-status data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

PRE-OWNED AIRCRAFT SALES SEARCH FOR STABILITY IN FAILING ECONOMY

Tuesday, November 25, 2008 at 4:31PM

Tuesday, November 25, 2008 at 4:31PM Vol. 20, No. 43 | Nov. 25, 2008 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

The end of the third quarter of 2008 brought havoc and chaos to our national and global economies. Consider the devastation of a violent act of Mother Nature. Everything in the radius of destruction gets annihilated, without concern for good or bad, passive or active, aware or unaware. Corporate aircraft sales could not dodge the violence of the economic meltdown. In the wake of economic failure, the aircraft market is searching for stability.

Although everyone is quick to blame the other guy, the bottom line is that America has been victimized again by its own mediocrity whether because of greed, Fannie Mae and Freddie Mac’s version of social justice, or, well, whatever. At the core of this current crisis is the failure to coordinate and effectively execute economic intelligence and data that would otherwise protect and promote the economic environment. A three-dimensional level of communications is lacking. Alan Greenspan, former U.S. Federal Reserve Board chairman, had a talent for getting information to flow across the board. He taught his organization to acquire economic data and to effectively analyze, communicate and execute it. The actions of the Federal Reserve protected the U.S. economy and allowed it to flourish during his nearly 20 years of leadership. Communications can only be effective when the appropriate action is taken. Action needs leadership. Leadership is only as good as the information on which it operates. The human element will always inspire or slumber or, said in another way, provide charisma or mediocrity as the catalyst for action.

Jet

Bluebook-at-a-glance

Increased — 0

Decreased — 795

Stable — 24

Nearly all of the jet aircraft tracked in Aircraft Bluebook experienced a decline in value ranging from 7 percent to nearly 20 percent when compared to the previous quarter. As expected, aging aircraft were responsible for the more significant declines in value.

Turboprop

Bluebook-at-a-glance

Increased — 20

Decreased — 351

Stable — 247

There was some good news for the turboprop segment. With a tight inventory of available equipped DeHavilland Twin Otters in the current market, values for these aircraft have increased. Ag turboprop aircraft were mostly responsible for reporting stable values when compared to the previous quarter. The remainder of the aircraft in this category averaged 8 percent decreases in value.

Multi

Bluebook-at-a-glance

Increased — 0

Decreased — 488

Stable — 182

Multi piston engine aircraft, though suffering from the negative effects of the economy, did not suffer as much in the loss column when compared to last quarter. Losses were closer to the 5 percent range, generally speaking.

Single

Bluebook-at-a-glance

Increased — 112

Decreased — 1120

Stable — 1197

The single engine market has also felt the brakes on the economy. Sales nearly came to a full stop after the economic curtain fell in September. Again, the ag planes experienced modest gains from the previous quarter. Aircraft with unchanged values were in the $100,000 range or less. For the most part, decreases in value were minimal when compared to other aircraft market segments.

Helicopter

Bluebook-at-a-glance

Increased — 272

Decreased — 173

Stable — 503

Helicopter values remained stable for yet another quarter. Late-model single and twin turbines continued to hold value. Aging turbines as well as piston models experienced some decline in value. In all, the helicopter segment has weathered this economic storm better than the other aircraft in Bluebook.

Aircraft Bluebook — Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concerns in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

CHARTS — NOV. 25, 2008

Tuesday, November 25, 2008 at 4:29PM

Tuesday, November 25, 2008 at 4:29PM

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Export Data: These numbers include both airplanes and helicopters. The numbers do not include aircraft that have empty weights in excess of 33,069 lbs.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The green line represents multis.

Jet/Turboprop/Heli: The dark blue line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The green line depicts turboprops, and the light blue line represents helicopters.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

PRE-OWNED AIRCRAFT SALES THROTTLE BACK

Wednesday, August 20, 2008 at 12:01AM

Wednesday, August 20, 2008 at 12:01AM Vol. 20, No. 3 | Aug. 20, 2008 | Go to Charts

Activity Drops in Second Quarter

by Carl Janssens, ASA | Aircraft Bluebook — Price DigestThe second quarter of 2008 was a turning point for pre-owned aircraft sales activity. Sales have throttled back, and inventories have increased. The price of fuel and the general economy might have found their way into the aviation market. Although such factors have an indirect impact, interested and qualified buyers remain in the marketplace. The only difference is that these buyers are not willing to pay as much today for an aircraft.

For pre-owned aircraft, supply and demand have turned a seller’s market into a buyer’s market. Values will undoubtedly have to decrease before an agreement in price can be reached between the willing and knowledgeable buyer and seller. According to AMSTAT, the number of jets tracked by Aircraft Bluebook and available for sale or lease increased during the second quarter of 2008. When compared to the first quarter of 2008, inventories grew by a whole percentage point. Although 1 percent does not sound like a significant increase, it does represent an additional 170 jets for sale that were not being marketed in the previous quarter. Speculation does not skew Bluebook pricing. Sale prices generally were down when compared to the previous reporting period. As a result, a number of decreases in values appear in the fall 2008 edition of Bluebook.

Jet

Bluebook-at-a-glance

Increased — 12

Decreased — 366

Stable — 419

Values of a few model groups did increase. The Dassault Falcon 7X, Bombardier Challenger 604 and 605 as well as the Gulfstream G150 all experienced increases in value. All of the other models remained unchanged or experienced reductions in the reported average retail values. Prices of late-model, long-range, large-cabin models generally remained stable during this reporting period. One noted exception is the Falcon 50 series, which was down $250,000-$500,000 when compared to the previous quarter.

The Cessna Citation X also demonstrated lower values. Extra value can be added to a Citation X if the engines are enrolled in Rolls Royce CorporateCare. For other late-model, mid-range, cabin-class jets, such as the Cessna Citation 560 series, Hawker 800XP and Lear 45XR, values were unchanged for yet another quarter. Late-model light jets, such as the Cessna 525 CJ, and Hawker 400XP were down in value when compared to the previous quarter. For the most part, earlier-model jets were down. This segment will probably not see any future appreciation in values.

Turboprop

Bluebook-at-a-glance

Increased — 30

Decreased — 309

Stable — 277

AMSTAT reports that inventories of pre-owned turboprop aircraft listed for sale or lease and covered in Aircraft Bluebook grew by 1 percent. But overall, less than 9 percent of the total turboprop fleet tracked by Bluebook was on the offering table. Sales were average with values holding steady or slightly lower than the previous quarter.

Cessna Caravans were reported down an average of $25,000. The Cessna Conquest and DeHavilland Twin Otter were down $100,000. Fifteen-year-old King Air 90s dropped $100,000 while later models remained unchanged. Most of the King Air 350 and 200 markets had little or no change in values from the previous quarter. Late-model Pilatus PC-12s experienced modest gains. The Socata TBM 700 series remained stable.

Multi

Bluebook-at-a-glance

Increased — 0

Decreased — 509

Stable — 159

Well-equipped and maintained twin-piston aircraft are selling. Other piston-twins that are in need of maintenance and upgrades are taking more than 6 months on market to sell at discounted prices.

Beech Barons were generally down $10,000 when compared to the previous quarter. Values of pressurized Cessna twins also fell $10,000. Earlier-model piston-twin prices also dropped an average of $5000 from last quarter.

Single

Bluebook-at-a-glance

Increased — 184

Decreased — 1327

Stable — 897

No surprises in this segment. Like the piston-twin market, well-equipped and maintained singles continue to move, though evidence of lower values was evident when compared to the previous quarter. Activity was as scattered as a midday summer storm. Some dealers reported a noticeable lack of activity while others reported business as usual. Surprisingly, piston ag planes experienced some modest gains. Tail-draggers also demonstrated gains in value. The Cessna 185 and Piper Cub had modest increases in values when compared to last quarter. Cirrus, late-model Beechcraft, Piper and Mooney all experienced reductions in value in the single-piston category.

Helicopter

Bluebook-at-a-glance

Increased — 39

Decreased — 68

Stable — 835

Helicopter values remained consistent during the second quarter of 2008. Days on market continue to be limited for well-equipped, late-model helicopters. Values predominantly remain unchanged for the third quarter of 2008 as noted in the fall 2008 edition of Bluebook.

Aircraft Bluebook — Price Digest

and AC-U-KWIK around the globe

Please visit us if you are attending Jet Expo in Moscow, Russia, Sept. 17-19. We will be located with AC-U-KWIK in booth No. 136. At NBAA, Oct. 6-8 in Orlando, Fla., stop by and visit us. We are located in booth 1663. If you plan to attend MEBA in Dubai, UAE, Nov. 16-18, our booth number is 334. We look forward to visiting with you.

[Go to Charts.]

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Newsletter

Newsletter